Working capital to total assets

The working capital to total assets ratio is a financial metric used to assess a company’s efficiency in managing its working capital (current assets and liabilities) in relation to its total assets. It provides insight into how well a company is using its assets to generate short-term liquidity.

The formula for calculating the working capital to total assets ratio is:

Working Capital to Total Assets Ratio = (Working Capital / Total Assets) * 100

Where:

– Working Capital = Current Assets – Current Liabilities

– Total Assets = All assets owned by the company, including both current and non-current assets

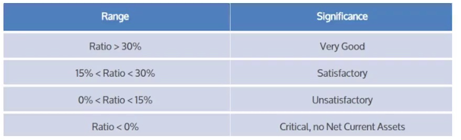

The resulting ratio is expressed as a percentage. A higher ratio indicates that a larger portion of a company’s assets is tied up in working capital, which may suggest that the company is less efficient in managing its short-term liquidity. On the other hand, a lower ratio indicates that the company is using its assets more efficiently to generate revenue and cover its short-term obligations.