Mastering Monetary Policy: Strategies for Economic Stability and Growth

A nation’s central bank uses a range of monetary policy tools to control money supply in its financial system aiming to achieve sustainable economic growth.

A country’s economy is healthy when there is stable inflation combined with robust economic growth and low unemomployment.

The nation’s central bank monitors economic indicators like inflation, employment, real GDP and reacts when these indicators show weakening or overheating economic conditions. They use monetary policy and fiscal policy tools to inject liquidity into the financial system and boost economic activity during recessions or withdraw liquidity during overheating economic activity.

There are three groups of monetary policy tools which are used by central banks depending on the severity of the economic situation.

A nation’s ability to use monetary and fiscal policy to stimulate its economy depends on the capital markets’ confidence on that country. When a country’s credibility weakens due to reckless fiscal and monetary policies, political crisis or financial crisis, capital leaves the country causing a deep economic contraction and financial crisis.

Countries should be very diligent when conducting economic policies to sustain capital markets’ confidence in their economy and financial markets. Even developed countries like the United States which have implemented prolonged expansionary policies can eventually experience a loss of confidence in their country’s currency which will trigger an inflationary crisis.

Developed vs Emerging Economies: Developed economies like the US are considered low-risk due to their economic and military power. Hence, they enjoy a reserve currency which allows them to borrow on their own currency and use more aggressively fiscal and monetary policies. Conversely, emerging economies rely on foreign capital flows to grow.

Vulnerable countries which have limited capacity to apply monetary and fiscal policies are those which have 1. Low FX reserves, 2. High foreign debt, 3. Current Account deficit, 4. Large domestic debt, 5. -ve real interest rates, 6. History of high inflation and -ve total returns.

The first group of monetary policy tools (MP1) aims to expand or contract the money supply into the financial system and cause economic growth or contraction by controlling short-term interest rates and the banks’ reserve requirement.

Lower short-term interest rates cause a rise in economic activity triggered by rising demand, debt service easing and the wealth effect.

Rising Demand

Low short-term rates cause rising demand for interest rate sensitive goods. The most important sectors which are sensitive to interest rates are the real estate and the automotive industry.

Debt service ease

Low short-term interest rates reduce the monthly interest payments for business and individual borrowers. This causes an increase in their funds available for consumption and investment.

Wealth effect

The wealth effect is a theory suggesting that people spend more as the value of their assets rise. Lower interest rates cause a rise in assets like real estate, stocks and bonds causing people to spend more.

During severe economic depressions however, MP1 monetary policy tools are inadequate to boost economic activity.

When short-term interest rates reach the zero bound without succeeding in an economic recovery the central bank uses the second group of monetary policy tools (MP2). The second group of monetary policy tools (MP2) aims to stimulate economic activity by forcing investors make riskier investments. The central bank achieves this by printing money (expanding the central bank’s balance sheet) and using the proceeds to purchase long-term financial assets like government bonds to reduce interest rates. MP2 is effective when risk premiums are high but becomes less effective once risk premiums drop. Risk premium is the return in excess of the risk-free rate of return for an investment.

Once MP2 becomes ineffective the central bank uses the third set of monetary policy tools (MP3). Monetary policy 3 (MP3) aims to increase the economy’s aggregate demand. The central bank accomplishes this by printing money and distributing it to the government and individuals to spend it.

If you want to get a more in-depth analysis of a nations’ financial system and the role of monetary policy read more below.

Central Bank Balance Sheet

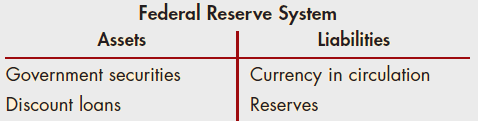

Monetary policy is a set of actions conducted by the nation’s central bank to control financial liquidity. These actions affect the central bank’s balance sheet.

Liabilities

The sum of currency in circulation and reserves is the nation’s money supply also called the monetary base. Currency in circulation is the amount of currency and notes in the hands of the public. Notes are IOUs of the central bank meaning that the central bank promises to pay back the holder of these notes with other notes.

IOUs of the central bank are used as a recognized medium of exchange and are accepted as a means of payment when a country’s financial and economic system is sound and the money supply is restricted. If a nation uses expands its money supply recklessly for prolonged periods, keeping inflation high it can potentially erode the markets’ confidence on the currency and lead the economy to a catastrophic inflationary crisis.

Commercial banks have an account in the central bank to hold deposits. Reserves are assets for commercial banks and liability for the central bank since banks can demand payment on them at any time.

Assets

The central bank holds two groups of assets: government securities and discount loans. The central bank provides liquidity to the financial system and expands the money supply by printing money and using the proceeds to purchase securities. The central bank also expands the money supply by printing money and making discount loans directly to commercial banks. The interest rate charged to commercial banks for these loans is called the discount rate.

Monetary Policy 1

The central bank uses the following tools to lower short-term interest rates.

Open Market Operations

The central bank injects or withdraws liquidity in the banking system by purchasing or selling government securities like bonds in the open market.

When the central bank purchases financial securities it expands reserves and deposits in the banking system causing an increase in the money supply.

Open market operations are used by the central bank for conducting MP1 and MP2 strategies.

Discount Loans

Discount loans from the central bank to commercial banks lead to an injection of liquidity, an expansion of banking reserves which leads to an expansion of the money supply.

Reserve Requirements

The central bank also uses reserve requirements to expand or contract money supply. The reserve requirement is a certain fraction of customer deposits all commercial banks must hold as reserves in the central bank. The rest of customer deposits can be used to make loans.

The central bank sets a reserve requirement which is a certain fraction commercial banks must hold. When the central bank raises reserve requirements it causes a reduction in money supply.

Expansionary monetary policy using the tools above involves the central bank buying short-term government bonds to lower short-term interest rates and encourage commercial banks to increase loans.

Monetary Policy 2

A traditional expansionary monetary policy involves the central bank buying short-term government bonds to lower short-term interest rates, increase money supply and encourage banks to increase loans. However, during severe economic slowdowns short-term interest rates approach the zero bound without succeeding in an economic recovery. This is when, monetary policy 2 is applied.

Quantitative easing (QE) is the purchase of high-quality long-term financial assets like government bonds by printing money aiming to force investors to riskier investments whilst increasing the monetary base.

Monetary Policy 3

Monetary policy 2 is effective in stimulating the economy when risk premium, which is the excess return of an investment relative to the risk-free interest rate is high. Once risk premiums diminish, monetary policy 2 becomes ineffective to stimulate the economy.

The central bank often in coordination with the treasury implement monetary policy 3. The aim is to boost aggregate demand in the economy by expanding government spending and providing funds to businesses and consumers for spending. The following list presents different ways to carry out monetary policy 3.

- Debt-financed government spending

The nation’s government carries out big infrastructure projects by issuing new debt. The nations’ central bank prints money and purchase the new debt issued.

- New money given directly to the government for spending

Instead of the nation’s treasury to issue new debt and the central bank purchasing the new issuance, the central bank prints money and gives them to the government directly to spend

- Cash transfers to households (“helicopter money”)

The central bank prints money and distributes it to citizens.

This analysis is based on the economic principles of Ray Dalio.