SOFR futures

Explore how to interpret the SOFR forward curve dynamics. Sign up using the form on the right to access MacroVar analytics, research and data of the SOFR Forward curve and all major financial markets and economies.

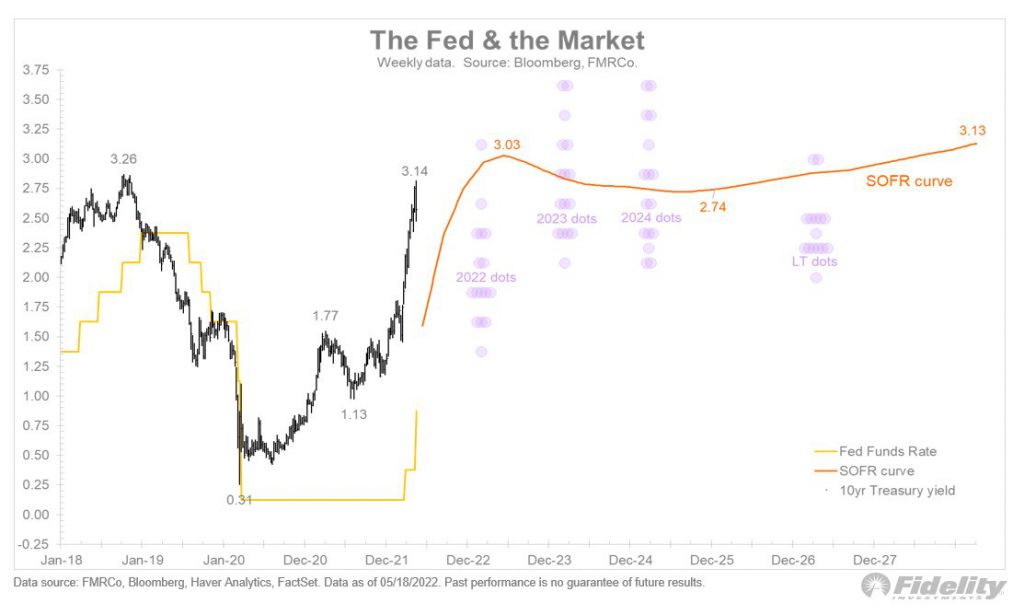

MacroVar analyses the 1-month and 3-month SOFR futures and provides historical data to monitor the market’s expectations for the US central bank monetary policy actions (rate hikes/cuts) and its effects on financial markets and the US economic outlook.

SOFR futures contracts

What are SOFR futures

SOFR (Secured Overnight Financing Rate) futures are financial derivatives contracts based on the SOFR interest rate. SOFR is a benchmark interest rate that measures the cost of borrowing cash overnight, collateralized by U.S. Treasury securities. It is intended to replace the London Interbank Offered Rate (LIBOR) as the reference rate for a wide range of financial transactions, especially those in the derivatives and financial markets.

SOFR futures are traded on futures exchanges and are used by market participants to hedge interest rate risk, speculate on future interest rate movements, and manage their exposure to the SOFR benchmark rate. These futures contracts allow market participants to enter into agreements to buy or sell SOFR-based interest rates at a specified future date, with the price and terms of the contract determined at the time of the agreement.

SOFR futures are designed to provide a transparent and standardized way to gain exposure to SOFR and manage interest rate risk. They are typically settled in cash, which means that the difference between the contract’s initial price and the final settlement price is exchanged, rather than delivering the underlying assets themselves.

The transition from LIBOR to SOFR is part of a broader effort to improve the stability and transparency of financial markets, reduce the risk associated with benchmark rate manipulation, and align with global regulatory reforms. As such, SOFR futures and other SOFR-based financial instruments have gained prominence in the financial industry as the transition away from LIBOR continues.

MacroVar tracks and keeps a historical database of 3-month and 1-month SOFR futures contracts. 3-Month SOFR futures are quarterly contracts reflecting SOFR expectations between IMM dates. 3-month SOFR futures listings extend out to 10 years. 1-Month SOFR futures listings extend to the nearest 13 calendar months.

Sign up to gain free access to MacroVar database and SOFR futures analytics.