Sector & Industries for Business

MacroVar analyzes sectors, industry groups, industries and sub-industries in US, Europe, Emerging Markets and Asia. Each segment is analyzed through its stock market dynamics, credit markets, news flow and industry specific quantitative and macroeconomic factors.

If you are new to Sector & Industry specific investing click here for an introduction to sectors & industries.

More specifically, stock market dynamics are analyzed based on S&P Dow Jones Indices indexes developed based on GICS (? For more), credit markets using individual Credit Default Swaps of specific companies and IBOXX corporate bond indices, news flow based on feeds from reliable finance news sources and industry specific factors based on MacroVar statistical Models and a broad range of sector specific related macroeconomic factors based on PMI & ESI Surveys and other factors like Building Permits. Lastly, MacroVar ranks sectors based on our quantitative models to identify Long / Short Investment themes.

Click here to get an overview of Sectors & Industries across the US, Europe and Asia.

Sector Specific Factor Analysis

Macrovar models analyze in real-time the following relative factors which will be explained briefly in the next sections of this article.

- Stock Sectors vs Credit (Credit default swaps or Corporate bonds)

- Stock Sectors vs Macroeconomics Surveys

- News flow for corporations in each sector / industry

Moreover, MacroVar monitors the following families of factors specific to a sector:

- Commodity related Stock Sectors vs Actual commodities For Example XLE representing energy companies’ vs crude oil

- Banking related Stock Sectors vs Yield Curve For example Banking ETF (KBE) vs the US Yield Curve

- Real estate stock sectors vs Macroeconomic Indicators For example Homebuilders ETF (ITB) vs Building Permits and 30-year Mortgage rates

- Stock Sectors vs Macroeconomic leading Surveys ESI and ZEW sector specific reports

Stock sectors analysis of prices, momentum, trends, charts, and news.

Sectors & Industries investing introduction

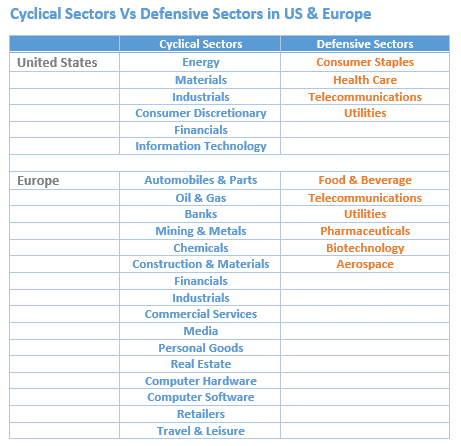

Stock Sectors are categorized not cyclical sectors and defensive sectors. Cyclical stock sectors are sectors of stocks whose earnings are more sensitive to the business cycle and the economic growth. Defensive stock sectors are sectors of stocks whose earnings are less sensitive to the business cycle.

Cyclical stock sectors Overview

- Materials The materials stock sector includes companies manufacturing construction materials, chemicals, glass, paper, forest products, minerals, mining, metals, and steel.

- EnergyThe energy stock sector includes companies in the exploration, production, refining, storage, transportation and marketing of oil and gas, coal, and fuel.

- Industrials The industrials stock sector includes companies engaged in the manufacturing and distribution of capital goods such as electrical equipment and machinery, aerospace, and defence. It also includes services providers such as construction and engineering, research and consulting services and transportation services.

- FinancialsThe financials stock sector includes financial firms like banks and asset management companies offering financial services like consumer finance, asset management, investment banking, brokerage services and security underwriters.

- Consumer DiscretionaryThe consumer discretionary stock sector covers companies involved in the manufacturing of consumer discretionary durable goods like automobiles, household goods, textiles, and apparel. The stock sector covers service providers of consumer discretionary services like hotels and restaurants.

- Information TechnologyThe information technology stock sector covers companies which develop software, manufacture, and distribute technology hardware and equipment and offer IT consulting services. This stock sector excludes companies offering internet services.

Defensive stock sectors Overview

- Consumer Staples The consumer staples stock sector covers businesses manufacturing and distributing of food, beverage, tobacco, personal products, and household goods. The stock sector also includes food and drug retailers.

- Healthcare The healthcare stock sector covers businesses offering healthcare services, manufacture and distribute healthcare equipment and supplies. This stock sector includes pharmaceutical and biotechnology companies

- Utilities The Utilities stock sector covers utility companies producing, distributing and trading electricity, gas and water.

- Communication services The communication services stock sector covers companies that provide content like entertainment, news and social media through the internet and other networks.

cyclical vs defensive sectorsSectors & Industries versus the Business Cycle

During different economic regimes, different sectors outperform others. For example, during recessions more defensive sectors like consumer staples outperform cyclical sectors like the industrials sector. Hence, an investor would want to scale back on the industrial sector and go long consumer staples.

Hence, after having a global view of the current economic environment, investors can choose their exposure either long, short or long/short across sectors.

The figure below shows which sectors tend to outperform and underperform during different economic cycles.

sectors and the business cycleSectors & Industries and the Value Chain

Investment themes are generated primarily from Macroeconomic factors and secondarily Microeconomic factors affecting the value chain in industries. Investors need to look for clues in the world, have views on the value chain and trade to invest with or against the trend.

value chainSectors Investing vs Top-Down process and Sector / Industry views

Investors can maximize returns while minimizing risks by investing Long and/or Short across sectors using the following steps:

- Obtain view on the market using MacroVar macro view analysis

- Obtain a view on a sector by analyzing fundamentals like the value chain and quantitative factors

- Decide whether a specific sector will outperform on underperform the market

- Decide whether they want to access Market Risk, Sector Risk and build a portfolio based on these criteria

All economic activities are categorized in specific sectors and industries in each sector. Your business depends on the overall country’s economic conditions and on the performance of the specific sector in which you operate.

MacroVar analysis aims to help you predict how the sector and industry you operate in will behave in the next 6 to 12 months.

Sectors & Industries Overview

There are two types of sectors: cyclical and defensive. Companies in the cyclical sectors sell goods and services which are in demand only when the economy is strong (e.g. cars). Companies in defensive sectors sell basic goods and services (e.g. soap) which are essential for humans and are not sensitive to economic growth.

Cyclical sector companies are riskier since they go up and down with the economy, while defensive sector companies are steady earners in good and bad times. Cyclical sectors have much higher profitability than defensive sectors when economic growth conditions are strong.

Below is a list of cyclical and defensive sectors in the economy:

| Cyclical Sectors | Defensive Sectors |

| Energy: Oil & Gas, Alternative Energy | Consumer Staples: Food-Beverage, Personal goods |

| Basic Materials: Chemicals, Basic Resources, Mining | HealthCare: Pharma & Biotech |

| Industrials: Construction-Materials, Industrial Goods | Telecommunications: Fixed & Wireless |

| Consumer Discretionary: Automobiles & Parts, Retail | Utilities: Electricity, Gas, Water |

| Consumer Services: Retail, Media, Travel & Leisure | |

| Financials: Banks, Insurance, Real Estate, Fin. Services | |

| IT: Software & Computer Services, Tech Hardware |

Sectors & Industries Indicators

MacroVar monitors each sector’s performance in the United States, Europe and Asia using the following indicators:

- Stock Sector & Industry performance: MacroVar analyses the trend and momentum and other statistics for each sector and industry. You can monitor the sectors & industries current performance here.

- Credit Sector & Industry performance: MacroVar analyses the corporate bonds of each sector and industry in the US and Europe.

- US ISM and NMI Industry Macroeconomic Analysis: MacroVar analyses the US ISM and NMI components to derive the strength or weakness of a specific sector.

- Europe ESI Macroeconomic Analysis: MacroVar analyses ESI sector and industry data for all European countries to estimate a sector’s expected growth based on indicators like Production, Order Books, Export Order Books, Stock Levels, Production Expectations, Selling Price Expectations and Employment expectations.

- Macroeconomic Indicators: MacroVar analyses economic indicators affecting specific sectors and industries. For example. building permits are consistent leading indicators for construction activity in the next twelve month and University of Michigan Consumer Sentiment Index is a leading indicator for retail activity across the United States. A country’s interest rates, Money Supply and the central bank’s monetary policy and government’s fiscal policy are closely monitored to examine liquidity in the economy and aggregate demand.

- Sector & Industry specific News: MacroVar compiles news by sector and industry and delivers the most important developments via your News feed and Newsletter.

The following is an in depth guide of how financial markets work and macroeconomic analysis in detail.