What Is Carry Trade and How Does It Work in the Foreign Exchange Market?

A Carry trade is carried out by receiving returns from holding one asset against borrowing another asset.

Carry trade in currencies

The Carry trade strategy is a popular but risky investment strategy applied in the forex market. A carry trade strategy is carried out by borrowing funds using a low interest rate currency to buy a high interest rate currency and profit from the interest rate differential. The investment is profitable as long as the target currency does not weaken against the fund currency easing the interest rate differential.

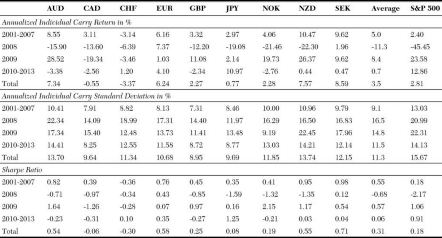

MacroVar has examined the performance of carry trades with the us dollar as the base currency versus the nine most liquid currencies namely the Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), Euro (EUR), British Pound (GBP), Japanese Yen (JPY), Norwegian Krone (NOK), New Zealand Dollar (NZD) and the Swedish Krone (SEK).

The carry trade strategy is performed as follows: on a monthly basis an equally weighted basket is structure, if the interest rate of the foreign currency is higher than US interest rate. The strategy borrows 1 US dollar and buys and holds the equivalent amount of foreign currency for a month and vice-versa. If the interest rate of the foreign currency is lower than the us interest rate, the foreign currency is borrowed to purchase and hold an amount of us dollars. The performance of these strategy is presented below.

The carry trade strategy outperformed the returns of the S&P 500.

However, the risk of a Forex carry trade is that during high global risk environments exchange rates tend to move dramatically. During the global financial crisis of 2008 (more specifically between August 2008 and January 2009) the AUDJPY lost 43%. Warren Buffett has famously quoted that: “carry trade is like picking up nickels in front of a steam roller.

High correlation AUDJPY pair and risky assets versus average G10 carry basket, create EWS market anxiety

Improving the Forex Carry trade strategy

The forex carry trade strategy performance can be improved by modifying the strategy using the following:

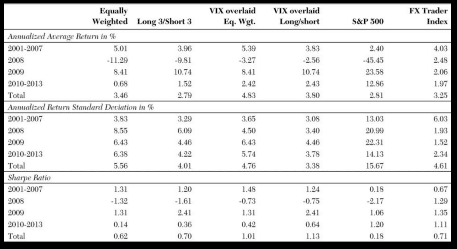

- Diversification: Instead of trading individual currencies, build a portfolio of the G9 currencies presented before and purchase the currencies with positive carry and sell those with negative carry against the us dollar for the following month

- Global Risk Detection: Stay in cash if the VIX volatility indicator is higher than 90th percentile of the past year’s VIX values. In this way financial crisis like that during global financial crisis 2008 would have been avoided

Filters:

- Diversification across FX (build portfolio G9 vs USD: AUD, CAD, CHF, EUR, GBP, YEN, NOK, NZD, SEK) – buy FX with positive carry, sell those with negative carry against USD hold positions for 1 month. Diversified G9 carry portfolio reduces overall volatility to half from 11% to 5.5%

- VIX as market indicator of trouble: If VIX > than 90th percentile of past year’s VIX – out (avoided subprime ’07, financial crisis ’08, EU/Greek ’10)

These two modifications in the carry trade strategy will improve it’s performance dramatically. The following table shows the performance improvement.

Bonds Carry trade strategies

The carry trade strategy is applied in bonds by borrowing using short term interest rates like overnight rate and lending at long-term interest rates assuming a positive sloping yield curve.

Positive carry

A positive carry is a strategy whose net position is profitable to hold, for example borrowing on low short-term interest rates to lend on higher long-term interest rates.

Negative carry

A negative carry is a strategy whose net position is loss making. It is a speculative high-risk strategy where the trader expects a dramatic repricing to compensate for the losses of passively holding a losing position.