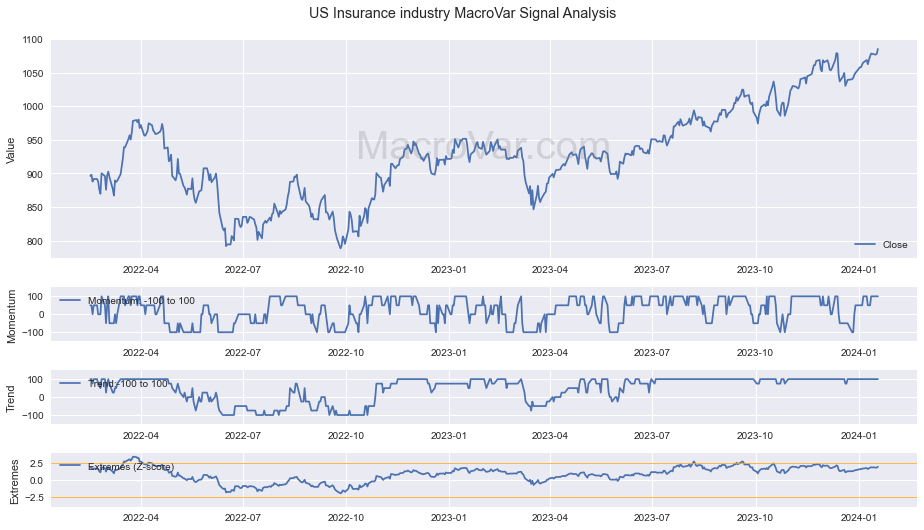

US Insurance industry MacroVar Financial Signals

MacroVar algorithms have detected the following signals for US Insurance industry.

Checkout below the signals related to US Insurance industry momentum, trend and exhaustion.

[rml_read_more] Explore below the signals generated today

| Signal Type | Timeframe | Signal | Last | Previous |

|---|---|---|---|---|

| Trend | Composite | 0.75 | 1.0 | |

| Price vs MA | 20-days | Down | -1.00 | 1.0 |