How the Fractional Reserve Banking System works

Fractional reserve banking

A fractional reserve banking system requires that commercial banks hold a minimum fraction of customer deposits as reserve and can lend out the remaining funds.

Fractional reserve banking example:

In this example we will 2 banks: Bank 1 (B1), Bank 2 (B2)

The central bank of a specific country has set the reserve requirement ratio to 20%. This means that all commercial banks in the country must hold only 20% of their customer deposits as reserve and are allowed to lend the rest of the funds.

A bank’s excess reserves are defined as the 80% of the funds available for lending or other activities. When a commercial bank has zero excess reserves, it means that it has lent out 80% of the available funds and it has 100% loan capacity.

B1 and B2 start with $10,000 in deposits and $8,000 in loans outstanding. A new customer deposits $1,000 to B1. B1 is allowed to loan out 80% of the new customer deposits or $800 and is only required to keep $200 (20%) in reserve. The new debtor who borrowed $800 of the bank decides to take his $800 loan and deposit it to B2. B2 deposits are now ($10,800 = $10,000 + $800). B2 is now allowed to lend out 80% of the new $800 customer deposits.

Under a fractional reserve banking system, $1,000 added as new deposits end up $1,800. B1 created $800 as a new loan from nothing.

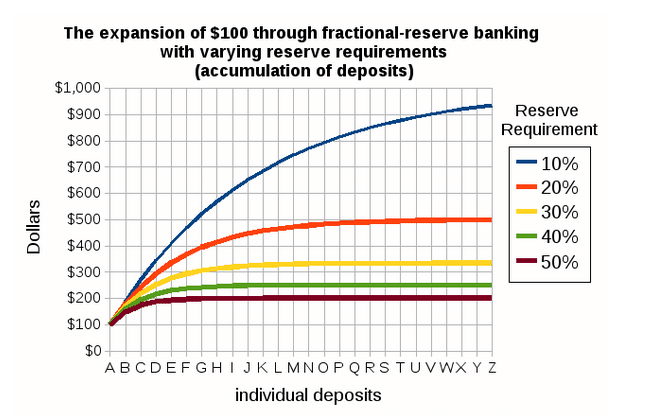

The chart below shows the total amount of $ which can be created with $100 of reserves for different reserve requirement ratios.

The table below shows how $100 end up with total amount of deposits of $457,07 and a total amount of loans of $357.05 given a reserve requirement of 20%.