Annualized Return Definition: How to Calculate and Interpret Your Investment Performance

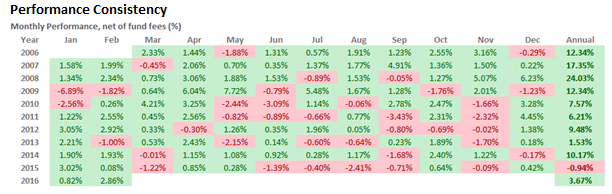

Annualized return is the percentage historical return of an investment.The annualized return must be examined for long historical periods of at least 10 years to confirm how an investment performed during different market environments (Economic Growth, Recessions). Check in the image below what annualized returns one of MacroVar investment strategies has generated in the past including during the Global Financial crisis of 2008.

Annualized Returns of Low Risk Bonds

Low Risk investments like government bonds (US Treasuries, TIPS), Investment Grade US Corporate bonds, municipal bonds and savings have historically generated annual rates of return of 0-2%. In the past bonds generated consistent 3-4% annual returns. However, since the 2008 global financial crisis and to a larger extend during the 2020 Covid-19 pandemic fixed-income returns have fallen substantially (0-2%). The reason for this reduction in returns is that the Federal Reserve has lowered interest rates drastically to provide financial stimulus to the economy and avoid a hard recession.

Read our full guide of how the economy works to understand why authorities like central banks and governments adjust parameters like interest rates to affect economic growth and inflation.

Moreover, it is important to understand why investing in bonds maybe incur considerable risks in specific economic environments.

Annualized Returns of Stock Markets

Historically the main benchmark of the US stock market which is the S&P 500 has generated annualized returns of 8-10%. However, given that stock markets overall are currently overvalued based on popular metrics like the cyclically adjusted price-to-earnings ratio it is unlikely that these annualized returns will persist in the next years.

Other assets which can provide similar annual rates of return but need caution in terms of the risk they incur are: High yield dividend stocks, Emerging markets stocks and Real estate investment trusts (REITs).