Unlocking the World of Commodities Trading: Opportunities and Insights

Commodities & the Global Economy

Energy commodities and metal commodities used in manufacturing are cyclical and closely correlated with global economic growth. The most important commodities considered leading indicators of the global economy are crude oil and copper.

Crude oil demand depends on global trade hence it is intricately linked to global economic growth. Copper is the main metal used in most sectors of the economy from construction to electronics and power generation and transmission. Shipping is a commodity related sector which is also affected by global economic growth.

MacroVar monitors both commodities prices dynamics closely versus the Global Manufacturing PMI which is a leading indicator of global economic growth. Large divergences between commodities and Global PMI momentum measured by year over year return may signify commodity trading opportunities.

Commodities versus the US Dollar

Since commodities are priced in US dollars, when the value of the dollar rises, the price of commodities measured in other currencies rise. When raw material prices rise, demand tends to fall. A long-term bear market in the dollar began in 2002 and corresponded with a secular bull market in commodity prices.

Commodities and Global Risk

Precious metals are considered low-risk safe assets during increased global market risk. Funds flow to precious metals in anticipation of fiscal and monetary policy stimuli programs which normally bring inflationary conditions and currency depreciations or devaluations. Gold is the most important safe asset followed by silver platinum and palladium. Silver, platinum and palladium are considered precious metals but since they are also used as basic metals in manufacturing, they are also affected by the global economy.

Commodities Seasonality

Some commodities are heavily affected by seasonality. MacroVar monitors seasonality for the following commodities: Crude Oil, Natural Gas, Gold, Lumber, Sugar, Corn, Baltic Dry Index, Copper, Silver, Palladium, Cotton. Check our guide on how MacroVar monitors seasonality for financial markets.

Demand / Supply Dynamics

Commodity prices are determined by demand and supply dynamics. Commodities supply shocks like the Vale dam disaster or extreme weather conditions like floods often lead to supply disruptions and sudden spikes in commodity prices. Some commodities are affected by political crisis in commodity producing countries.

Crude Oil

The main sources for monitoring the physical demand and supply of the crude oil market are OPEC, and IEA reports and actions.

Platinum & Palladium

John Matthey produces detailed reports for the demand / supply dynamics of the physical market for platinum and palladium.

Weather

Agriculture commodities are affected by weather conditions. Extreme weather phenomena like spring floods have historically caused commodities prices spikes due to supply shocks mainly for food commodities like corn, wheat, rice, soybeans, and coffee.

Weather forecasts are particularly useful in monitoring when trading food commodities. US weather forecasts are provided by NOAA.

Aura commodities provides live monitoring of global weather conditions and detailed reports for demand and supply dynamics for the following food commodities: corn, soybeans, wheat, cocoa, coffee, cotton, sugar, and palm oil.

Commodities & COT Report

The COT report is used by MacroVar to analyze the sentiment of financial institutions and hedge funds about commodities monitored. Check our guide on how to analyze the cot report.

Commodities Markets vs ETF Instruments

ETFs comprised of commodities producing companies are closely correlated with the spot price of these commodities. MacroVar monitors the correlations of those pairs looking for divergence investment opportunities.

Commodities Markets vs Currencies

The economies and currencies of commodity producing countries for a specific commodity are leading indicators of specific commodities. MacroVar monitors correlations between commodity prices and currencies of these countries. For example, MacroVar monitors the correlation between crude oil and the Russian Rubble since Russian economy is heavily exposed in the production of crude oil.

Commodities Markets analysed

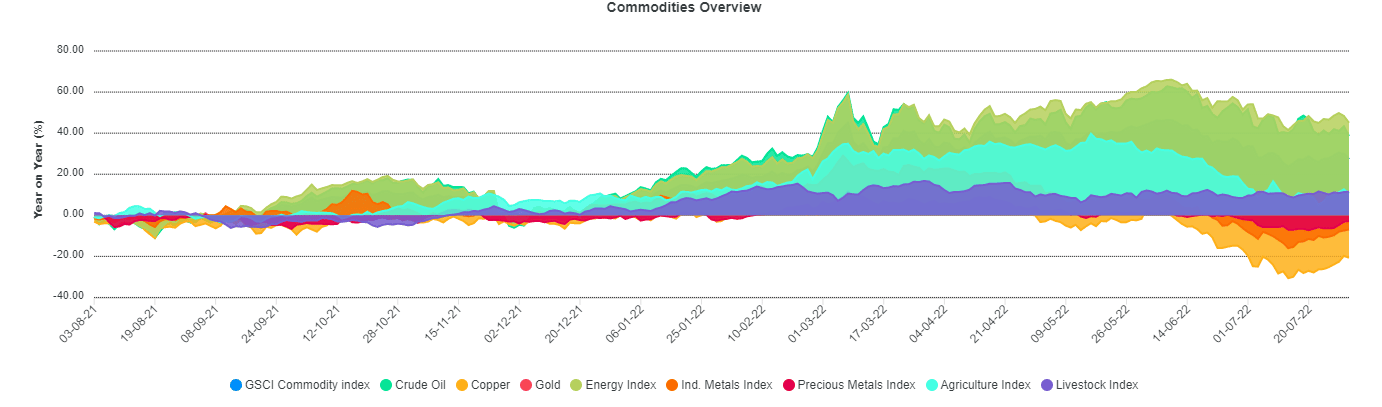

MacroVar analyses the following commodities grouped by type:

- Commodities Indices: Energy, Industrial Metals, Precious Metals, Agriculture

- Energy: Crude Oil, Natural Gas, Heating Oil, Uranium

- Metals: Copper, Iron Ore, Aluminum, Nickel

- Precious Metals: Gold, Silver, Platinum, Palladium

- Soft commodities: Rubber, Lumber, Cotton, Platinum, Coffee, Cocoa, Sugar, Orange Juice

- Food commodities: Corn, Wheat, Oat, Rice, Soybeans, Soybean Oil, Soybean meal, Feeder Cattle

- Shipping: Baltic Dry Index, Baltic Capesize Index, Baltic Panamax Index, Baltic Supramax Index, Baltic Handysize Index, Baltic Dirty Tanker Index, Baltic Clean Tanker Index, China Bulk Freight Index, China Container freight index

MacroVar Quantitative Signals

The MacroVar index is a synthetic variable derived by a combination of the Momentum, Trend and Bubble models described below. It ranges between -150 and +150. MacroVar displays signals schematically as follows:

The MacroVar index is a synthetic variable derived by a combination of the Momentum, Trend and Bubble models described below. It ranges between -150 and +150. MacroVar displays signals schematically as follows: Value currently 0 meaning that trend is flat.

Value is -25 meaning a strong -ve momentum is currently present.

Value is -50 meaning a strong -ve momentum is currently present.

Value is -75 meaning a strong -ve momentum and long-term is currently present.

Value is -100 meaning a strong -ve momentum and long-term is currently present.

Value is +25 meaning a strong +ve momentum is currently present.

Value is +50 meaning a strong +ve momentum is currently present.

Value is +75 meaning a strong +ve momentum and long-term is currently present.

Value is +100 meaning a strong +ve momentum and long-term is currently present.

Value is either +125 (when Momentum and Trend is +100) or -125 (when Momentum and Trend is -100) meaning that there is a moderate possibility of price reversal from the current trend.

Value is either +150 (when Momentum and Trend is +100) or -150 (when Momentum and Trend is -100) meaning that there is a very high probability of price reversal from the current trend.

MacroVar Momentum Model (M)

Momentum trading is used to capture moves in shorter timeframes than trends. Momentum is the relative change occurring in markets. Relative change is different to a trend. A long-term trend can be up but the short-term momentum of a specific market can be 0.

If a market moves down and then moves up and then moves back down the net relative change in price is 0. That means momentum is 0. A short-term positive momentum, with a long-term downtrend results in markets with no momentum.

MacroVar momentum signal ranges from -100 to +100. The market trend signal is derived as the mean value from 4 calculations for each asset. The timeframes monitored are the following:

- 1 Day (1 trading day)

- 1 Week (5 trading days)

- 1 Month (20 trading days)

- 3 Months (60 trading days)

For each timeframe, the following calculations are performed:

- Calculations of the return for the specific timeframe

- If return calculated is higher than 0, signal value 1 else signal value -1

Finally, the 4 values are aggregated daily.

A technical rollover is identified when MacroVar momentum strength indicator moves from positive to negative value or vice-versa. Value currently 0 meaning that momentum is flat.

Value is -25 meaning a weak -ve momentum is currently present.

Value is -50 meaning a strong -ve momentum is currently present.

Value is -75 meaning a strong -ve momentum is currently present.

Value is -100 meaning a strong -ve momentum is currently present.

Value is +25 meaning a strong +ve momentum is currently present.

Value is +50 meaning a strong +ve momentum is currently present.

Value is +75 meaning a strong -ve momentum is currently present.

Value is +100 meaning a strong -ve momentum is currently present.

MacroVar Trend model (T)

MacroVar Trend signal ranges from -100 to +100. The market trend signal is derived as the mean value from 8 calculations for each asset. The timeframes monitored are the following:

- 1-month (20 trading days)

- 3-months (60 trading days)

- 6-months (125 trading days)

- 1-year (250 trading days)

For each timeframe, the following calculations are performed:

- Closing price vs moving average (MA): if price greater than MA value is +1, else -1

- Moving average slope: if current MA is higher than previous MA, upward slope +1, else -1

MacroVar trend model can be used as a trend strength indicator. MacroVar trend strength values ranging between +75 and +100 or -75 and -100 show strong trend strength.

A technical rollover is identified when MacroVar trend strength indicator moves from positive to negative value or vice-versa.

Value currently 0 meaning that trend is flat.

Value is -25 meaning a weak -ve trend is currently present.

Value is -50 meaning a strong -ve trend is currently present.

Value is -75 meaning a strong -ve trend is currently present.

Value is -100 meaning a strong -ve trend is currently present.

Value is +25 meaning a strong +ve trend is currently present.

Value is +50 meaning a strong +ve trend is currently present.

Value is +75 meaning a strong -ve trend is currently present.

Value is +100 meaning a strong -ve trend is currently present.

MacroVar Bubble model (B)

MacroVar bubble model monitors a financial asset’s price relative to its 252-day moving average to identify possible inflection point. Extreme moves often followed by price reversals have a high probability of occuring when MacroVar bubble indicator is greater than 2.5 or less than -2.5.

The MacroVar bubble model is calculated using the formula: Latest Price – (252-day Moving Average) / (252-day Standard Deviation). It represents a z-score and extreme values are greater than 2.5 and less than -2.5. Other thresholds include -3, +3.

Value is higher than +2.5 or lower than -2.5 meaning that there is a moderate possibility of price reversal from the current trend.

Value is higher than +3 (when Momentum and Trend is +100) or -3 (when Momentum and Trend is -100) meaning that there is a very high probability of price reversal from the current trend.

Commodities and the Value Chain

One of the most important blocks of global macro strategies, is the analysis of commodities dynamics since they are original source in the value chain.