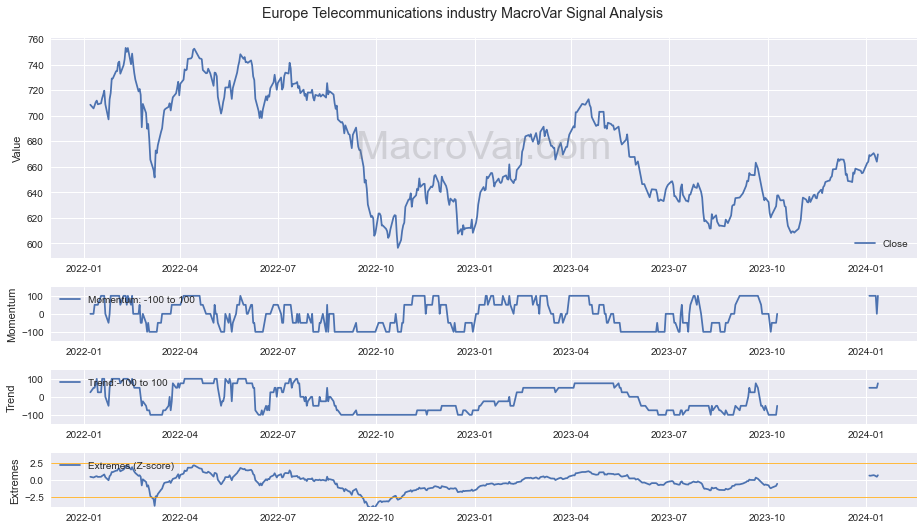

Europe Telecommunications industry MacroVar Financial Signals

MacroVar algorithms have detected the following signals for Europe Telecommunications industry.

Checkout below the signals related to Europe Telecommunications industry momentum, trend and exhaustion.

[rml_read_more] Explore below the signals generated today

| Signal Type | Timeframe | Signal | Last | Previous |

|---|---|---|---|---|

| Trend | Composite | -0.5 | -1.0 | |

| Momentum | Composite | 0.0 | -0.5 | |

| Price vs MA | 20-days | Up | 1.0 | -1.0 |

| MA Slope | 250-days | Up | 1.0 | -1.0 |