Yield Curve research & analytics

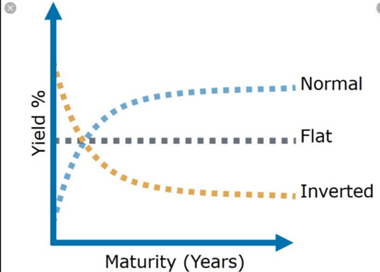

The yield curve is a line that plots yields (or interest rates) of bonds having equal credit quality but differing maturity dates. Bond maturities range from 3 months to 30 years.

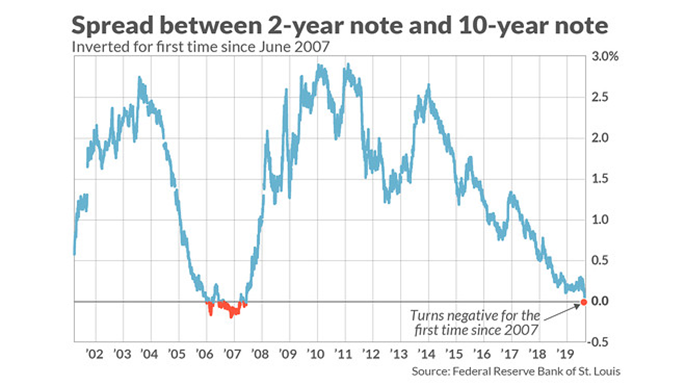

The benchmark yield curve monitored closely for all economies is the spread between the 10-year bond and the 2-year bond. The 10-year to 2-year yield curve predicts economic conditions 4-5 years out.

The short-end (the 2-year bond) of the yield curve is driven by market expectations of central bank’s actions while the long-end (the 10-year bond) is driven by the market’s expectations of future economic conditions and the inflation outlook.

The US yield curve is one of the most important leading indicators used to predict the US economy and markets. The full US yield curve (the spread between the US 10-year bond and the Fed funds target rate) is often leading or lagging other leading indicators of the economy and markets. The most important leading indicators to gauge US markets and the economy are the US yield curve against are the US ISM Manufacturing PMI, the S&P 500 stock market index, the US CDX IG credit risk index and the VIX equity risk index. These few leading indicators when combined, provide you an overall outlook of the US economy and financial markets.

MacroVar monitors yield curves for the largest 25 global markets and the yield curve global breadth.

Bond Prices versus yields and inflation

Bond prices move in opposite direction to bond yields (interest rates). Higher yields lead to lower bond prices. The reason is that if current yields are higher than the level of yields when the existing bonds were issued, the prices of those bonds will fall because new bonds will be issued with higher coupon rates making the old outstanding bonds with lower coupon rates, less attractive unless they can be purchased at a lower price and vice-versa.

Inflation is the most critical factor affecting bonds. A bond’s coupon rate is fixed for the bond’s life. Hence during rising inflation, the price of bonds tends to drop, because the bond may not be paying enough interest to stay ahead of inflation. Long-term bonds prices are more sensitive to rising inflation than short-term bonds.

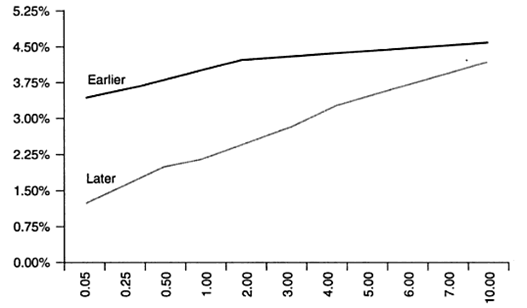

Normal Yield Curve

A normal yield curve is one in which longer-term bonds (US 10-year bonds) have higher yields compared to shorter-term bonds (US 2-year bond) to compensate for the additional rising inflation risk taken by investors to lend governments for a longer-period of time.

During economic expansions and rising inflation, funds flow from bonds to riskier financial assets like stocks or high yield bonds causing long-term rates to rise more than short-term rates. At the same time, rising inflation expectations lead funds flow out of long-term bonds which are adversely affected by rising inflation risk into other riskier assets or short-term bonds which are not as heavily affected by rising inflation. This causes the yield curve to steepen forming a normal yield curve.

Check more details on the different market and economic causes leading to yield curve steepening

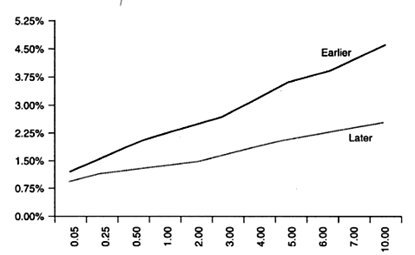

Flat Yield Curve

A flat yield curve is one in which the yields between short-term bonds (2-year bond) and long-term bonds (10-year bond) come closer together. A flattening of the yield curve can happen in two ways:

- Short-term Bond yields rising more relative to Long-term bond yields: If the market expects central banks raise short-term interest rates in order to decelerate the economy, it will sell short-term bonds causing short-term yields to rise more than long-term yields and hence the yield curve to flatten

- Long-term bond yields falling more relative to short-term bond yields: If the market expects rising risk or inflation expectations to fall, funds will move into long-term bonds for safety causing long-term bond yields to fall relative to short-term bond yields. This will cause the yield curve to flatten.

A flat yield curve often serves as a transitioning stage, shifting from a normal yield curve to an inverted one. As the economy moves from a phase of growth to a period of stagnation or even shrinkage, and possibly toward a recession, the yields on long-term bonds generally decrease compared to those on short-term bonds.

Investors tend to buy long-term bonds while selling short-term bonds and riskier assets like stocks when the economy is transitioning from growth to contraction. In this scenario, the yield curve flattens and may eventually invert.

Conversely, when the economy is expected to recover from a downturn and move toward growth, investors are more likely to buy short-term bonds and riskier assets like stocks, while selling long-term bonds.

In this case, the yield curve starts to steepen as the economy transitions from contraction to expansion.

Check more details on the different market and economic causes leading to yield curve flattening

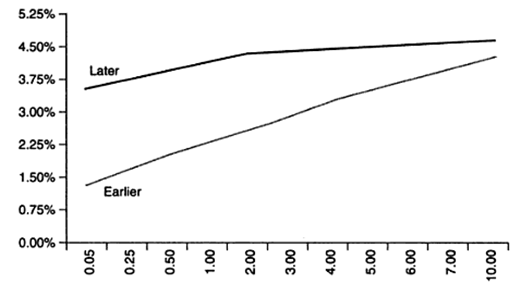

Inverted Yield Curve

An inverted yield curve is one in which the yield of long-term bonds is lower than short-term bonds. When the market expects disinflation and deteriorating economic conditions, fund flows into safe long-term bonds out of risky assets like stocks causing long-term yields to drop more than short-term rates. This causes bond yields of long-term bonds to fall substantially relative to short-term bonds causing an inversion of the yield curve.

Historically, an inverted yield curve has predicted a recession 12 months later. However, this occurred before central banks started taking extreme monetary policy measures like QE, QQE and MMT. Read our analysis on the yield curve and central banks.

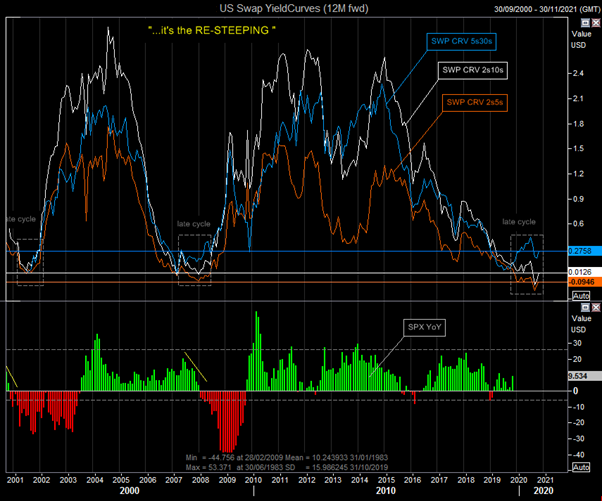

Yield Curve and the Stock Market

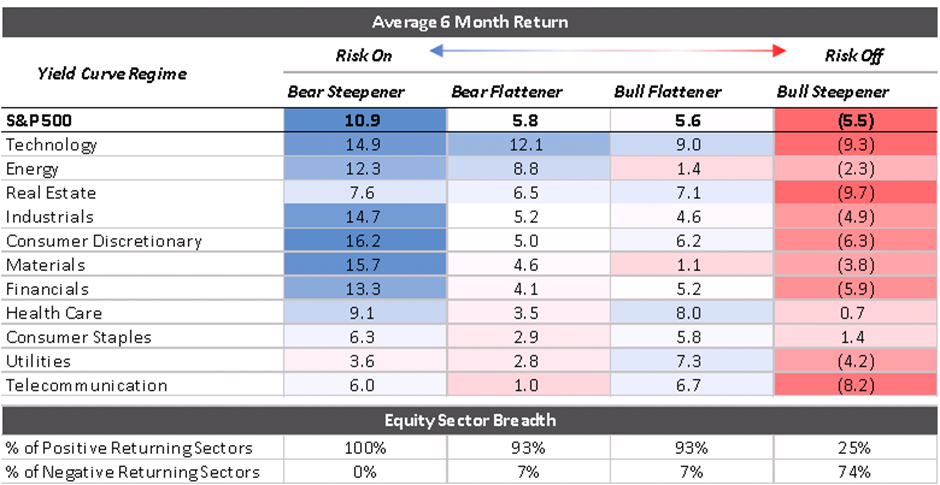

Equities have historically been the best performers during periods of bear steepener yield curves. Bear steepening yield curve periods occur during risk-on periods of accelerating economic growth and inflation.

Conversely, periods of bull steepener yield curves is the worst risk-off regime. This regime largely reflects the Federal Reserve easing monetary policy in response to a recession.

The S&P 500 which is the benchmark stock market index has generated its best performance during bear steepening periods. Bear steepening yield curves occur during reflationary periods early in the business cycle when the economy emerges from recession. During risk on periods, cyclical sectors (i.e. consumer discretionary, financials, industrials) historically have performed the best. During risk off regimes, defensive sectors historically have performed the best, e.g., consumer staples, health care.

Another useful yield curve to monitor is the spread between the 5-year bond and the 2-year bond. This yield curve shows bond market expectations on economic strength for the next 1 to 2 years. New lows 5-year to 2-year spread values predicts weaker economic growth within the next 1 to 2 years. An inversion of the 5-year to 2-year yield curve predicts a recession in the following 1 to 2 years.

Yield Curve steepening

Bear Steepening yield curve: interest rates rise & yield curve steeper

Bear steepening occurs when long term interest rates rise faster than short term interest rates. This often happens when inflation expectations pick up. Equities historically are the best performers during periods of bear steepener yield curves. Read analysis of the yield curve versus stocks.

Bull Steepening yield curve: interest rates fall & yield curve steeper

Bull steepener yield curves occur when short term interest rates fall faster than long term interest rates. This often happens when the central bank is expected to cut interest rates in order to stimulate a weakening economy. Historically, during periods of bull steepening yield curves, equities are the worst performing assets. Read our analysis of the yield curve versus stocks.

Yield curve flattening

There are two types of yield curve flattening.

Bull flattening yield curve: interest rates falling, yield curve flat

Bull flattening yield curves occur when long-term rates fall faster than short-term interest rates. A bull flattening yield curve occurs during elevated market risk or lowered inflation expectations. During these periods, funds flow into long-term treasuries in search for safety. This causes a sharp drop in long-term yields while short-term rates remain relatively flat. Equities historically have performed relatively poorly during periods of bull flattening yield curve. Read analysis of the yield curve versus stocks.

Bear flattening yield curve: interest rates rising, yield curve flat

Bear flattener yield curves occur when short-term interest rates rise faster than long-term yields. A bear flattening yield curve occurs because the market expects the Fed to raise short-term interest rates to cool off an overheated economy. Historically, equities have performed relatively well during periods of bear flattening yield curve. Read analysis of the yield curve versus stocks relationship.’

Bull Re-Steepening

A bull re-steepening yield curve often signifies an upcoming recession. During such periods stock markets have experienced heavy losses. Bull re-steepening occurs because the economy is hard hit and the central bank cuts short-term rates a lot or even using emergency cuts, while long-term bonds are bought on a much lower GDP outlook and in search for safety.

Bull Re-Steepening

However, central bank policies like MMT and fiscal packages may cause long-term bonds not to be considered as safe assets since these policies will cause huge bond supply and inflationary future expectations to rise.

Moreover, when a bear-flattening yield curve is transformed into bull-flattening yield curve it is a great cause for concern.

Yield Curve and Central Banks

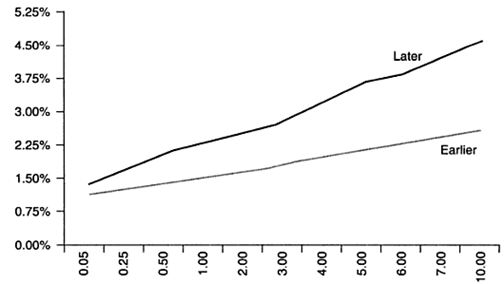

During normal economic conditions, short-term rates are controlled by central banks while long-term rates are controlled by fund flows and the market.

The US 2-year bond yield shows the market’s expectation on the central bank moves. It is useful to closely monitor the spread between the US 2-year bond yield and the Fed funds rate. When the US 2-year is below the fed funds rate, it signifies that the market expects the Fed to lower rates in anticipation of a weakening economy.

An alternative measure of this dynamic is the difference between the yield of the Fed Funds 12-month and 1-month futures. Moreover, traders should monitor the implied yield of 1-month, 3-month Fed funds futures versus the current Fed funds mid target range.

During extreme economic conditions like long and deep recessions, central banks take extreme monetary measures like expanding their balance sheets in a big way (money printing) and use the proceeds to buy bonds across the yield curve. This leads to full control of the yield curve by the central bank making the yield curve a worthless tool for predicting economies and stock markets.

Treasury bill purchase programs also affect the yield curve by lowering short-term rates.

Fiscal interventions like government infrastructure spending projects adversely affect government bonds by causing both short-term government bond yields and long-term government bond yields to rise predicting rising future inflation.

Yield Curves and country risk

During capital flight from a country, the country’s inverts heavily for the following reasons: 1. Fund flows out long-term government bonds and out of the currency pushing long-term rates up, 2. The central bank raises short-term rates sharply to slow down or reverse capital flight. The rise in short-term interest rates causes a severe economic recession.

Later on and if capital flight eases (economy becomes more competitive, global landscape changes like US dollar rates lower), the central bank reduces emergency short-term rates and the yield curve normalizes.

Factors affecting US Yield Curve

MacroVar monitors the following factors which are highly correlated to the US Yield Curve:

- ISM Manufacturing PMI vs the US 10-year to 2-year Yield Curve

- ISM Manufacturing PMI vs the US 5-year to 2-year yield curve

- VIX vs US 10-year to 2-year yield curve