Mastering the Basics: A Comprehensive Guide to Investing for Beginners

If you are a beginner in investing MacroVar investing basics guide below will help you grasp the most important principles of investing to general long-term wealth creation. Moreover, you will learn how to invest in mutual funds, index funds, stocks, bonds, commodities, and currencies.

The most important mistake amateur investors make is they select investments based only on their past short-term returns while ignoring the volatility of returns.

Investors should select investments with high average returns and low volatility.

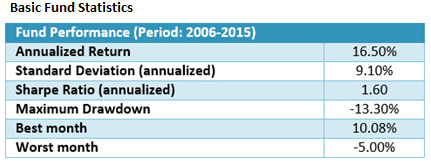

To examine an investment’s performance, you must analyse the following characteristics:

- Average Annual returns: Average annual return (AAR) is the percentage historical return of an investment. Typical Fund average returns are 5-10%.

- Volatility: Volatility describes the degree to which an investment’s value moves up and down. This is the investment’s risk.

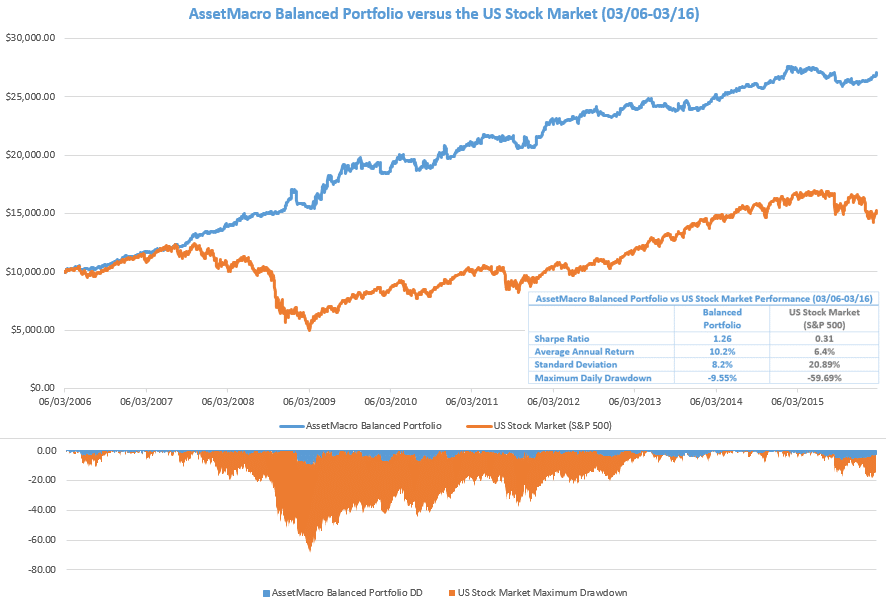

Investors should select investments with the highest return possible and the lowest volatility.

Conclusion: Balanced Portfolio generated 10% average returns with 5% risk as compared to the US stock market which generated 5% with twice the risk

If an investment has an average annual return of 10% and a volatility of 15%, investors should expect annual returns to fall within a range of 5% to 25%.

- Maximum Drawdown: An asset or investment strategy suffers a drawdown when it loses money. Maximum drawdown measures the largest single drop from peak to bottom in the investment’s value. Investors in a fund with a max drawdown of 50% saw their portfolios lose half of their value.

Investors should select investments with the lowest possible maximum drawdown. Investments with Maximum Drawdown between 5% and 20% are considered safe investments.

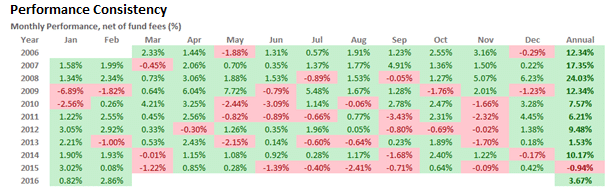

- Performance Consistency: An investment’s performance should be examined for long historical periods of at least 10 years to confirm how an investment performed during different market environments (Growth, Recession).

Market crashes: Special attention must be given on how the investment performed during market crisis like 2000 dot-com bubble, 2008-2009 crash etc.

Longer periods of historical performance often guarantee similar future investment performance irrespective of the market environment.

- Sharpe Ratio: Sharpe ratio helps investor understand the return an investment compared to its risk. Good safe investment strategies generate Sharpe ratios between 1.0 and 2.0. (Version 2 investment strategies)

- Investment Costs: An investment’s net performance must be examined after all costs have been deducted. The higher the cost of an investment, the greater the erosion of an investor’s returns is and hence the more difficult it is to generate profits.

- Mutual funds embed their costs into what investors see as their net performance.

- Financial advisors charge a flat financial advisor fee covering the whole advisory, which is generally based on a percentage of assets under management (AUM). Common values are between 1-2% of AUM.

- Investors in individual securities (stocks, ETFs etc.) pay commissions for trade execution. When analysing a specific strategy, it is critical to examine the total trading costs. The 2 major variables to check are 1. The frequency of trading and 2. The cost per trade (typically $5-10).

If you are interested in structuring your investment strategy without relying on anyone and paying no commission check MacroVar asset allocation guide followed by many successful fund managers.

Investment Strategies

You can access our investment strategies section to research and implement strategies of different trading styles.