Exploring the Impact of the M2 Money Supply

M2 Money Supply definition

Money supply M2 is the most important indicator used to monitor money supply. Money supply is the total amount of currency in circulation in a country.

Money supply M2 is the sum of notes and coins in circulation, demand deposits and other checkable deposits (OCD), saving deposits, time deposits of less than $100,000 and money market deposit accounts. Money supply M2 is the most important economic indicator used to monitor money supply.

M2 money supply historical data are provided in MacroVar database.

Money Supply definition

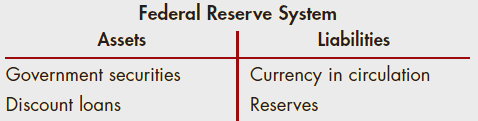

Money supply is controlled by the central bank’s monetary policy. Monetary policy is a set of actions conducted by the nation’s central bank to expand or contract economic activity by expanding or contracting the money supply. These actions affect the central bank’s balance sheet.

The central prints new money and expands the money supply by increasing the supply of two money types: currency in circulation and reserves.

Currency in circulation is money in physical form notes and coins. Reserves consist of deposits of commercial banks held at the central bank and any currency that is physically held by banks.

The central bank uses three tools to expand or contract money supply: 1. Open market operations, 2. Discount loans and 3. Reserve requirements.

Open market operations: The central bank prints new money and uses it to purchase government securities like bonds in the open market. The previous holder of the government securities purchased by the central bank ends up with the newly issued money held as reserves in the banking system. This causes an expansion in the monetary base and the money supply.

Discount lending: The central bank makes discount loans to commercial banks. A discount loan leads to an expansion of banking reserves which can be used for making loans and an expansion of the money supply.

Reserve Requirements: The central bank sets a reserve requirement which is a certain fraction of customers’ deposits commercial banks must hold in reserve with the central bank. When the central bank reduces reserve requirements, it causes an increase in banking reserves and an expansion of the money supply.

M2 money supply versus currency

The growth of M2 money supply is an important factor in predicting the value of a country’s currency. Increasing rate of m2 money supply is inflationary and negative for the country’s currency and vice-versa.

The central bank increases / decrease money supply by increasing / decreasing banking reserves.

When a central bank increases reserves, it allows the country’s banking system to increase the amount of money available in the economy, encouraging lending and economic activity. The most important money supply economic indicator is money supply M2. M2 is a leading indicator of economic activity, inflation and the value of the country’s currency.

The most important indicator MacroVar follows is the annualized M2 growth rate (take monthly rate of change multiply it by 12 weeks).

Given an analysis of Money Supply M2 returns statistical distribution, 20% of the time there are either positive or negative shocks which affects the country’s currency dramatically.

The central bank responds to an overheating economy with rising inflation by decreasing banking reserves substantially (statistically less than 1 standard deviation move) to cause deflation and currency strengthening.

During deflationary periods of economic contraction, the central bank responds by increasing bank reserves substantially (higher than 1 standard deviation move) causing inflation and currency depreciation.

During mild periods of M2 expansion we have a mild short currency bias and vice versa.

The Federal reserve’s M2 money supply is the most important economic indicator affecting the dollar and the global economy as a whole. During severe economic recessions, the Fed intervenes by expanding money supply M2 significantly, to weaken the US dollar provide global liquidity, and cause significant inflationary pressures to negate the deflationary pressures arising from the bad economic conditions.