How to Invest in Corporate Bonds and Earn High Returns

Corporate bonds are bonds issued by large corporations, to finance projects or their business activity. Investors interested in buying corporate bonds must thoroughly analyse the corporate bond’s indenture which is a contract clarifying the borrower’s obligations and the lender’s rights.

The risk of each corporate bond has varying risk since default risk depends on the company’s health which is affected by many different variables. Consequently, corporate bonds are complicated debt securities which need professional investment knowledge to analyze their return and risk characteristics.

A corporate bond’s credit risk is measured by its credit spread which is the extra interest a lender requires to compensate for the additional risk of the specific corporate bond relevant to a government bond. Riskier corporate bonds have higher credit spreads.

Corporate Bond Prices vs credit spreads

Corporate bond prices are intricately linked to credit spreads. Higher credit spreads lead to lower corporate bond prices. The reason is that if the bond market for the specific corporate bond requires credit spreads due to an upward reevaluation of the bond’s risk than the initial level of credit spreads when the existing corporate bond was issued, the price of this corporate bond will fall because new corporate bonds will be issued with higher coupon rates making the old outstanding corporate bonds with lower coupon rates, less attractive unless they can be purchased at a lower price. Conversely, lower credit spreads mean higher corporate bond prices.

Corporate Bonds and the Economy

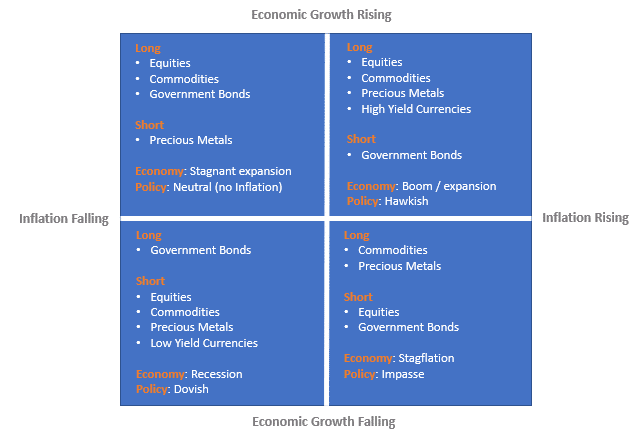

Real economic growth expectations and the inflation outlook of the global economy drive all financial assets. There are 4 economic environments based on economic growth and inflationary conditions.

- Inflation boom: Accelerating Economic growth with Rising inflation

- Stagflation: Slowing Economic Growth with Rising Inflation

- Disinflation boom: Accelerating Economic growth with Slowing Inflation

- Deflation Bust: Slowing Economic Growth with Falling Inflation

Corporate bonds are highly correlated with stocks. Hence, corporate bonds are the best performing assets during periods rising economic growth combined with moderate or rising inflation.

Corporate bonds are the worst performing financial assets during periods of falling economic growth.

Corporate Bonds and Market Risk

During global economic expansions when inflation expectations are positive, capital flows out of low-risk assets such as US treasuries and German bunds into higher risk financial assets such as corporate bonds in search for high yield.

During economic slowdowns where the market expectation is disinflation funds flow from risky assets like corporate bonds and stocks to low-risk financial assets like US treasuries and German bunds.

Factors affecting Corporate Bonds

Each corporate bond has a varying default risk level based on the specific company’s financial health which is dependent on many variables.

However, the two most important factors affecting a corporate bond’s performance are:

- The corporate bond’s sector and industry

- The specific company’s credit risk

Corporate Bonds by sector and industry

The corporate bond’s sector and industry is the most important factor affecting a corporate bond’s performance since corporate bonds in different sectors, have totally different risk-return profiles.

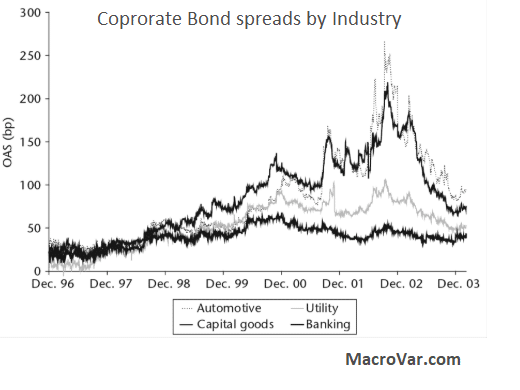

Cyclical versus noncyclical Corporate Bonds sectors

Sectors differ by their sensitivity to the economic environment. Investors distinguish sectors into cyclical and noncyclical sectors. Cyclical industries are highly correlated to the business cycle. During economic expansions, their revenues and cash flows expand substantially outperforming noncyclical sectors because their goods and services are linked to private consumption. A Typical example of a cyclical sector is the automotive industry. Non-cyclical sectors are not highly correlated to the business cycle. Hence, corporations in these sectors are very resilient during recessions. A typical example of a noncyclical sector is the utility sector.

The figure shows the different behaviors of various sectors during the recessions of 2008 and the most recent economic crisis of Covid-19.

During economic recessions, corporate bonds of cyclical sectors credit spreads widened substantially signifying credit default probability rising. On the other hand, corporate bonds of non-cyclical sectors remained stable.

Corporate Bond specific Credit Analysis

A specific corporate bond is also affected by company-specific factors which require further investigation of the company’s fundamentals.

A bottom-up analysis of the company is required to analyse thoroughly the company’s credit risk. Check our guide on bottom-up approach to analyse companies.

How to buy Corporate Bonds

The simplest way to buy corporate bonds is by buying mutual funds or ETFs through a brokerage. Brokers like Fidelity, Charles Schwab allow you to invest in ETFs and mutual funds.

The two largest high-yield ETFs are the iShares iBOXX $ High Yield Corporate Bond Fund (Ticker: HYC) and the SPDR Barclays Capital High Yield bond ETF (JNK). However, the exposure of the fund on each sector and industry is out of your control and specified by the fund’s manager.

Hence, before you invest, it is important to follow these steps thoroughly:

- Monitor the Global economy and make sure the current economic environment is healthy and the future economic and inflation expectations are also robust.

- Verify that the overall corporate bond market with the specific credit rating (AAA or other) under examination has strong performance using MacroVar free tools listed below.

- Analyze the fund’s composition in terms of its exposure by sector, by country and corporate credit rating

If you are interested in investing in a specific sector, industry or an individual corporate bond, then follow these additional steps:

- Carefully read the bond indenture which is a contract stating the lender’s rights and the borrower’s obligations. Any collateral offered as security to the bondholders will be described in this contract.

- Verify that the specific corporate bond sector and the related stock sector currently have strong momentum and trends using MacroVar free credit spreads monitor.

- Analyze the sector’s performance during economic recessions using historical data to make sure you can incur a potential loss if it arises in the future.

- A company’s corporate bond is highly correlated with the company’s stock and credit default swap. By analyzing the company’s stock using our stock trading guide and the company’s credit default swap you can easily verify that the company’s corporate bond is a solid investment.

- Analyze the company’s fundamentals using our bottom-up guide.

MacroVar monitors daily the 80 sectors and industries of the United States Corporate bond market and the 50 sectors and industries of the European corporate bond market.

Sign up free using the forms on the right to receive daily analysis of financial markets and the global economies from MacroVar professional fund managers in order to identify investment opportunities and potential risks across financial markets like corporate bonds, stocks, commodities and currencies.

Credit Research

Start monitoring bond markets by signing up to MacroVar Credit research.