Demystifying the Sharpe Ratio: A Comprehensive Definition and Guide

Sharpe ratio definition

Sharpe ratio is the ratio of the average return earned in excess of the risk-free rate per unit of volatility. Sharpe ratio helps investor understand the return an investment compared to its risk.

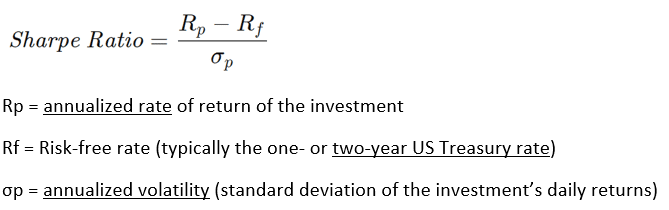

Sharpe ratio formula

What is a good sharpe ratio

Good safe investment strategies generate Sharpe ratios between 1.0 and 2.0.

Sharpe Ratio Example

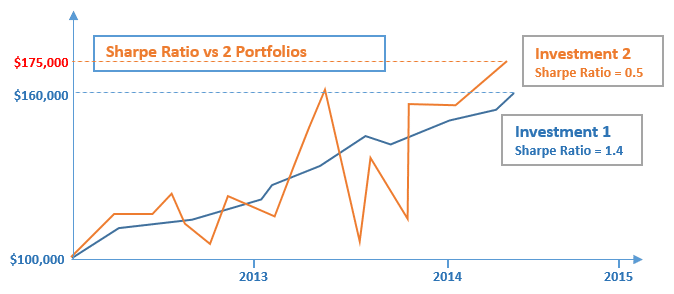

An investor has to choose between two investments with the investment performance displayed above. Although Investment 2 has a higher ending value than Investment 1, it has much higher volatility and drawdown than Investment 1. As a result, Investment’s 1 Sharpe Ratio is 3 times higher than Investment’s 2 Sharpe Ratio and hence for low risk investors the Investment 1 is preferred.

In the example during the half of 2013 till the end of 2013 Investment 2 dropped from $160,000 to $105,000 losing 35% of its value. On the other hand, Investment 1 biggest drawdown occurred in end of 2013 losing 4.5 of its value.

Sign up free to download MacroVar Sharpe Ratio Excel calculator.