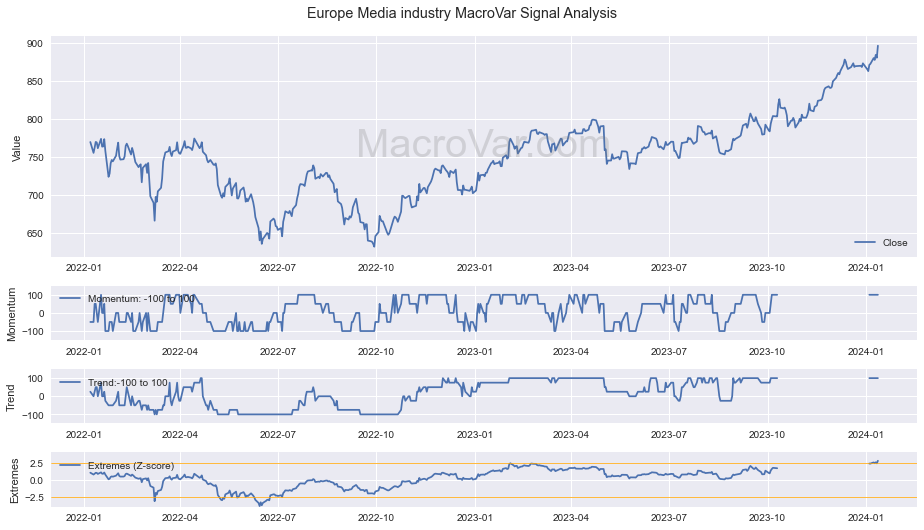

Europe Media industry MacroVar Financial Signals

MacroVar algorithms have detected the following signals for Europe Media industry.

Checkout below the signals related to Europe Media industry momentum, trend and exhaustion.

[rml_read_more] Explore below the signals generated today

| Signal Type | Timeframe | Signal | Last | Previous |

|---|---|---|---|---|

| Trend Exhaustion | 250-days | Overbought | 2.77013 | 2.39067 |

| RSI | 14-days | Overbought | 72.33240 | 64.21580 |