Demystifying Buy Side vs. Sell Side: Definitions and Differences

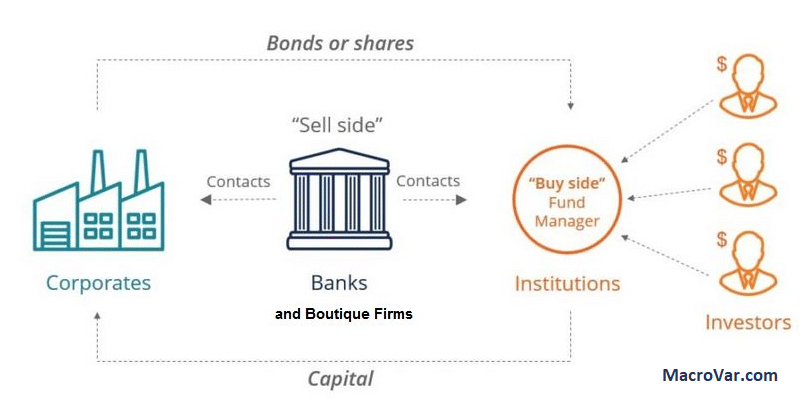

The financial industry consists of financial firms with different roles. Financial firms are often categorised based on their role as buy side or sell side. MacroVar presents the buy side vs sell side roles.

The sell side in the financial industry are investment banks and boutique firms. Their roles are to advise corporate clients on major financial transactions, facilitate in raising capital including debt and equity, advise corporate clients on mergers and acquisitions (M&A) and win new business by building relationships. Moreover, the sell side’s role is to market and sell securities, create liquidity for listed securities, help Clients get in and out of positions and provide equity research coverage of listed companies.

The buy side are fund managers either active like hedge funds and pension funds or passive like mutual funds. The roles of the buy side are to manage their clients’ money by making investment decisions, earn the best risk-adjusted return on capital, perform in-house research on investment opportunities, perform financial modeling and valuation and find investors and recruit capital to manage and grow assets under management (AUM).