Unlocking the Secrets of Forex Trading: A Comprehensive Guide

Investing in currencies requires analysis of global and local economic growth dynamics, liquidity, market risk as well factors specific to an individual nation’s economy.

If you are new to forex, check our free guide on forex trading for beginners

MacroVar Currency models Overview

MacroVar monitors the following economic and financial market factors affecting currencies.

Currencies versus Yield Differentials

Most importantly, currencies are affected by relative differences in monetary policies between 2 countries and their currencies which is depicted in the yield differential between short-end bonds (2-year bonds) or by the long-term inflation outlook or country risk premium between countries represented by the 10-year bond yield differentials.

For example, let us examine the USDGBP in an environment where the US economy is stronger than the UK economy. During a strong US economy, the Fed raises short-term rates to keep the economy strong while controlling inflation. This causes the US 2-year bond rates to rise. At the same time, the BOE keeps short-term interest rates low to help a weak UK economy strengthen. This causes UK 2-year bond rates to stay low. Since US 2-year bond rates yield more than UK 2-year bond rates, capital flows out of GBP into the US Dollar causing the USDGBP to appreciate.

Currencies versus 10Y, CDS, 2Y

When credit risk in a country rises, it’s currency weakens and vice-versa. MacroVar monitors the dynamics of the country’s 5-year CDS (Credit default swaps) vs each currency.

Currencies and the Economy

Currencies are highly correlated to the country’s economy. The country’s economy is compared with the currency’s performance using manufacturing PMI. Click Here to learn more about how macroeconomics work and affect currencies.

Currencies and Monetary Policy

When a country’s economy weakens, the government and central bank use fiscal policy and monetary policy tools to inject or withdraw liquidity from the country’s financial system to support the economy.

Central banks use monetary policy tools to inject liquidity. The tools used are the expansion of their balance sheets, reduction of the required reserve ratio and cutting short-term rates. Expansion monetary tools cause the country’s currency to weaken versus other countries. Click Here to learn more about how macroeconomics work and affect currencies.

Currencies and Fiscal Policy

Countries’ policymakers use fiscal policy tools to strengthen a weakening economy. Fiscal policies may include reduction in taxes and increase in government spending through infrastructure spending. Fiscal and Monetary policy stimuli weaken the country’s currency.Click Here to learn more about how macroeconomics work and affect currencies.

Currencies and Trade Balance

When a country’s trade balance strengthens the global demand for the specific currency tends rises, which causes the specific currency to strnegthen and vice-versa. Click Here to learn more about how macroeconomics work and affect currencies.

Currencies and Commodities

The currencies of countries which depend on heavily on producing commodities are closely correlated with the price of commodities.

Crude Oil related Currencies

The Russian Rubble, Norwegian Krona, Canadian dollar depend on the price of crude oil because these countries are major crude oil producers.

Currencies linked to industrial metals

The Australian Dollar is dependent on industrial metals because Australia is a major metal exporter mainly to China. Chile is a major producer and exporter of copper, hence the Chilean Peso is closely correlated with the spot price of copper.

South Africa is major producer and exporter of Gold and Platinum. Gold and Platinum are respectively 20% and 7.5% of South Africa’s exports. Hence, the South African Rand (ZARUSD) is closely correlated with the spot price of these commodities.

Examples

Australia is highly dependent on exporting commodities to China. When China slows down, its demand for iron ore, coal and metal exports from Australia falls. Australia’s economy as a result weakens and it’s central bank (RBA) injects liquidity by lowering short-term interest rates. This causes Australia 2-year bond yields to weaken versus those of the United States.

Currencies versus CESI

The Citi Economic Surprise Index (CESI) measures whether data releases from an economy have beaten or missed expectations in the past 90 calendar days. A positive index means releases have been better than expected and vice-versa. The index is measured in basis points of aggregated and decay-adjusted standard deviations of surprises and has no natural bounds.

CESI is a coincident indicator, oscillating fast and is used for short-term Forex trading.

Currencies Quantitative models

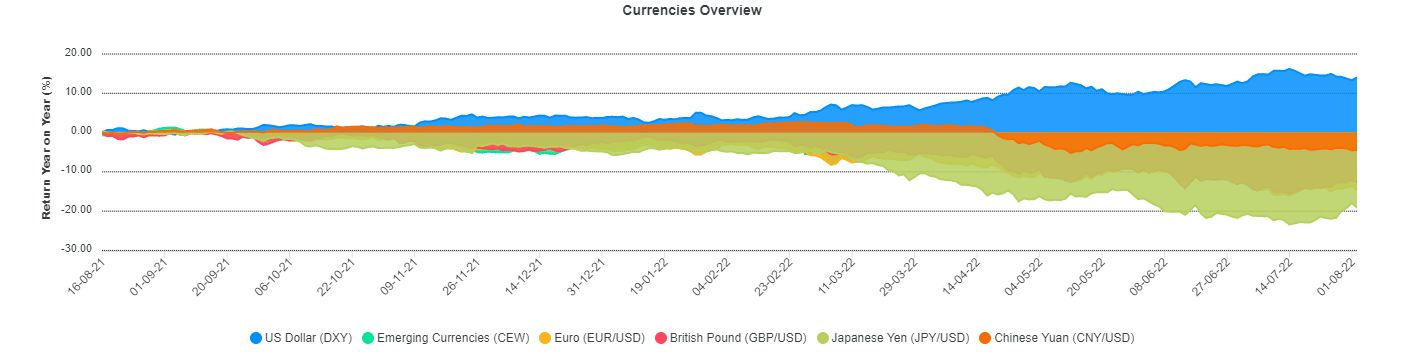

MacroVar models monitor different quantitative values for all currencies. The most important currencies price indicators are: 1. MacroVar Trend Indicator, 2. MacroVar Momentum Indicator, 3. Year on Year momentum, 4. 3m, 5. 1m, 6. 1w

MacroVar currencies trend indicator is compiled from signals compiles from different timeframes. Currencies trend indicator ranges from -100 to +100. A currency technical rollover is identified when MacroVar trend strength indicator moves from positive to negative. MacroVar currencies momentum indicator monitors price action for different timeframes of commodities. Momentum indicator ranges from -100 to +100.

Geopolitics

Trade tensions between countries cause global economic slowdowns which lead to rising market risk and capital flows to low-risk countries and financial assets like the US Dollar. Moreover, sanctions or tariffs imposed by major importing countries like the United States to other countries leads to depreciation of those currencies. For example, in June of 2019 the United States increased tariffs in Mexico causing the Mexican peso to depreciate a lot.

Currency Implied Volatility

MacroVar monitors implied volatility of major currencies. Implied volatility is used as a leading indicator of the currency’s risk. Currency implied volatility indicates how much the market expects a currency pair to fluctuate. Currency implied volatility is considered a measure of market risk.

Currency 3-month Risk Reversal

One of the most useful indicators for sentiments is looking at call-put skew on 3-month risk reversals. If someone is long EUR and needs to maintain a long bias, they could buy out-of-the-money puts when their view turns bearish and finance the hedge by selling out-of-the money calls.

If this happens to a large extent, implied volatility of puts will rise relative to that of the calls. This relationship would be negative for EUR, implying EUR weakness.

Currencies vs COT report

The COT report is published weekly (available every Friday) and provides analysis of holdings of different market participants for all major currencies monitored.

The COT report is used to monitor capital flows of currencies and detect trend continuations or reversals. A specific currency tends to reverse when the currency is overbought or oversold. COT report data are especially useful in detecting overbought and oversold market conditions.

COT Report versus US Dollar

The COT report is used by MacroVar to monitor the market’s US Dollar net positioning by calculating the average position of total Open Interest of large speculators for the following assets: EUR, GBP, CHF, JPY, CAD, AUD, NZD, MXN, RUB, BRL. Net long positioning in this indicator is interpreted as net long in the US Dollar.

COT Report and Safe Currencies

MacroVar also monitors net positions in low-risk currencies like the JPY and CHF. During high market risk environments capital flows to these currencies reporting increasing net long positions. Other safe financial assets related to the JPY, CHF are the US 10-year bond, Gold and VIX.

Country Macroeconomic Analysis

This analysis is based on the work of Ray Dalio and more specifically how the economic machine works

Introduction: An economy is the sum of the transactions that make it up. A country’s economy is comprised of the public and private sector. The private sector is comprised of businesses and consumers.

Economic activity is driven by 1. Productivity growth (GDP growth 2% per year due knowledge increase), 2. the Long-term debt cycle (50-75 years), 3. the business cycle (5-8 years). Credit (promise to pay) is driven by the debt cycle. If credit is used to purchase productive resources, it helps economic growth and income. If credit is used for consumption it has no added value

Money and Credit: Economic transactions are filled with either money or credit (promise to pay). The availability of credit is determined by the country’s central bank. Credit used to purchase productive resources generating sufficient income to service the debt, helps economic growth and income.

Country versus Rest of the World: A country’s finances consist of a simple income statement (revenue–expenses) and a balance sheet (assets–liabilities). Exports are imports are the main revenue and expense for countries. Uncompetitive economies have negative net income (imports higher than exports), which is financed by either savings (FX & Gold reserves) or rising debt (owed to exporters).

Debt: A nation’s debt is categorized as local currency debt and FX debt. Local debt is manageable since a country’s central bank can print money and repay it. FX debt is controlled by foreign central banks hence it is difficult to be repaid. For example. Turkey has US dollar denominated debt. Only the US central bank (the Federal Reserve), can print US dollars hence FX debt is out of Turkey’s control.

A country can control its debt by either: 1. Inflate it away, 2. Restructure, 3. Default. The US aims to keep nominal GDP growth above interest rates (kept low) to gradually reduce its debt.

Injections & Withdrawals

The government and central bank use fiscal and monetary policies to inject liquidity during slowdowns to boost growth and withdraw liquidity from an overheating economy to control rising inflation. The available policies and tools used during recessions are the following:

Monetary Policies (MP)

- Reduce short-term interest rates > Boost Economic growth by 1. Raising Credit, Easing Debt service

- Print money > purchase financial assets > force investors to take more risk & create wealth effect

- Print Money > purchase new debt issued to finance Gov. deficits when no local or foreign investors

Fiscal Policies (FP)

Expansionary FP is when government spends more than tax received to boost economic growth. This is financed by issuing new debt financed by 1. domestic or foreign investors or 2. CB money printing

Currency vs Injections & Withdrawals and inflation

The degree of economic intervention depends on the country’s economic fundamentals, its currency status and credibility. Countries with reserve currencies or strong fundamentals are allowed by markets to intervene. However, when nations with weak economic fundamentals intervene heavily, confidence is lost, causing a capital flight out of the country, spiking inflation and interest rates which lead to a severe recession, political and social crisis.

Reserve vs Non-reserve currencies: Reserve currencies are used by countries and corporations to borrow funds, store wealth and for international transactions (buy commodities). They are considered low risk. The US dollar is the world’s largest reserve currency. The main advantage of reserve currency nations is their ability to borrow (issue debt) on their own currency. These countries have increased power to conduct monetary and fiscal policies to boost their economies. However, prolonged expansionary fiscal and monetary policies eventually lead to loss of confidence in these currencies as a store of value and potential inflationary crisis.

Non-reserve currency countries: Conversely, developing nations are not considered low risk hence their ability to borrow in their own currencies is limited. Their economic growth is dependent on foreign capital inflows denominated in foreign currencies like the US dollar. During periods of global economic growth, capital flows from developed markets into developing nations looking for higher returns. These economies and their corporations’ issue foreign debt to grow. However, during periods of weak global economic growth or financial stress, foreign capital flows (also called capital flight) back to developed countries causing an inability of countries and companies to repay their debt. Central banks gather foreign exchange reserves during growth periods to create a cushion against capital outflows.

A nation’s economy is vulnerable to economic weakness or financial stress when it experiences:

- Current account deficit: a current account deficit indicates an uncompetitive economy which relies on foreign capital to sustain its spending. Hence, is vulnerable to capital outflows

- Government deficit: a big government deficit indicates an economy relying or rising debt to finance its operations

- Debt/GDP: a high Debt/GDP pushes a nation to borrow large amounts to finance its debt, print money or default. Historically, Debt/GDP higher than 100% is a red warning for economies.

- Low or no foreign exchange reserves: Developing economies are vulnerable to capital flight since foreign exchange reserves provide a cushion against capital outflows

- High external debt: Nations are vulnerable to high external debts which may be caused by a sudden depreciation of their currency or rising foreign interest rates (due to foreign growth)

- Negative real interest rates: Lower interest rates than inflation, are not compensating lenders for holding a nation’s debt hence making nation’s currency vulnerable to capital outflows.

- A history of high inflation and negative total returns: Nations with bad history have lack of trust in value of their currency and debt

Currency Fundamentals

A country’s currency strength is determined in the long run by its current account balance, and in the short-term by the relative dynamics of interest rates, supply/demand imbalances and policymakers.

US Dollar

The US Dollar is affected by the US economy and global market conditions. During global economic expansions, funds flow out of the US into emerging markets searching for higher investment returns causing the US Dollar to depreciate.

Conversely, during global economic slowdowns, global market risk is high, credit conditions are tight and funds flow into the US in search for low-risk safe assets causing the US Dollar to appreciate. Economic divergences between the US economy and the rest of the world may also cause US dollar to appreciate. When the US economy outperforms other economies, the Fed may raise short-term rates higher related to other countries causing funds to flow back to the US.

Which economies succeed and Fail

A country’s success is determined by three factors: 1. Productivity: producing more by working harder or smarter, 2. Culture: Sacrificing life for achievement, innovation, commercialism, low bureaucracy, corruption, rule of law, 3. Indebtedness: low debt to income (reference: how the economic machine works – Bridgewater Associates)

Forex Trading research

Sign Up to access MacroVar research for Forex.