Asset Allocation: A Strategy to Optimize the Portfolio Composition Based on the Investor’s Goals and Risk Profile

Asset allocation is the process of structuring an investment portfolio by allocating funds across asset classes like stocks, bonds, commodities, currencies, real estate and cash.

The guide below explains how to structure a typical asset allocation strategy. You can also explore MacroVar’s database of systematic investment strategies.

Asset Allocation principles

The investment strategy analysed is flexible to adapt to different market and economic environments and generate good returns with low risk. To achieve this the strategies were designed based on the following principles:

- Asset Selection of Portfolio: Assets of our portfolios are selected based on their behaviour to all economic and market environments and their dynamic correlations.

- Momentum: Quantitative methods monitor each asset’s momentum and decide whether to keep it in the portfolio.

- Balancing Volatility: Quantitative methods monitor every asset and adjust each asset’s weight on the Portfolio Allocation.

- Advanced Methods: Quantitative methods optimize each asset’s weight in the portfolio based on volatility, correlation, and minimum variance optimization algorithms.

Balanced Investment Portfolio

The assets selected to structure portfolios is the most important decision an investor should take. Balanced portfolios should use assets uncorrelated to one another in order to generate good returns with low volatility in all market environments.

This asset allocation strategy includes assets which perform well under each of the 4 economic environments the global economy experiences. The assets used to build this portfolio are: US Stocks, US Treasuries Bonds, Emerging Market Stocks, US Real Estate, Commodities and Cash.

Assets are represented by the following high quality Exchange Traded Funds (ETF): 1. VTI (US Stocks), 2. TLT (US Long-Term Bonds), 3. EEM (Emerging Stocks), 4. ICF (US Real Estate), 5. DBC (Commodities) and 6. SHY (Cash)

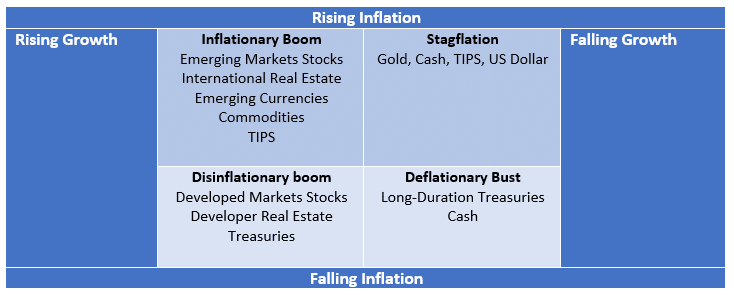

Financial Assets vs Economic Environment

The global economy status is best described by 2 combined factors: inflation and economic growth.

There are 4 global economic environments:

- Inflationary boom: Accelerating Economic growth with Rising inflation

The best performers are emerging market stocks, international real estate, emerging countries’ currencies, commodities, and TIPS (treasury inflation protected securities).

The worst performers are US treasury bonds and cash since they are adversely affected by rising inflation.

High global growth with rising inflation expectations lifts commodities. Many emerging economies growth is linked to commodities. When commodities rise emerging market stocks, currencies and real estate rise as well.

- Stagflation: Slowing Economic Growth with Rising Inflation

The best asset performers protecting investors from inflation are Gold, Cash, Treasury Inflation Protected Securities, and the US Dollar.

The worst performers are long-duration treasury bonds adversely affected by rising inflation.

- Disinflationary boom: Accelerating Economic growth with Slowing Inflation

The best performers are developed markets stocks, developed Real estate and US Treasury bonds.

Low inflation with moderate growth is a good environment for bonds and stocks and bad for the worst performs which are commodities and commodity related sectors.

- Deflationary Bust: Slowing Economic Growth with Falling Inflation

During this environment the best asset performers are Long-Duration Treasuries and Cash. Everything else experiences big volatility and often large losses.

During crashes and economic depressions bonds rise while stocks and commodities fall. Investors during these environments look for the safety of their asset rushing into the safety of US treasury bonds and the US dollar while selling stocks and commodities.

Stocks versus Bonds

Stocks and Bonds are the 2 main pillars of all professional portfolios. Each of the two assets perform wells during different economic conditions.

When economic growth is high and inflation is rising stocks generate good consistent returns. At the same time, rising inflation is the worst possible economic environment for bonds.

However, when economic growth is slowing and/or inflation is falling or at the extreme cases economic recessions, depressions and market crashes are experienced long-term US bonds is the best performing asset by far, generating good returns with low volatility.

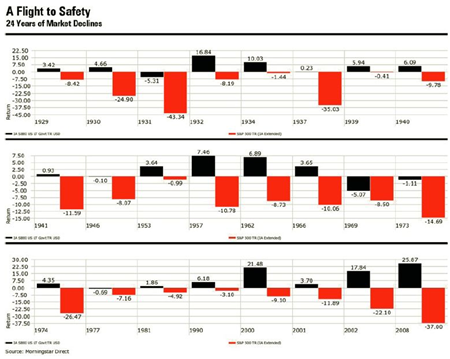

Since the Great depression in 1929, investors in the United States have experienced 24 years of negative stock market returns. During all periods, US Treasury Bonds protected investors from capital loss and served as a flight to safety. In 19 out of 24 years US Treasury bonds generated positive returns.

Momentum

Momentum is one of the largest market inefficiencies generating consistent returns. The fundamental reason is that humans usually choose to follow the crowd rather than act against it. This causes rising prices to attract buyers and falling prices to attract sellers. Academic research has shown momentum to be a market anomaly from the early 1800s up to the present and across nearly all asset classes.

“Cut your losses; let your profits run on” – David Ricardo, 1838

The Simple Momentum Portfolio

There are many quantitative methods to apply momentum to an asset or portfolio. Our simple Momentum portfolio applies momentum as follows:

- Each asset (VTI, IEF, EEM, ICF, DBC) holds an equal weight to the portfolio (20%).

- At the end of every week, the algorithm calculates each asset’s previous 1-month (20 trading days) return

- If the return is negative or zero, we substitute the specific asset with cash (SHY).

- If the return is positive, we keep the asset in the portfolio or we buy the asset if we do not already hold it.

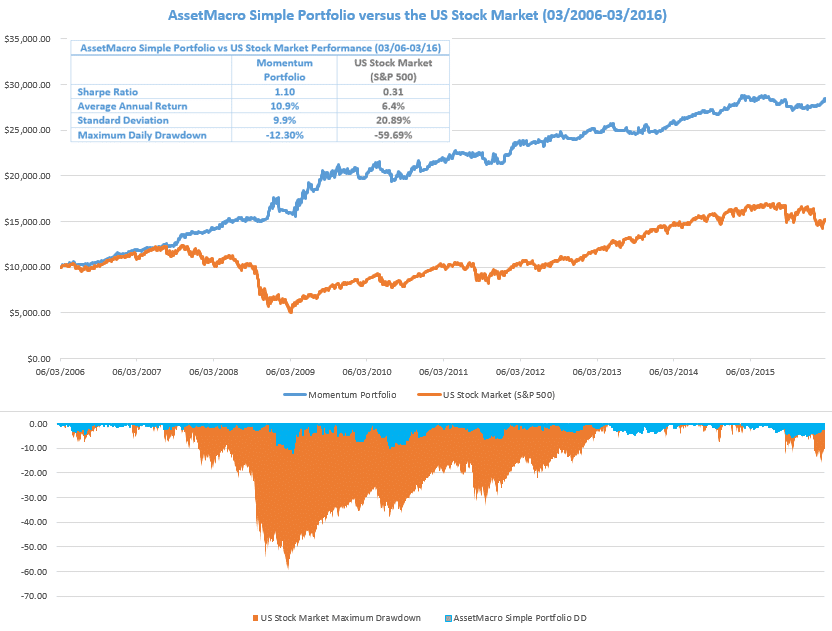

The Simple momentum portfolio generated impressive results while been extremely simple. The portfolio generated three times the risk-adjusted returns of the US Stock market.

The portfolio’s average annual return was 11% when the stock market’s return was 6.4%. A 56% improvement in returns was achieved with half the US Stock market’s volatility. Moreover, the Simple Momentum portfolio lost a maximum of 12.30% during it’s worst performance while the US Stock market lost 59% which is almost 5 times more.

Risk Parity – Balancing Risk

The goal of risk parity is to build a balanced portfolio which will generate stable annual returns with lower risk than the same portfolio with equal weight among assets.

Risk parity ensures that each asset in the portfolio contributes an equal amount of risk (volatility) to the portfolio. Each asset’s weight in the balanced portfolio is calculated based on the amount of the asset’s recent volatility as compared to the volatilities of the other portfolio’s assets.

On the other hand, the simple portfolio assigns equal weight to the portfolio’s assetsfocusing on balancing the dollar amounts invested in each asset of the portfolio.

Volatility describes the degree to which an asset’s price moves up and down. Recent volatility of an asset can be estimated by calculating the recent (trailing) 20-day standard deviation of the asset’s returns

During periods of high volatility, asset returns tend to be lower and during low volatility asset returns tend to be higher. When an asset’s volatility spikes it is usually leading to big asset losses.

Balancing Volatility Example

The aim is to build a balanced portfolio with only stocks and bonds and assign equal risk contribution to both assets. The recent volatility of stocks is 2 times (200%) the observed volatility of bonds. The appropriate allocation to each asset would be computed as follows:

Allocation to stocks x volatility of stocks = allocation to bonds x volatility of bonds

Since ratio of volatility of stocks: bonds is 2:1, the allocation would be equal 1:2 that is 1/3 stocks and 2/3 bonds

Structuring the Balanced Portfolio

The Balanced portfolio is structured as follows:

- The Portfolio consists of the following assets: US Stocks (VTI), US Bonds (IEF), Emerging Stocks (EEM), US Real Estate (ICF) and Commodities (DBC)

- At the end of every week the portfolio is structured based on the following calculations:

- Each asset’s recent 1-month (20 trading days) return is computed

- If the return is negative or zero, the specific asset is substituted with cash (SHY) and is allocated 20% of the portfolio’s weight otherwise the asset is kept in the portfolio

- If the return is positive, the asset is held in the portfolio or is bought back if not already included in the portfolio

- Each asset’s recent 1-month (20 trading days) standard deviation is compued. The risk parity formula described above is used to calculate the weights of the portfolio’s assets. The risk parity formula takes into account each individual asset’s volatility versus the volatility of the rest of portfolio’s non-cash assets

- Each asset’s recent 1-month (20 trading days) return is computed

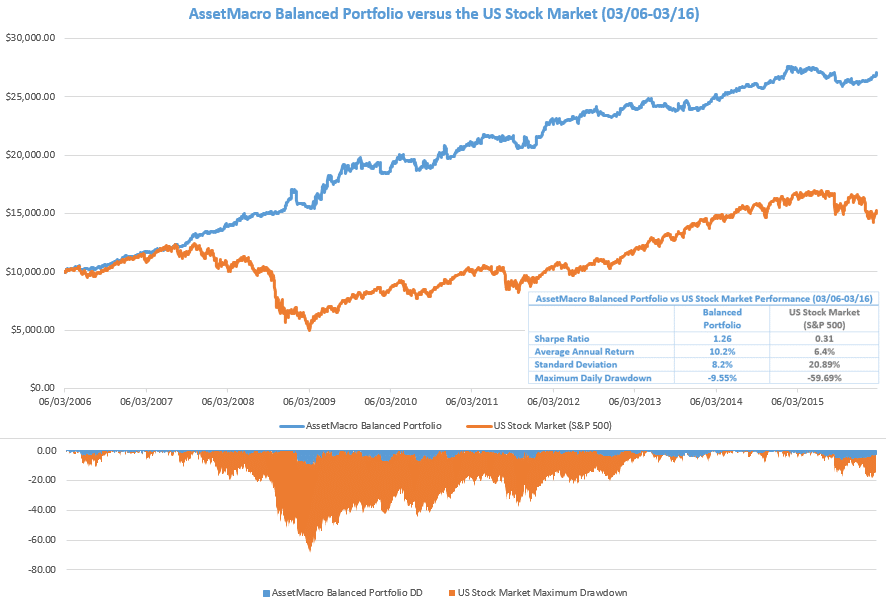

The Risk Parity portfolio generated impressive results while been very simple. The portfolio generated four times the risk-adjusted returns of the US Stock market (Sharpe Ratio of 1.20 versus 0.31 of US Stock Market).

The portfolio’s average annual return was 8.6% when the stock market’s return was 6.4%. Most importantly, the Risk Parity portfolio lost a maximum of 7.2% during its worst performance while the US Stock market lost 59%, 8 times more! This can be viewed clearly from the lower chart above where in blue is the maximum loss of the risk parity portfolio and in orange the maximum loss incurred from the US Stock market.

Risk Parity portfolio has successfully protected its investors while offering consistent returns during the last 10 years.

Portfolio Optimisation

Default risk parity assumes that all assets have a correlation of zero. In reality, assets’ correlations are dynamic and almost never zero. (show charts rolling correlations of assets)

Assets which are highly correlated in the portfolio contribute much more risk than assets that are good diversifiers.

Minimum variance optimization algorithms strive to find the perfect weights of all assets in a portfolio by estimating dynamic volatilities and correlations between portfolios’ assets. These algorithms and consequently the portfolios utilizing such methods offer flexibility and short response times to changing market conditions.

Keep in mind that a good diversified selection of portfolios’ assets is a prerequisite for such algorithms to succeed in finding the optimum balance between assets.

Portfolio Leveraging

To improve the portfolio’s performance further, portfolios’ returns can be enhanced further using dynamic methods to increase portfolio leverage when markets are calm and volatility is low. This occurs typically in the early and mid-stages of bull markets. When volatility is high which is in early stage of bear markets portfolio leverage is scaled down dynamically.

Enriching the Portfolio’s Asset Selection Further Other assets can be included in the portfolio in order to broaden the portfolio’s spectrum monitored. In this way, returns can be boosted further while maintaining low levels of volatility.

Investment Strategies

Alternatively, you can access our investment strategies section to research and implement strategies of different trading styles.