Understanding the Impact of Reserve Requirements on Financial Stability

Reserve requirement definition

Reserve requirement is the fraction of customer deposits commercial banks must hold in a fractional reserve banking system. Banks can lend the rest of the funds.

Commercial banks hold their deposits in an account at the central bank. Reserves are assets for commercial banks and liabilities for the central bank since commercial banks can demand their payment at any time.

Total reserves are divided into two required reserves and excess reserves. The central bank sets a reserve requirement ratio. This is the fraction of customer deposits commercial banks must hold. These funds are called required reserves. Commercial banks can lend out the rest of customer deposits.

Reserve Requirement example:

In this example we will 3 banks: Bank 1 (B1), Bank 2 (B2), Bank 3 (B3)

The central bank of a specific country has set the reserve requirement to 20%. This means that all commercial banks in the country must hold only 20% of their customer deposits as reserve and are allowed to lend the rest of the funds.

A bank’s excess reserves are defined as the 80% of the funds available for lending or other activities. When a commercial bank has zero excess reserves, it means that it has lent out 80% of the available funds and it has 100% loan capacity.

B1 and B2 start with $10,000 in deposits and $8,000 in loans outstanding. A new customer deposits $1,000 to B1. B1 is allowed to loan out 80% of the new customer deposits or $800 and is only required to keep $200 (20%) in reserve. The new debtor who borrowed $800 of the bank decides to take his $800 loan and deposit it to B2. B2 deposits are now ($10,800 = $10,000 + $800). B2 is now allowed to lend out 80% of the new $800 customer deposits.

Under a fractional reserve banking system, $1,000 added as new deposits end up $1,800. B1 created $800 as a new loan from nothing.

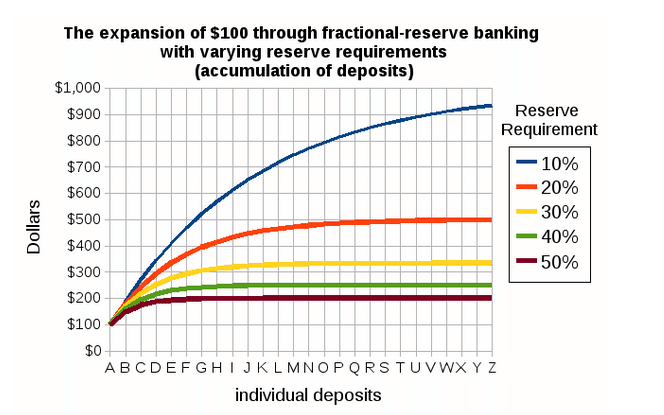

The chart below shows the total amount of $ which can be created with $100 of reserves for different reserve requirement.

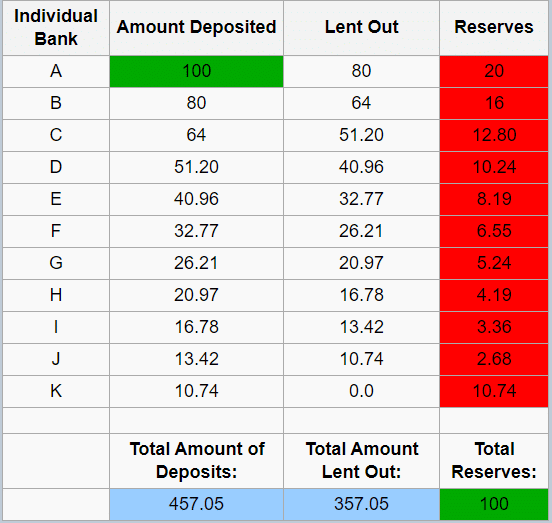

The table below shows how $100 end up with total amount of deposits of $457,07 and a total amount of loans of $357.05 given a reserve requirement of 20%.

The relationship between the reserve requirement ratio (RR) and the money created is given by the deposit multiplier (M).

Deposit multiplier (M) = 1 / Reserve requirement