How can we help?

Macroeconomics

MacroVar Global Macroeconomic Analysis

MacroVar analyzes more than 10,000+ macroeconomic indicators of the largest 35 countries in the world. You can use MacroVar Newsfeed to get real-time updated on the latest Macroeconomic releases. Moreover, you can personalize your feed to select for which countries you want to get notified.

Top-down Analysis of Global Macroeconomic factors

MacroVar top-down approach of macroeconomic conditions seeks to focus first on analyzing the most important leading macroeconomic indicators which are predictive of economic growth and inflation 3-12 months in advance. These leading indicators drive the global economy which in turn drive all financial markets.

Click here for an introduction to macroeconomics and financial markets.

Moreover, MacroVar statistical models compare financial markets momentum with the momentum of these indicators to identify potential investment themes arising from divergences or new trend formations. Click here to see how Macroeconomic indicators as used as factors in MacroVar models.

The major components of MacroVar Global Macro top-down approach are the following:

| Economic Growth Dynamics |

| Inflation Outlook |

| Liquidity Conditions |

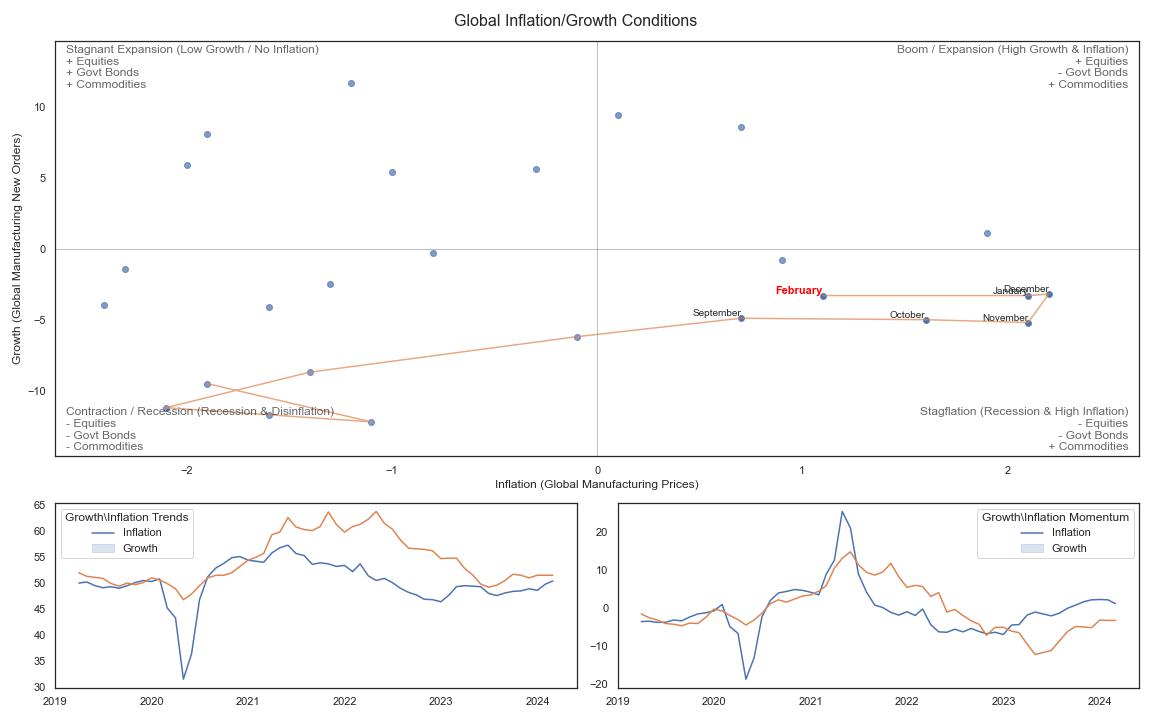

MacroVar Growth/Inflation model

MacroVar models analyze the relationship between economic growth and inflation by using the MV Growth/Inflation model. Leading indicators primarily based on Manufacturing PMI / ESI and the respective price indexes are used to present an outlook of what to expect in the next 3-12 months. Moreover, financial assets expected risk/returns are calculated based on the dynamics of the Growth/inflation model.

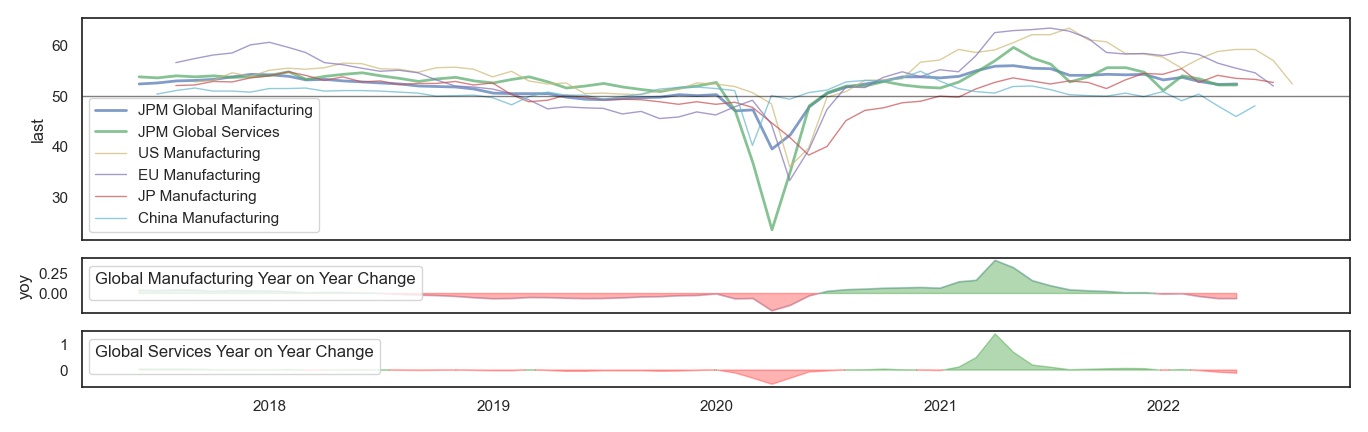

Global Economic Growth Dynamics

The most important factor to monitor is global economic growth trends and momentum. Individual country economic growth expectations are gauged using principally each country’s Manufacturing PMI and other business and consumer confidence indicators. Global growth is gauged by calculating MacroVar Global PMI based on each country’s weighting to Global GDP of the 35 largest economies monitored and Manufacturing PMI. Special attention is given to the top four largest economies (United States, Eurozone, China, Japan) comprising more than 50% of global GDP. We also monitor divergences between developed and emerging economies. Lastly, global macroeconomic growth breadth is monitored. MacroVar uses the following indicators to analyze Macroeconomic trends.

The Global Economy section presents the current global macroeconomic conditions using different statistics. The largest four economies in the world closely monitored are the US, Eurozone, China and Japan economies comprising more than 50% of Global GDP. MacroVar also monitors the relative performance of Developed and Emerging economies.

Global Inflation Outlook

MacroVar monitors the CPI Y/Y rates for the largest 35 economies in the world, segmented by region and developed vs emerging economies.

Since CPI Y/Y is a coincident economic indicator, the following leading indicators which often predict the future inflation outlook are used as well:

| US: ISM Manufacturing Prices |

| Eurozone, Europe and Individual European Countries: ESI Retail Prices |

| China: Official Manufacturing PMI prices |

Global Liquidity Conditions

Global liquidity is a major factor affecting all financial markets. It is of paramount importance to monitor Global Liquidity of the four major central banks in the world namely the Federal Reserve (US), ECB (Eurozone), PBoC (China) and BOJ (China).

MacroVar monitors central banks actions by closely monitoring published statistics and news flow.

The Central Banks section presents quantitative data and news flow for the four major central banks and secondarily to the rest of the 31 countries monitored.

Macroeconomic Factors

MacroVar monitors various macroeconomic and financial factors affecting each financial market. A brief list is provided below. From click on a specific financial market in the World Markets or Sectors sections of MacroVar to examine the related factors.

| Global Manufacturing PMI vs Global Stock Market, US Dollar, Emerging Markets, US 10 year treasury |

| Global Manufacturing PMI vs Cyclical Commodities (Metals, Energy, Shipping) |

| Country Stock Market vs Yield Curve, Manufacturing PMI, 10-year Bond, ZEW |

| Country Bonds vs Manufacturing PMI, ESI, Inflation, ZEW, Inflation Expectations (ISM, ESI) |

| Country Currency vs 10-year Bond, Stock Market, Central Bank B/S, 10-Year bond yield differential, 2-year bond yield differential, Manufacturing PMI, ZEW |

| Country ETF vs Manufacturing PMI, ESI, Country Currency, 10-year Bond, CDS, ESI |

| US & EU Stock Market vs Credit Index (YoY) – Index and Sector Analysis |

| Construction ETF vs Building Permits |

| Bank Sector ETF vs Yield Curve |

| ISM Manufacturing Prices vs US 10-year Bond yield |

MacroVar Trend model for Macroeconomic Indicators

A macroeconomic indicator is in an uptrend when last value is higher than its twelve month moving average and its twelve month moving average slope is positive (last twelve month moving average is higher than the previous month’s twelve month moving average)

Lastly, MacroVar calculates the number of months the current value has recorded highs or lows. Trend change is assumed when a specific indicator has recorded a 3-month high / low or more.

MacroVar Momentum model for Macroeconomic Indicators

A macroeconomic indicator’s momentum is monitored by calculating its long-term year over year (Y/Y) return and its short-term month on month (M/M) return.

Our Global Macroeconomic models are open-source and MacroVar displays these signals in the Ecoonomies section of the dashboard and will alert you through MacroVar Newsfeed and Daily newsletter automatically when new signals are generated. You can also access process these signals further and combine them with your research by downloading them from the MacroVar database using Excel, Python API or the Web.

Country Macroeconomic Overview

Economic Aim: A nation’s economy is healthy when it experiences stable economic growth with low inflation and low unemployment. Economic growth is measured by Real GDP and inflation by CPI, PPI. An economy is affected by its individual performance and its economic performance relative to the rest of the World (RoW).

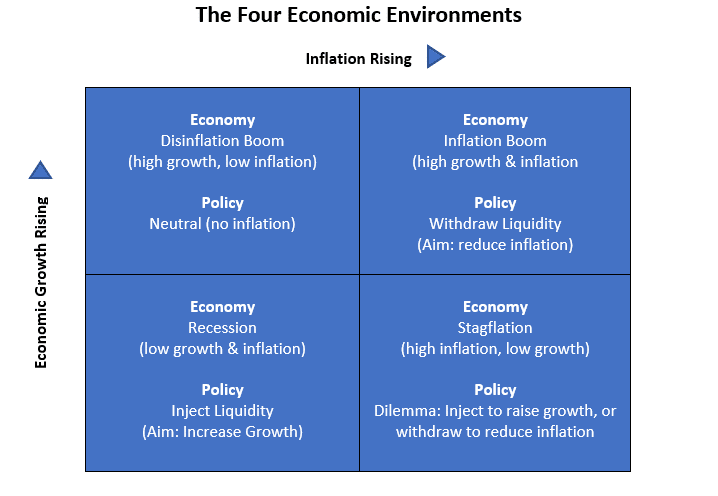

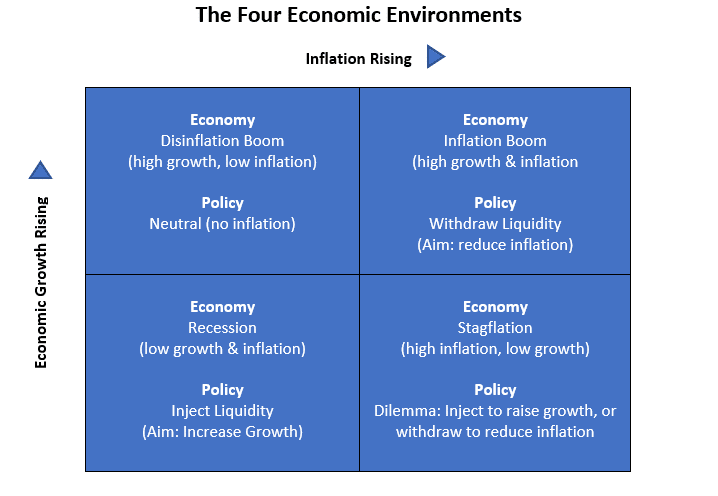

Policymakers (government & central bank) use fiscal and monetary policy to inject liquidity (print & spend money) during slowdowns (to solve weak economic growth) and withdraw liquidity (buy back money & stop spending money) from an overheating economy (to solve high inflation).

Excessive intervention in the economy may lead to loss of confidence in the country and a financial crisis. The degree of intervention depends on the country’s fundamentals. Read how to analyze a country’s economic in depth.

The Four Economic Environments

The four economic environments:

- Inflation boom: Accelerating Economic growth with Rising inflation

- Stagflation: Slowing Economic Growth with Rising Inflation

- Disinflation boom: Accelerating Economic growth with Slowing Inflation

- Deflation Bust: Slowing Economic Growth with Falling Inflation

MacroVar uses leading economic indicators for each country to predict economic and inflation expectations. More specifically for each country the Price Expectations and New Orders expectations components of the PMI, ISM and ESI indicators are used for structuring the models.

Country Macroeconomic Analysis

This analysis is based on the work of Ray Dalio and more specifically how the economic machine works

Introduction: An economy is the sum of the transactions that make it up. A country’s economy is comprised of the public and private sector. The private sector is comprised of businesses and consumers.

Economic activity is driven by 1. Productivity growth (GDP growth 2% per year due knowledge increase), 2. the Long-term debt cycle (50-75 years), 3. the business cycle (5-8 years). Credit (promise to pay) is driven by the debt cycle. If credit is used to purchase productive resources, it helps economic growth and income. If credit is used for consumption it has no added value

Money and Credit: Economic transactions are filled with either money or credit (promise to pay). The availability of credit is determined by the country’s central bank. Credit used to purchase productive resources generating sufficient income to service the debt, helps economic growth and income.

Country versus Rest of the World: A country’s finances consist of a simple income statement (revenue–expenses) and a balance sheet (assets–liabilities). Exports are imports are the main revenue and expense for countries. Uncompetitive economies have negative net income (imports higher than exports), which is financed by either savings (FX & Gold reserves) or rising debt (owed to exporters).

Debt: A nation’s debt is categorized as local currency debt and FX debt. Local debt is manageable since a country’s central bank can print money and repay it. FX debt is controlled by foreign central banks hence it is difficult to be repaid. For example. Turkey has US dollar denominated debt. Only the US central bank (the Federal Reserve), can print US dollars hence FX debt is out of Turkey’s control.

A country can control its debt by either: 1. Inflate it away, 2. Restructure, 3. Default. The US aims to keep nominal GDP growth above interest rates (kept low) to gradually reduce its debt.

Injections & Withdrawals

The government and central bank use fiscal and monetary policies to inject liquidity during slowdowns to boost growth and withdraw liquidity from an overheating economy to control rising inflation. The available policies and tools used during recessions are the following:

Monetary Policies (MP)

- Reduce short-term interest rates > Boost Economic growth by 1. Raising Credit, Easing Debt service

- Print money > purchase financial assets > force investors to take more risk & create wealth effect

- Print Money > purchase new debt issued to finance Gov. deficits when no local or foreign investors

Expansionary FP is when government spends more than tax received to boost economic growth. This is financed by issuing new debt financed by 1. domestic or foreign investors or 2. CB money printing

Currency vs Injections & Withdrawals and inflation

The degree of economic intervention depends on the country’s economic fundamentals, its currency status and credibility. Countries with reserve currencies or strong fundamentals are allowed by markets to intervene. However, when nations with weak economic fundamentals intervene heavily, confidence is lost, causing a capital flight out of the country, spiking inflation and interest rates which lead to a severe recession, political and social crisis.

Reserve vs Non-reserve currencies: Reserve currencies are used by countries and corporations to borrow funds, store wealth and for international transactions (buy commodities). They are considered low risk. The US dollar is the world’s largest reserve currency. The main advantage of reserve currency nations is their ability to borrow (issue debt) on their own currency. These countries have increased power to conduct monetary and fiscal policies to boost their economies. However, prolonged expansionary fiscal and monetary policies eventually lead to loss of confidence in these currencies as a store of value and potential inflationary crisis.

Non-reserve currency countries: Conversely, developing nations are not considered low risk hence their ability to borrow in their own currencies is limited. Their economic growth is dependent on foreign capital inflows denominated in foreign currencies like the US dollar. During periods of global economic growth, capital flows from developed markets into developing nations looking for higher returns. These economies and their corporations’ issue foreign debt to grow. However, during periods of weak global economic growth or financial stress, foreign capital flows (also called capital flight) back to developed countries causing an inability of countries and companies to repay their debt. Central banks gather foreign exchange reserves during growth periods to create a cushion against capital outflows.

A nation’s economy is vulnerable to economic weakness or financial stress when it experiences:

- Current account deficit: a current account deficit indicates an uncompetitive economy which relies on foreign capital to sustain its spending. Hence, is vulnerable to capital outflows

- Government deficit: a big government deficit indicates an economy relying or rising debt to finance its operations

- Debt/GDP: a high Debt/GDP pushes a nation to borrow large amounts to finance its debt, print money or default. Historically, Debt/GDP higher than 100% is a red warning for economies.

- Low or no foreign exchange reserves: Developing economies are vulnerable to capital flight since foreign exchange reserves provide a cushion against capital outflows

- High external debt: Nations are vulnerable to high external debts which may be caused by a sudden depreciation of their currency or rising foreign interest rates (due to foreign growth)

- Negative real interest rates: Lower interest rates than inflation, are not compensating lenders for holding a nation’s debt hence making nation’s currency vulnerable to capital outflows.

- A history of high inflation and negative total returns: Nations with bad history have lack of trust in value of their currency and debt

Currency Fundamentals

A country’s currency strength is determined in the long run by its current account balance, and in the short-term by the relative dynamics of interest rates, supply/demand imbalances and policymakers.

US Dollar

The US Dollar is affected by the US economy and global market conditions. During global economic expansions, funds flow out of the US into emerging markets searching for higher investment returns causing the US Dollar to depreciate.

Conversely, during global economic slowdowns, global market risk is high, credit conditions are tight and funds flow into the US in search for low-risk safe assets causing the US Dollar to appreciate. Economic divergences between the US economy and the rest of the world may also cause US dollar to appreciate. When the US economy outperforms other economies, the Fed may raise short-term rates higher related to other countries causing funds to flow back to the US.

Which economies succeed and Fail

A country’s success is determined by three factors: 1. Productivity: producing more by working harder or smarter, 2. Culture: Sacrificing life for achievement, innovation, commercialism, low bureaucracy, corruption, rule of law, 3. Indebtedness: low debt to income (reference: how the economic machine works – Bridgewater Associates)