The Ultimate Guide to Real Estate Investing: Strategies, Tips, and Resources

In this section we will analyze the factors affecting real estate and how MacroVar tracks global and local real estate markets.

Real estate is a good investment vehicle. Real estate is closely correlated to the level of interest rates and inflation. Real estate is inversely correlated with long-term interest rates. When interest rates rise which generally occurs during strong economic environments, real estate weakens. On the other hand, when interest falls which occurs during economic recessions, real estate strengthens. Housing starts is a coincident economic indicator which has historically fell during economic booms and recovered during economic busts.

Sign Up free to MacroVar financial & Macroeconomic analytics to monitor real estate values across most countries and major cities of the world.

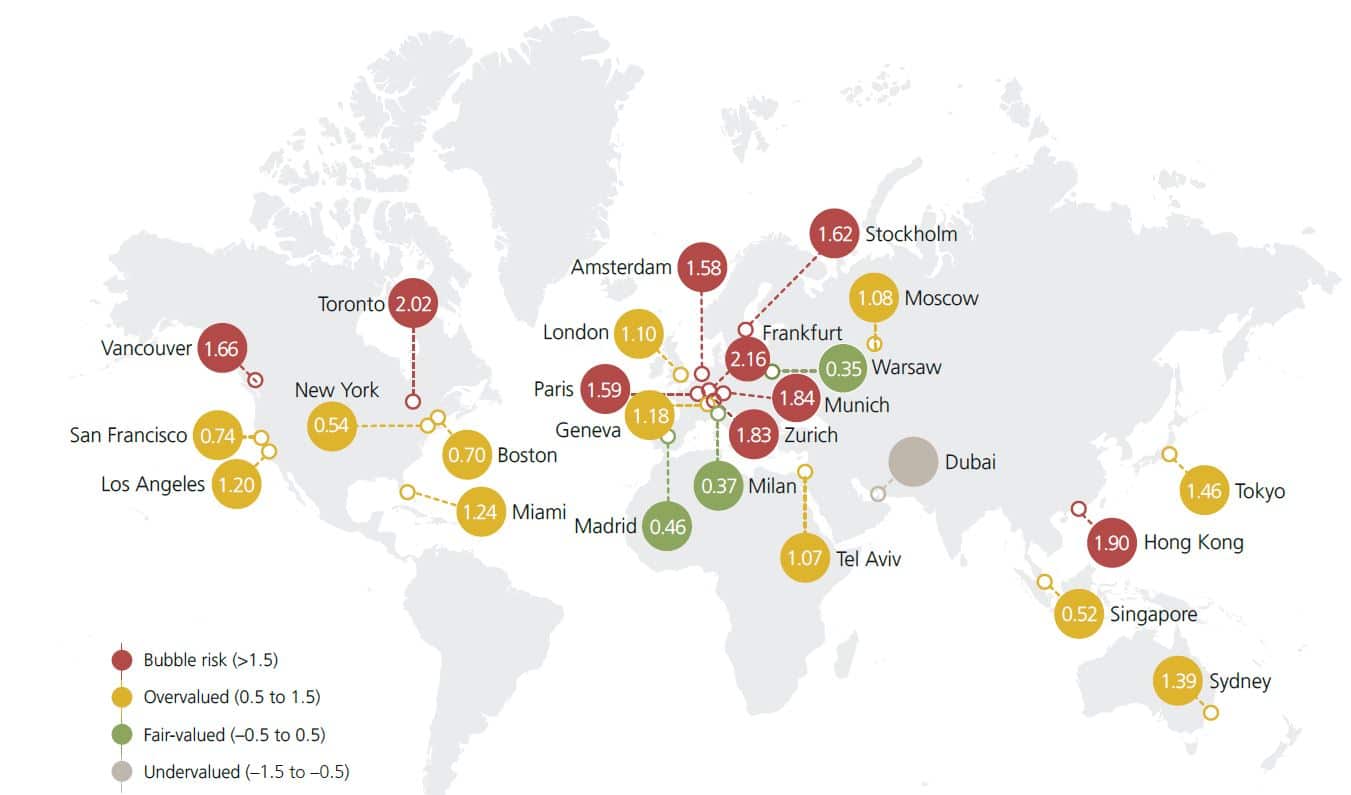

Global Housing Market Trends

Housing Market Factors

Real Estate is the most important investment asset class globally. Real estate offers two sources of wealth: 1. capital gains/losses, 2. rental income. Both the value of the asset and it’s rental income is affected by macroeconomic factors which affect the demand and supply for any market.

Each property is evaluated primarily by forecasting the demand and supply dynamics for the specific asset based on its unique properties, such as layout, location, and amenities.

Demand-Side Dynamics

The factors affecting the demand for a specific property market are:

- Cost of Borrowing: 80% of US property market is purchased using borrowing. When long-term interest rates rise real estate prices fall and vice-versa. Long-term rates are affected inflation expectations.

- Average Local income: Local economic activity affects real wage growth which in turn affects rents. When economic activity rises, real wages (nominal wages minus inflation rate) rise causing a rise in rental market, rising yields cause asset prices to rise.

- Demographics: Migration into a specific location, causes increased demand for real estate pushing property markets. On the other hand, aging population and migration out of a location causes drop in demand for real estate.

- Unemployment Rate: Rise in unemployment rate, causes a reduction in purchasing power which in turn drop in demand for real estate.

- Job Openings: A rise in job openings causes rise in demand for real estate.

Supply-Side Dynamics

The factors affecting the supply for a specific property market are:

- Inventory: Inventory represents homes available for sale. A high level of real estate inventory and new listings is a strong sign of market weakness.

- Foreclosures: Foreclosures is taking posession of property when the mortgagor fails to keep up with mortage payments. Rising foreclosures is a strong of market weakness.

- Building Permits: Building permits are a type of authorization granted by a government before the construction of a new building can legally occur. Rising building permits is a sign of healthy market.

- Job Openings: A rise in job openings causes rise in demand for real estate.

Real Estate Indicators

The most important indicators to gauge a specific real estate market are:

- Price/Income ratio: Price-to-income ratio is the ratio between the price of a median home to that of the median annual household income in a particular area. The concept of price-to-income ratio is used to measure the affordability of homes in a certain area.

- Price/rent ratio: The price-to-rent ratio is the ratio of home prices to annualized rent in a given location. The price-to-rent ratio is used as an indicator for whether housing markets are fairly valued, or in a bubble

- Real Long-Term Interest Rates: Real estate prices are closely correlated with real interest rates (nominal interest rates minus inflation). Historically, during the 1970s rising long-term rates didn’t prohibit real estate values from rising. The inflationary forces were stronger than the dampening force of rising interest rates.

MacroVar monitors real estate price and rental dynamics by country and city in combination with a country’s and state’s macroeconomic indicators. MacroVar monitors the following:

- US Home Prices: Zillow Database is used for tracking US home prices

- US Rental Market: Zillow Database is used for tracking US home rental market

- US Housing Market Index: Case Shiller housing price indexes are lagging indicators of the housing market. MacroVar also monitors leading indicators like building permits for each state and US as a whole.

- Global Home Prices & Rents: Various sources are used to get data for Global home prices and rents

- Macroeconomic Indicators: MacroVar analyzes more 14,000+ macroeconomic indciators for all countries to forecast real estate prices.

Real Estate characteristics as an investment asset

Real estate as an asset class can generate a return of capital bewteen 10-30% but it has certain characteristics which need caution. Firstly, real estate is the least liquid investment. The ideal real estate investment should have the following criteria:

- A problematic asset which can be fixed: Investing in real estate can generate extraordinary returns if it is handled properly. The value is hidden in real estate which isn’t in use, is old and in bad shape cosmetically, located in mid to low quality areas. Purchasing these real estate properties and refurbishing them can generate substantial returns.

- A strong asset enduring short-term challenges

- A motivated seller with cash flow or other issues

- Purchase assets after recessions, in the low part of the cycle: Between 2009-2011 UK commercial real estate dropped in value by 80%. This was a very good investing opportunity, which produced a capital appreciation of 30% in a matter of 2 years.

- Change the function of an asset to generate higher yields In the past 50 years, London real estate has experienced a boom due to high population growth and lack of supply. There were many commercial buildings which were converted to blocks of flats and could be either sold or rented out. Low interest rates were the ideal environment to finance such projects.

- High gross yields Real estate properties can generate a gross yield of 6-8 per cent.

- Normal leverage levels Leverage in real estate investing must be used prudently. 60-70 per cent is normal leverage.

Sign up for MacroVar analytics for Free

Monitor real estate dynamics using MacroVar analytics & tools for free.