Credit Trading: A Strategy to Profit from the Changes in the Credit Quality of Bonds

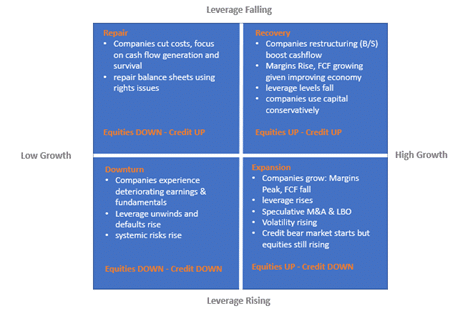

Credit is the market of corporate bonds which is very important for all major economies. Corporate bonds are closely correlated with stocks and since bond investors are more diligent in analyzing credit risk, their decisions represented by credit spreads are often leading indicators for stocks.

MacroVar statistical models analyse the dynamics between stock indices, stock sectors versus credit default swaps and corporate bond indices to identify investing opportunities when divergences between the different markets occur.

MacroVar monitors credit default swaps of more than 1,000 individual companies and indexes as well as IBOXX corporate bond indices for 80 sectors and industries of the United States and 50 sectors and industries of the European corporate bond market.

MacroVar Credit Related Factors

MacroVar uses a top-down approach for analyzing the credit market. The models used are regression models between the momentum of stock markets and the corresponding credit markets in order to identify potential divergences and investment opportunities in the stock market.

Credit Risk versus Stocks Overview

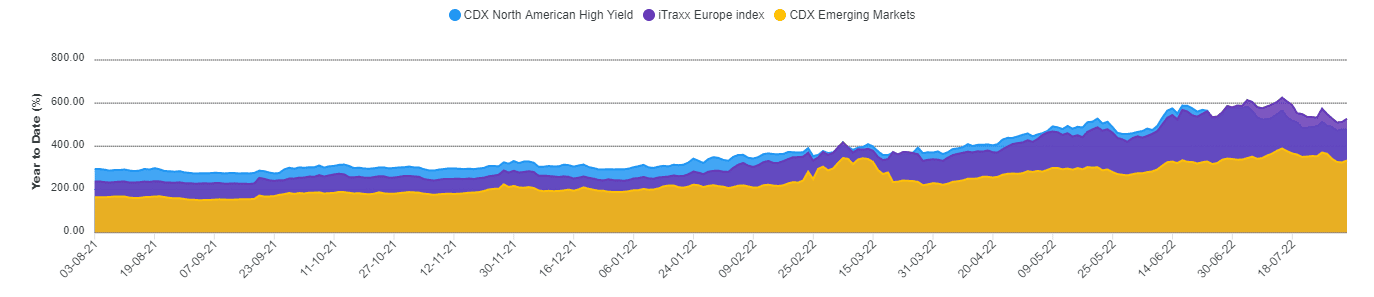

The major credit indicators analyzed versus the corresponding stock market indices are:

US Credit Risk vs Stocks Models compares Stock Indices (S&P 500) versus CDS (Credit Default Swaps) Indexes (CDX IG / CDX HY)

EU Credit Risk vs Stocks Models compares Stock Indices (STOXX 600) versus CDS (Credit Default Swaps) Indexes (ITRAXX Indexes)

Emerging Markets credit Risk vs Stocks Models compares Stock Indices (EEM) versus CDS (Credit Default Swaps) Indexes (CDX Indexes)

CDX indices are a family of tradable credit default swap (CDS) indices covering North America and the emerging markets.

ITraxx indices are a family of European, Asian and emerging market tradable credit default swap indices.

Credit Risk versus Stock Sectors Analysis

MacroVar models use the same regression models to analyze specific stock sectors to their IBOXX credit risk indexes for the US and European stock markets.

Credit Risk versus Volatility Risk

MacroVar monitors the relationship between credit risk and implied stock volatility to identify investment opportunities with the following strategies:

- Take advantage of compressed volatility when complacency in the market exists (monitor -1 standard deviation levels)

- Take advantage of temporarily spiked volatility if the credit risk levels are stable (monitor levels of +2 standard deviations)

The markets monitored are CDX vs VIX and ITRAXX vs VSTOXX. Countries Credit Risk versus Currencies

MacroVar models monitor all countries CDS to identify turning points in countries’ credit risk which in turn will affect their bonds, stocks and FX.

CDS Database

MacroVar keeps a database of 5-year credit default swaps indices for 1,000 corporations categorized by sector and region. Credit Default Swaps

Credit Research

Sign Up to access MacroVar research for Credit Markets.