Couch Potato Investing

| Investment Objective |

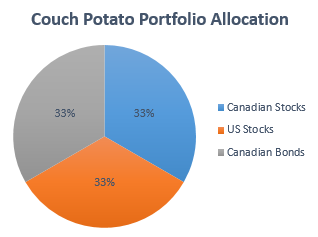

| Couch Potato Investing involves splitting the funds invested in 3 mutual funds which cover Canadian Equities, US equities and Canadian Bonds. The portfolio is rebalanced once a year to get back to original asset allocation. |

| How to Invest in Couch Potato Portfolio | |

The investor wants to invest $10,000 in the Couch Potato Portfolio. The investor buys the following three mutual funds which represent 1. Canadian Equity, 2. US equity and 3. Canadian Bonds:

Once a year, the investor must buy and sell his ETFs (or add new money) to get portfolio back to its 30%-30%-30% split. The result is a low-cost portfolio that has 66% of money invested in a wide range of stocks in Canada and US and 33% invested in Canadian Bonds. |

|

| Find Profitable Investment Strategies Matching your Needs | |||||||||||

| MacroVar offers a Database of Highly Profitable Investments. Search our Database and Find the Investment strategy matching your profile. We analyze & provide Reviews and Returns for all strategies. | |||||||||||

| Other Couch Potato Portfolios | |||||||||||

| Global Couch Potato Portfolio This portfolio is more diversified than the Classic Couch Potato portfolio and hence involves less risk. The investor wants to invest $10,000 in the Global Couch Potato Portfolio. The investor buys the following four mutual funds which represent 1. Canadian Stocks, 2. US Stocks, 3. International Stocks and 4. Canadian Bonds:

Once a year, the investor must buy and sell his ETFs (or add new money) to get portfolio back to its 20%-20%-20%-40% split. The result is a low-cost portfolio that has 60% of money invested in a wide range of Canada, US and International Stocks and 40% invested in Canadian Bonds. High Growth Couch Potato Portfolio

Once a year, the investor must buy and sell his ETFs (or add new money) to get portfolio back to its 25%-25%-25%-25% split. |

|||||||||||