Unlocking Profitable Potential: Identifying Innovative Trading Ideas

Professional portfolio management requires structuring a diversified portfolio of 15 or more uncorrelated trading positions.

Timeframe

Professional traders have a timeframe of 20 to 60 days in normal volatility conditions. This is not arbitrary. It is based on the volatility of assets. If an asset has 0 expected return and very low volatility on a daily basis it is impossible to create a profitable strategy on this timeframe. Instead larger timeframes must be exploited where volatility and expected returns are much higher.

To assess the probability of gaining a return from any asset whether it’s real estate, stocks or currencies we must examine the asset’s historical distribution of returns.

When we look at the S&P500 Daily Opportunities in terms of daily returns by calculating the open to close historical returns, the probability of making money is 0. It’s like playing a casino roulette.

The open to close returns distribution shows the following conclusions:

• 52% of the time daily returns are positive while 48% are negative, hence it’s impossible to predict the daily return (50-50 probability)

• If we probability adjust +ve and -ve returns to frequency %, the expected return is nearly 0 (0.34%, -0.31%)

Hence the expected return when day trading is zero. In order to find trading opportunities, timeframe must be broadened as displayed previously to capture trends in 20-60 day timeframe.

Trading Process

The process followed from idea generation to live position is summarized in the following steps:

Fundamental Analysis

The most crucial element in our comprehensive process for generating Professional Level Trade Ideas is the initial discovery phase, which involves a blend of both quantitative and qualitative assessments.

As we’ve noted before, our approach is heavily weighted towards Fundamental Analysis (FA), making up at least 80% of our strategy, while Price Action (PA) quantitative analysis contribute no more than 20%.

Our methodology starts with an in-depth Top-Down Macroeconomic Analysis. We then integrate this with Bottom-Up Fundamental Analysis to establish Long and Short biases for the overall stock market, specific sectors, and individual stocks.

We employ Macroeconomic Fundamentals to gain a broad perspective on the stock market, and Microeconomic Fundamentals to focus on individual stocks and sectors.

Helicopter View

The most important asset classes to monitor and their correlations are listed here. This is the core of how asset classes behave during risk on and risk off environments.

There are 2 market environments: Risk On periods during which funds flow from safe assets to risky assets and Risk Off periods where funds flow from risky assets to low-risk assets.

Risk Assets (Risk-On): Stocks, Cyclical Commodities, Cyclical Sectors / Industries, High Yield Bonds, Cyclical Currencies, Emerging Markets (Capital flows to emerging markets in search for higher yields, higher growth rates and hence profits)

Safe Assets (Risk-Off): US Treasuries, German Bunds, Defensive Sectors / Industries, US Dollar DXY, Swiss Franc, Japanese Yen, Gold

The most important asset correlation is between the US stocks and US Bonds. During risk on periods US stocks rise while US bonds are sold and vice-versa.

During Risk on Periods the markets behave as follows:

- Global Risk

- Equity Risk (VIX, VSTOXX): falling

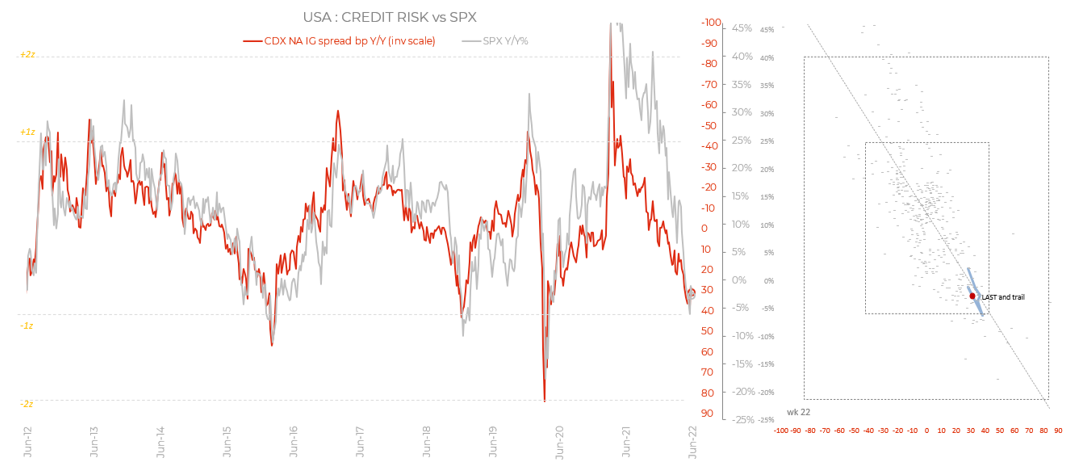

- Credit Risk (CDX IG, ITRAXX IG, BofA High Yield credit spreads): falling

- Volatility Term Structure: steep contango

- MacroVar Risk Index: falling

- MacroVar Risk On/Off monitor Ratios: falling

- Stocks

- Global Stocks rising (ideally this should occur with global bond market weakness)

- US Stock Breadth rising

- Emerging Market Stocks rising (often outperforming developed markets like US & EU)

- Global Stock Breadth rising

- Stock Sectors

- Cyclical sectors outperform Defensive sectors

- Sector breadth rising

- Bonds (MacroVar monitors 2-year, 5-year and 10-year bonds)

- Safe Bonds

- US Treasuries falling (yields rising)

- German Bunds falling (yields rising)

- Risky Bonds

- US High Yield Bonds rising (yields falling)

- Europe

- Club Med Bonds rising (yields falling)

- Emerging Markets Bonds rising (yields falling)

- Rates breadth rising (funds move out of bonds into stocks hence yield rates rise)

- Safe Bonds

- Yield Curve

- Yield Curve Bear steepening (on the contrary a Yield Curve bull re-steepening signifies Risk Off environment)

- Fed Funds futures above US 2-year bonds implying strong economic growth and FED hawkish stance

- Yield Curve Steepening Breadth rising

- Eurodollar Futures rising

- Currencies

- US Dollar (DXY) falling

- Safe Currencies (JPY, CHF) falling

- Risky Currencies (AUD, NZD, CAD) rising

- Currencies Breadth (vs the US Dollar) rising

- Commodities

- Energy (Crude Oil) rising

- Metals (Copper) rising

- Safe commodities (Gold) falling

- Commodities Breadth rising

- Macroeconomic Conditions

- Global PMI trend and momentum rising

- Global PMI breadth monitored strong

MacroVar models analyses thousands of financial markets and macroeconomic indicators to generate trade ideas for stocks, bonds, commodities and currencies.

Trading Idea Generation

The most important asset classes to monitor and their correlations are listed here. This is the core of how asset classes behave during risk on and risk off environments.

There are 2 market environments: Risk On periods during which funds flow from safe assets to risky assets and Risk Off periods where funds flow from risky assets to low-risk assets.

Risk Assets (Risk-On): Stocks, Cyclical Commodities, Cyclical Sectors / Industries, High Yield Bonds, Cyclical Currencies, Emerging Markets (Capital flows to emerging markets in search for higher yields, higher growth rates and hence profits)

Safe Assets (Risk-Off): US Treasuries, German Bunds, Defensive Sectors / Industries, US Dollar DXY, Swiss Franc, Japanese Yen, Gold

The most important asset correlation is between the US stocks and US Bonds. During risk on periods US stocks rise while US bonds are sold and vice-versa.

During Risk on Periods the markets behave as follows:

- Global Risk

- Equity Risk (VIX, VSTOXX): falling

- Credit Risk (CDX IG, ITRAXX IG, BofA High Yield credit spreads): falling

- Volatility Term Structure: steep contango

- MacroVar Risk Index: falling

- MacroVar Risk On/Off monitor Ratios: falling

- Stocks

- Global Stocks rising (ideally this should occur with global bond market weakness)

- US Stock Breadth rising

- Emerging Market Stocks rising (often outperforming developed markets like US & EU)

- Global Stock Breadth rising

- Stock Sectors

- Cyclical sectors outperform Defensive sectors

- Sector breadth rising

- Bonds (MacroVar monitors 2-year, 5-year and 10-year bonds)

- Safe Bonds

- US Treasuries falling (yields rising)

- German Bunds falling (yields rising)

- Risky Bonds

- US High Yield Bonds rising (yields falling)

- Europe

- Club Med Bonds rising (yields falling)

- Emerging Markets Bonds rising (yields falling)

- Rates breadth rising (funds move out of bonds into stocks hence yield rates rise)

- Safe Bonds

- Yield Curve

- Yield Curve Bear steepening (on the contrary a Yield Curve bull re-steepening signifies Risk Off environment)

- Fed Funds futures above US 2-year bonds implying strong economic growth and FED hawkish stance

- Yield Curve Steepening Breadth rising

- Eurodollar Futures rising

- Currencies

- US Dollar (DXY) falling

- Safe Currencies (JPY, CHF) falling

- Risky Currencies (AUD, NZD, CAD) rising

- Currencies Breadth (vs the US Dollar) rising

- Commodities

- Energy (Crude Oil) rising

- Metals (Copper) rising

- Safe commodities (Gold) falling

- Commodities Breadth rising

- Macroeconomic Conditions

- Global PMI trend and momentum rising

- Global PMI breadth monitored strong

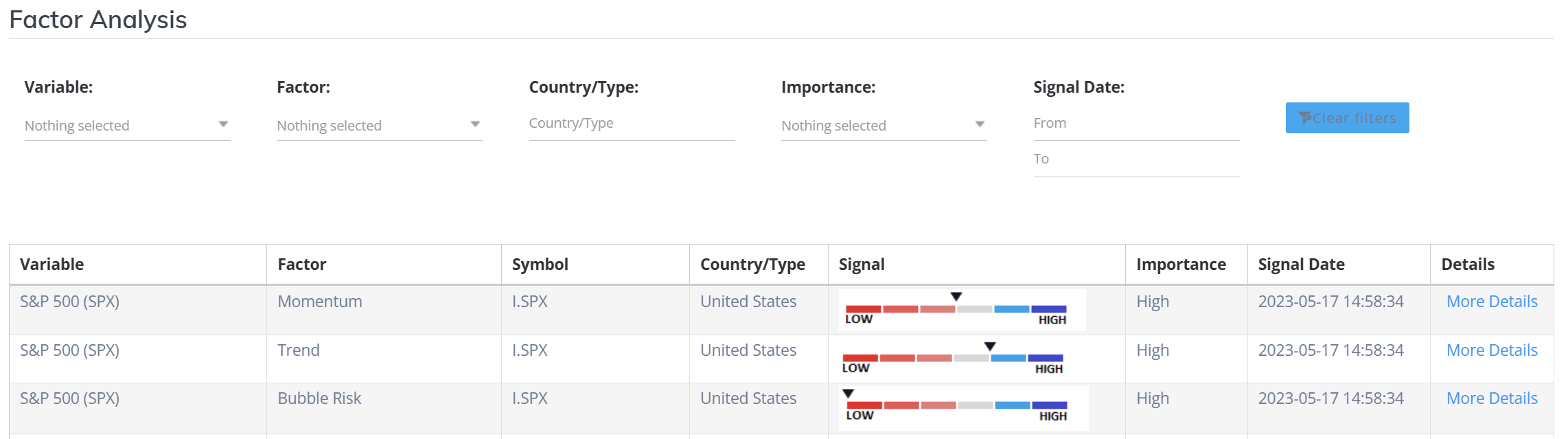

Factor Analysis

MacroVar Quantitative models, analyze more than 1000 factors affecting individual financial markets in order to find uncorrelated trading ideas to generate alpha. Financial factors are based on MacroVar Trend, Momentum and Regression models. MacroVar statistical models monitor dynamics and generate signals when unusual deviations are detected between financial markets and their factors expecting mean reversion.

For example, the S&P 500 is closely correlated with CDX NA IG credit default swap index. And credit markets lead equities. Any deterioration in the business outlook, leads to wider credit spreads (higher refinancing risk) which are often leading indicators of stock market performance. A big deviation between the two markets is a very reliable signal of stock market behavior.

MacroVar updates factors on a real-time basis as soon as models trigger a change in dynamics.

Timing

After completing Fundamental and Factor analysis, we have determined is a directional bias—either to go long or short on an asset.

The next step is to properly time the trade. For this, we rely on Price Action quantitative signals. These tools are primarily used to improve the timing of our trades and, in certain cases, to assist with risk management when it’s appropriate.

If we determine that the timing isn’t right for executing a trade, we hold off until conditions improve.

When the timing is right, we proceed to select the most effective trade structure.

Catalysts

In trading, the two primary limiting factors are the Timeframes and Volatility. Our focus is the 20–60 day timeframe, positioning ourselves in an optimal range of volatility.

Moreover, every trade we enter should offer additional upside potential (or potential volatility) beyond what the market has already accounted for. To achieve this, we look for Catalysts that are likely to materialize during the specified timeframe of the position.

A common misconception among Retail Traders in the stock market is the equation:

A Good Company = A Good Stock = A Good Trade Idea

This is a flawed approach, as it often leads to a situation where the stock doesn’t move within the intended trading timeframe, effectively turning a trade into an investment.

Traders look for unexpected events which are catalysts and which trigger the trade and optimize payoff within the 1-3 month time horizon.

Our trading approach requires synchronized signals by the underlying fundamentals, timing, and catalysts.

Catalyst types:

- Macroeconomic news or events that can promptly affect any asset are classified as market/economy catalysts. These are shifts in the broader economic landscape that have an impact on all stocks within the market.

- Macroeconomic surveys (ISM, NMI, ESI) – (Manufacturing, Services, Employment, Consumer, Inflation)

- Geopolitical Events

- Country political developments

- Central bank decisions (interest rates, FOMC)

- Rising / Falling bond market rates

- Big changes in commodities prices

- Big changes in currency markets

- Sector, stock news or events that affect a stock’s Revenue, Earnings & Forward valuation

- New Product/Service launch for the company and/or competitor

- Stock upgrades/downgrades from research analysts

- Credit Dynamics: Credit often leads Stock dynamics, hence the Stock-Credit relationship must be examined for stock against its credit, competitors and sector

- Credit Upgrades/Downgrades from rating agencies

- Regulatory updates affecting sector and a stock

- Quarterly & annual earnings announcements for the company and its competitors

- Forward guidance for the company and its competitors

- Survey Updates (ISM, NMI, ESI, Other) affecting the sector and stocks

- Changes in commodities prices affecting sectors and stocks

- Changes to the supply chain of a company and sector

- Stock / Bond specific technical news or event

- Changes in Stock Buybacks / splits / rights issues / dividend

- Stock inclusions / omissions in index or ETF

- Mergers & Acquisitions

- Company changes in its capital structure

- Short squeezes

Tradable Assets

MacroVar provides Investment Research for trading major asset classes. Click on any asset class below to learn more about asset specific trading framework.

- Stocks

- Bonds

- Forex

- Commodities

- Credit

- Short-term interest rates (STIR)

Systematic Investment Strategies

Active trading requires devotion and considerable time. You can use instead investment strategies generating consistent returns with low risk and minimal effort.