Mastering Portfolio Management: Strategies for Success

Professional Portfolio Management requires a systematic investment process to achieve the following targets:

| Protect capital by controlling the portfolio’s risk (hedged portfolio) |

| Generate Consistent & Smooth compounded risk-adjusted returns irrespective of the general market trend |

There are different investment strategies to achieve this either systematic (using software mdoels) or discretionary. Irrespective of the investment strategy followed, any investment strategy should be based on the following core principles.

Portfolio management aim

Professional traders manage a portfolio based on the following criteria:

| Their portfolio consists of Long/Short positions with 1-3 months under normal market volatility conditions. Their trading ideas are formed using 70% fundamental analysis and 30% Price Dynamics models. |

| Their portfolio consists of 20-30 uncorrelated positions with position limits ranging from 1% to 3% size. |

| Their aim is to generate consistently high risk-adjusted returns. For example: Portfolio returns 15%, 10% annualized volatility and a maximum drawdown of maximum 10%. |

Learn more about portfolio theory

Portfolio Management Stages

World View

The first step is to have a world view to position across equities, bonds, currencies, commodities and STIR. Once a World view is formed, you can move to analyze specific sectors and industries within sectors.

The most important element of portfolio management is to predict whether financial markets will be in a bull or bear market in the next 6-12 months.

Traders must continuously assess where market came from, where market is today and where market is going in the next 6-12 months. MacroVar models analyze in real-time Financial and macroeconomic data to help traders reassess conditions on a daily basis and generate trading ideas.

Financial Risk Monitoring

MacroVar risk management models, monitor financial conditions to identify risk-on or risk-off environments to help users position their portfolios accordingly.

During Risk-on environments stocks and commodities are the best asset class. This environment is carried by expanding corporate earnings, optimistic economic outlook, and accommodative central bank policies. During risk-off environments, bonds (under certain conditions) and cash are the best asset classes since there are widespread corporate earnings downgrades, contracting or slowing economic data and uncertain central bank policy. During risk-on periods:

| Stocks: Global Stock Markets Up, US Stocks Breadth Up, Momentum & Trends Up |

| Sectors: Cyclical Sectors stronger than Defensive Sectors |

| Short Term Interest Rates (STIR) Futures markets down, Market expects central bank interest rate hikes in the future to slowdown the economy |

| Bonds Low-Risk long-term Bonds (US, Germany) Down, higher-risk long-term Bonds (Europe Peripheral Countries, Emerging markets) Up – dynamics dependent on inflation expectations |

| Yield Curve Bear Steepening |

| Currencies US Dollar moderate, Currencies related to cyclical sectors and commodities up, Risk Off currencies moderate |

| Financial risk Stock Volatility Moderate to Low, Term Structure in Contango Corporate Bonds Spreads: Down |

| Global Business Confidence Macroeconomic indicators represented by Global Manufacturing & Services PMI strong – Momentum (YY) & Trends (12MA) |

| Risk Off assets JPY, Gold, CHF, Long-term bonds and VIX stable down |

Pricing Dynamics

MacroVar models analyse momentum, trends, and potential inflection points to time trading ideas correctly. Moreover, other factors like market flows through ETF Fund Flows, COT reports, Implied Volatility are also analysed by MacroVar models. Risk Management

Investors should always keep in mind the fundamental principle: In good times (that is when we make money from a trade) they should seek take more risk (let the profits run), while in bad times (when losing money) they should cut their losses short.

Humans seek certainty in profitable situations tending to take profits quickly and take more risks when losing money. Investors should do the opposite of being a human.

Risk Management

Investors should use hard stop losses based on the market’s realized or implied volatility to limit their losses. They should also use soft targets in order not to limit their upside by rolling their stop-losses.

Gross Exposure

Gross exposure is the absolute level of a fund’s investments. If an investors has $10 million in capital and deploys $3 million short positions and $7 million long positions he has a gross exposure of $10 million. His gross exposure as percentage of capital is 100%. If gross exposure exceeds 100%, it means that he is using leverage, borrowing money to amplify returns. A gross exposure below 100% indicates portfolio of portfolio is invested in cash.

Portfolio managers when starting to build a portfolio from zero should use 3-4X exposure. If their portfolios grow, they can increase their exposure accordingly to 4X and 5X.

Example:

Stage 1: $25K div. L/S portfolio, $100K (4X) exposure, 8-10 positions, 25% Cushion – P&L +$5k

Stage 2: $30K div. L/S portfolio, $150K (5X) exposure, 10-12 positions, 20% Cushion)

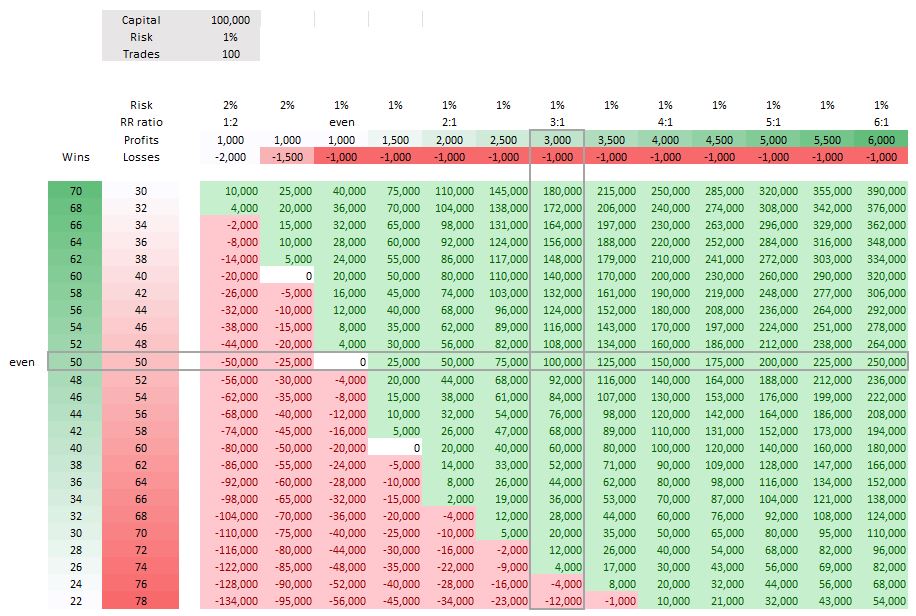

Example: Capital $100,000, Risk 1%, Trades 100, RR 3:1, Profit: $3,000, Loss: -$1,000, P/L: 50%

Depending on market volatility adjust timeframes of portfolio (during elevated risk, move to cash or lower position sizes to protect portfolio)

Net Exposure Limits

Net exposure = Long Exposure – Short Exposure (if long = 70K, short = 30K, Net long exposure = 40%)

Portfolio managers should place a net exposure limit +/- 25%

Single Asset Position Limits

Portfolio managers should restrict the size of any position to maximum 10% of gross exposure limit.

Portfolio Stop loss

Investors should set a stop loss of 5-10% in their overall portfolio. If portfolio’s drawdown has reached 10% it means all positions are wrong costing 1% x 10.

Example: Portfolio $100K exposure, each position is 10%, stop-loss 10%, 1% stop-loss of portfolio

Correlation analysis

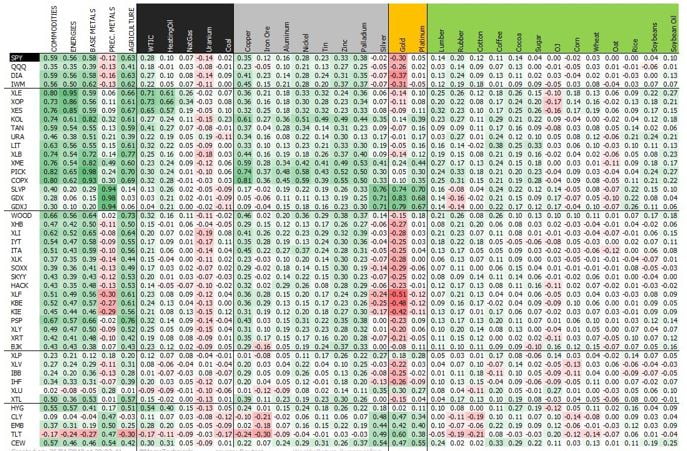

Before placing a specific trade, investors should monitor the trade’s correlation to the rest of the positions of the portfolio. MacroVar calculates 60-day rolling correlation between financial assets to monitor correlations.

Beta hedging

Beta measures the systematic risk of a security or portfolio in comparison to the market. A portfolio beta of one indicates the portfolio moves with the market.

Any investment entails two kinds of risks. Unsystematic risks are unique to stocks and industries and these can be reduced by diversifying your portfolio across dissimilar stocks. But systematic risk stems from factors like inflation, interest rates, geopolitical risk, rupee weakness etc. Here you cannot diversify as it impacts all stocks almost in a systematic manner. That is where beta hedging comes in handy.

The beta of a specific security is how much the asset moves (daily return) given a 1-unit market (S&P 500 is the market benchmark).

To hedge out a long/short position investors should calculate and then hedge the beta of the long/short position.

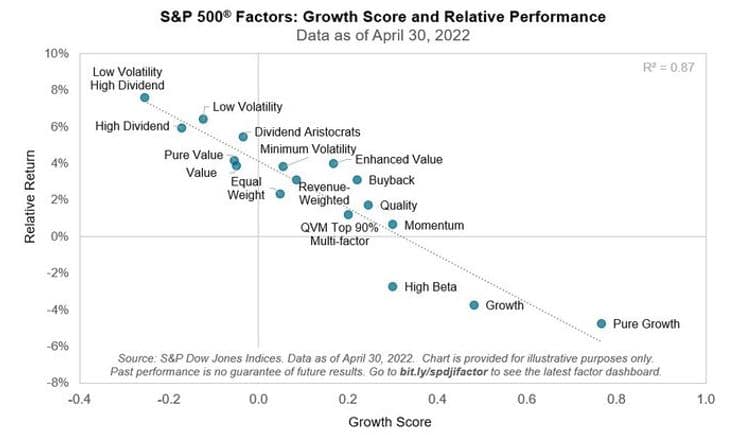

Factor hedging

Portfolio managers sometimes also hedge their portfolios against other factors which are negatively correlated to generic beta.

Value, growth are the major factors to monitor but portfolio managers monitor their portfolio’s sensitivity to other major factors like oil or rates.

Check some of the factors to watch for.

Self-Assessment

Traders aim to maximize return over risk. Investors should frequently assess their trading performance by calculating their portfolio’s sharpe ratio and Kelly Criterion.

| GROSS & NET EXPOSURE |

| CORRELATION ANALYSIS |

| HEDGING |

| POSITION LIMITS |

| PORTFOLIO PERFORMANCE |