Economic Sectors: A Classification of the Different Types of Economic Activities

MacroVar analyzes sectors, industry groups, industries and sub-industries in US, Europe, Emerging Markets and Asia. Each segment is analyzed through its stock market dynamics, credit markets, news flow and industry specific quantitative and macroeconomic factors.

If you are new to Sector & Industry specific investing click here for an introduction to sectors & industries.

More specifically, stock market dynamics are analyzed based on S&P Dow Jones Indices indexes developed based on GICS (? For more), credit markets using individual Credit Default Swaps of specific companies and IBOXX corporate bond indices, news flow based on feeds from reliable finance news sources and industry specific factors based on MacroVar statistical Models and a broad range of sector specific related macroeconomic factors based on PMI & ESI Surveys and other factors like Building Permits. Lastly, MacroVar ranks sectors based on our quantitative models to identify Long / Short Investment themes.

Click here to get an overview of Sectors & Industries across the US, Europe and Asia.

Sector Specific Factor Analysis

Macrovar models analyze in real-time the following relative factors which will be explained briefly in the next sections of this article.

- Stock Sectors vs Credit (Credit default swaps or Corporate bonds)

- Stock Sectors vs Macroeconomics Surveys

- News flow for corporations in each sector / industry

Moreover, MacroVar monitors the following families of factors specific to a sector:

- Commodity related Stock Sectors vs Actual commodities For Example XLE representing energy companies’ vs crude oil

- Banking related Stock Sectors vs Yield Curve For example Banking ETF (KBE) vs the US Yield Curve

- Real estate stock sectors vs Macroeconomic Indicators For example Homebuilders ETF (ITB) vs Building Permits and 30-year Mortgage rates

- Stock Sectors vs Macroeconomic leading Surveys ESI and ZEW sector specific reports

Stock sectors analysis of prices, momentum, trends, charts, and news.

Sectors & Industries investing introduction

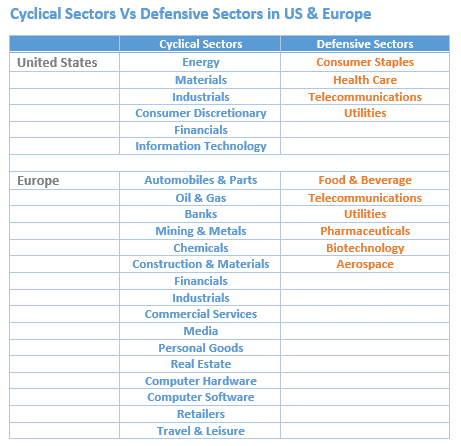

Stock Sectors are categorized not cyclical sectors and defensive sectors. Cyclical stock sectors are sectors of stocks whose earnings are more sensitive to the business cycle and the economic growth. Defensive stock sectors are sectors of stocks whose earnings are less sensitive to the business cycle.

Cyclical stock sectors Overview

- Materials The materials stock sector includes companies manufacturing construction materials, chemicals, glass, paper, forest products, minerals, mining, metals, and steel.

- EnergyThe energy stock sector includes companies in the exploration, production, refining, storage, transportation and marketing of oil and gas, coal, and fuel.

- Industrials The industrials stock sector includes companies engaged in the manufacturing and distribution of capital goods such as electrical equipment and machinery, aerospace, and defence. It also includes services providers such as construction and engineering, research and consulting services and transportation services.

- FinancialsThe financials stock sector includes financial firms like banks and asset management companies offering financial services like consumer finance, asset management, investment banking, brokerage services and security underwriters.

- Consumer DiscretionaryThe consumer discretionary stock sector covers companies involved in the manufacturing of consumer discretionary durable goods like automobiles, household goods, textiles, and apparel. The stock sector covers service providers of consumer discretionary services like hotels and restaurants.

- Information TechnologyThe information technology stock sector covers companies which develop software, manufacture, and distribute technology hardware and equipment and offer IT consulting services. This stock sector excludes companies offering internet services.

Defensive stock sectors Overview

- Consumer Staples The consumer staples stock sector covers businesses manufacturing and distributing of food, beverage, tobacco, personal products, and household goods. The stock sector also includes food and drug retailers.

- Healthcare The healthcare stock sector covers businesses offering healthcare services, manufacture and distribute healthcare equipment and supplies. This stock sector includes pharmaceutical and biotechnology companies

- Utilities The Utilities stock sector covers utility companies producing, distributing and trading electricity, gas and water.

- Communication services The communication services stock sector covers companies that provide content like entertainment, news and social media through the internet and other networks.

Sectors & Industries versus the Business Cycle

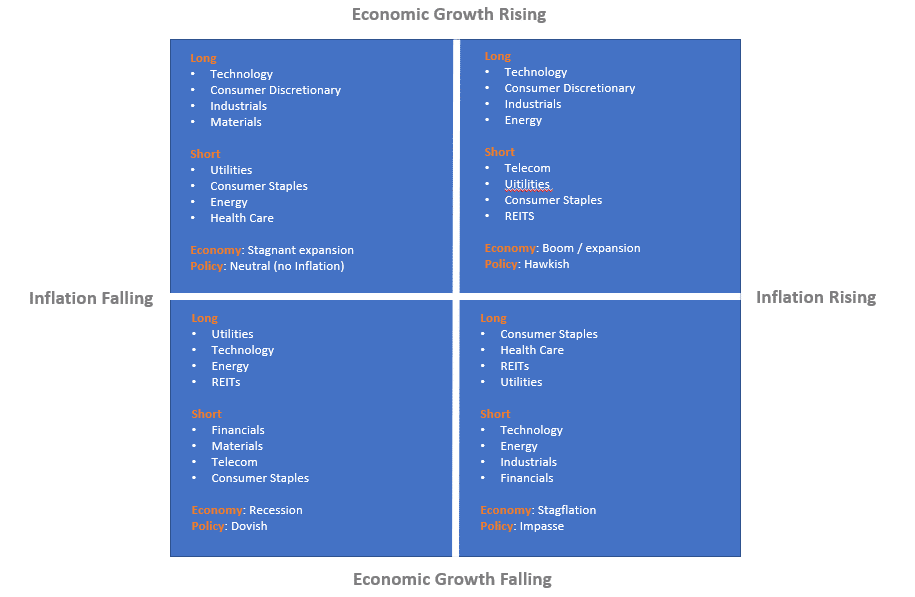

During different economic regimes, different sectors outperform others. For example, during recessions more defensive sectors like consumer staples outperform cyclical sectors like the industrials sector. Hence, an investor would want to scale back on the industrial sector and go long consumer staples.

Hence, after having a global view of the current economic environment, investors can choose their exposure either long, short or long/short across sectors.

The figure below shows which sectors tend to outperform and underperform during different economic cycles.

Sectors & Industries and the Value Chain

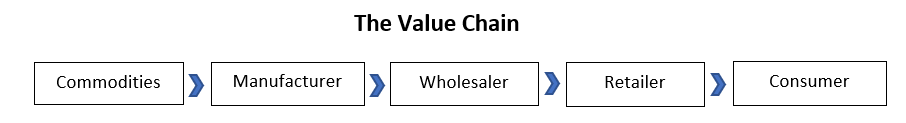

Investment themes are generated primarily from Macroeconomic factors and secondarily Microeconomic factors affecting the value chain in industries. Investors need to look for clues in the world, have views on the value chain and trade to invest with or against the trend.

Sectors Investing vs Top-Down process and Sector / Industry views

Investors can maximize returns while minimizing risks by investing Long and/or Short across sectors using the following steps:

- Obtain view on the market using MacroVar macro view analysis

- Obtain a view on a sector by analyzing fundamentals like the value chain and quantitative factors

- Decide whether a specific sector will outperform on underperform the market

- Decide whether they want to access Market Risk, Sector Risk and build a portfolio based on these criteria