Variance Swap |

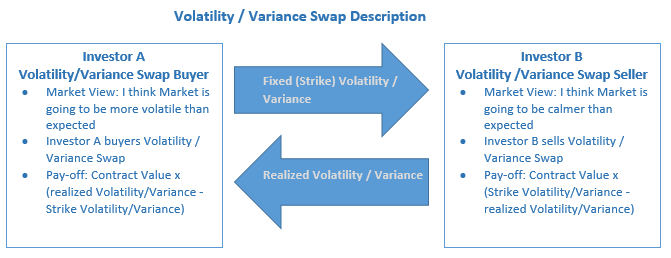

| Variance Swap or Volatility Swap are instruments used for Volatility Trading.

Volatility Trading deploys Investment strategies generating High and Stable profits analogous to the long-term success of insurance companies. Volatility Investments aim to receive the volatility premium. Enter your Email below to Download Free Historical Data for Nikkei 225 and Economic Data for 120,000+ Macroeconomic Indicators and Market Data covering Stocks, Bonds, Commodities, Currencies & Financial Indices of 150 countries in Excel or via Quantitative Python API.

Variance Swap Example The market is pricing that over the next year, S&P 500 will have a volatility of 30%. The historical volatility of S&P 500 is 15%. Your view, is that the market will remain calm. To gain a profit from this assessment you enter a contract in which at the end of the year, you will pay $1,000 multiplied by the upcoming actual volatility. In return you will receive $1,000 times the fixed volatility of 30%. At the end of the year, if the actual volatility was 15%, your profit is: $1,000 x (30-15) = $15,000 minus transaction costs. A volatility swap is the same as a variance swap since volatility is the root square of variance.

Volatility Premium Volatility Premium versus Insurance Premium Volatility Premium is similar to the insurance premium insurance companies receive for insuring clients against extreme events like flood. The insurance premium exists because the implied risk (what clients pay to get insured) is higher than the actual risk (what insurance companies pay out in case of flood) for these catastrophes occurring. In finance markets, most participants in options are options buyers willing to hedge their portfolios. Selling options is regarded dangerous and hence is avoided. Hence the price paid by buyers to get insured against extreme events is high since demand is much larger than supply for insurance. The imbalance between demand and supply is very high after a market crisis when investor protection demand spikes whereas investors willing to offer protection decreases. As a result, volatility trading is the one of the best investments after major market crisis. Extreme Event Insurance example High demand and low supply for insurance produces very high flood insurance rates but the probability of future floods occurring has not changed. A 200 year storm has remained a 200 year storm. As a result, the best time to issue insurance policies is immediately after a crisis when risk premium is highest. |