Economy by State

Monitor the economy by state based on macroeconomic indicators related to current Economic conditions, building permits and employment dynamics. Click on each state to examine each state's economic state in detail.

US states by GDP

StateClick on each country link to view each country's macroeconomic and financial data analysis |

GDPManufacturing PMI |

Current GrowthGrowth Momentum |

Building PermitsGrowth Momentum |

Jobless ClaimsGrowth Momentum |

Unemployment RateGrowth Momentum |

|---|---|---|---|---|---|

| California | 3164340 | 145.63 | 10610 | 72003 | 8.3 |

| Texas | 1820230 | 146.38 | 23606.5 | 21927 | 6.7 |

| New York | 1724930 | 117.94 | 3129.24 | 19615 | 8.2 |

| Florida | 1123900 | 144.35 | 17565.5 | 8257 | 4.8 |

| Illinois | 886565 | 120.85 | 1709.67 | 23516 | 7.1 |

| Pennsylvania | 799437 | 114.61 | 2697.61 | 31317 | 7.4 |

| Ohio | 694139 | 123.41 | 2761.77 | 14013 | 4.7 |

| New Jersey | 634903 | 122.53 | 3978.51 | 12771 | 7.5 |

| Georgia | 637216 | 147.14 | 5918.6 | 24622 | 4.3 |

| Washington | 637991 | 143.6 | 4320.17 | 10317 | 5.5 |

| Massachusetts | 598562 | 136.58 | 2132.36 | 8398 | 6.5 |

| North Carolina | 603013 | 138.03 | 7899.28 | 5932 | 5 |

| Virginia | 566425 | 131.81 | 3693.83 | 8090 | 4.7 |

| Michigan | 528238 | 121.22 | 2043.49 | 12865 | 4.9 |

| Maryland | 432908 | 129.72 | 1445.94 | 8643 | 6.2 |

| Colorado | 401074 | 145.49 | 5447.61 | 3926 | 6.4 |

| Minnesota | 385485 | 142.12 | 3015.58 | 4869 | 4.1 |

| Tennessee | 376233 | 135.25 | 5212.53 | 6936 | 5 |

| Indiana | 385319 | 124.34 | 2272.18 | 5940 | 3.9 |

| Arizona | |||||

| Wisconsin | 348166 | 126.81 | 2158.8 | 8369 | 3.9 |

| Missouri | 331576 | 122.76 | 2082.08 | 8666 | 4.1 |

| Connecticut | 288923 | 110.37 | 653.14 | 4346 | 8.1 |

| Louisiana | 248281 | 103.11 | 2272.3 | 5573 | 7.3 |

| Oregon | 256498 | 142.36 | 1927.23 | 6532 | 6 |

| South Carolina | 2908 | 2785 | |||

| Alabama | 231736 | 126.77 | 1533.38 | 7247 | 3.6 |

| Kentucky | 216470 | 122.01 | 1351.86 | 6318 | 4.7 |

| Oklahoma | 190776 | 128.92 | 1374.54 | 9364 | 4.3 |

| Iowa | 199948 | 125.21 | 1714.88 | 3380 | 3.8 |

| Utah | 202824 | 155.02 | 3911.92 | 3103 | 2.8 |

| Nevada | 178426 | 132.85 | 2251.87 | 5043 | 8 |

| Kansas | 178346 | 132.48 | 773.44 | 1810 | 3.5 |

| Arkansas | 132956 | 128.83 | 1219.24 | 2503 | 4.4 |

| Nebraska | 133062 | 132.33 | 827.23 | 1472 | 2.8 |

| Mississippi | 118122 | 117.62 | 747.32 | 2830 | 6.2 |

| New Mexico | 102635 | 121.36 | 669.12 | 4812 | 8.2 |

| Puerto Rico | |||||

| Hawaii | 90766 | 114.52 | 356.04 | 2175 | 8.1 |

| New Hampshire | 87300 | 146.15 | 426.62 | 906 | 2.8 |

| Idaho | 87358 | 148.03 | 1825.68 | 1655 | 3.1 |

| West Virginia | 75959 | 102.67 | 238.08 | 2594 | 5.8 |

| Delaware | 77688 | 123.48 | 882.42 | 5732 | 6.4 |

| Maine | 67839 | 125.07 | 589.55 | 1376 | 4.8 |

| Rhode Island | 61578 | 121.2 | 157.65 | 9610 | 6.3 |

| North Dakota | 55790 | 138.81 | 270.17 | 501 | 4.2 |

| Alaska | 52065 | 109.61 | 162.96 | 2959 | 6.7 |

| South Dakota | 57142 | 137.73 | 705.48 | 263 | 2.8 |

| Montana | 53015 | 118.74 | 412.1 | 1221 | 3.8 |

| Wyoming | 37053 | 114.35 | 195.28 | 416 | 5.4 |

| Vermont | 33718 | 133.88 | 226.41 | 372 | 2.9 |

Macroeconomic Indicators by State

Economic Basics

A country's economy is comprised of the public and private sector. The private sector is comprised of businesses and consumers. There are two types of businesses manufacturing, and services. A country's economy is also affected by the global economy since capital and products flow between countries.

Economic growth is measured by Real GDP which is the total income of a country in a year adjusted for inflation.

Inflation (CPI) measures the rate at which average price of products increases in a year.

Economic transactions are completed with either money or debt. The availability of credit is determined by the country's central bank. The degree to which debt is healthy for the economy depends on whether borrowed money is used productively to generate sufficient income to service the debt or not.

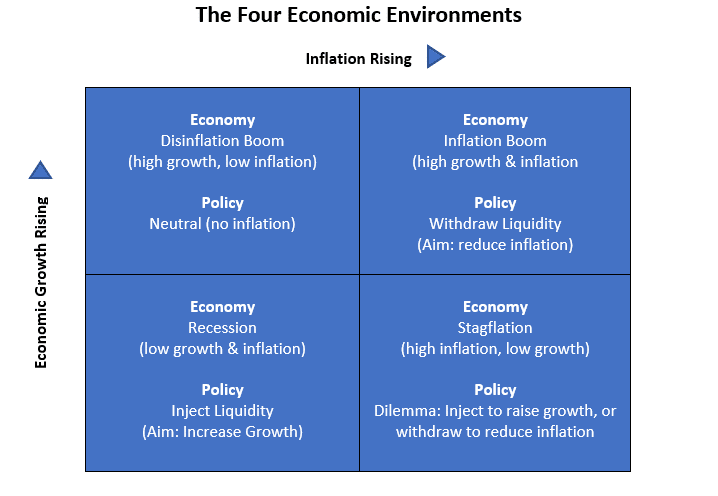

Economic Growth vs Inflation

An economy is healthy when it generates stable economic growth with low inflation and low unemployment.

Policymakers (government & central bank) use fiscal and monetary policy to inject liquidity during slowdowns (to solve weak economic growth) and withdraw liquidity from an overheating economy (to solve high inflation).

Excessive intervention in the economy may lead to loss of confidence in the country and a financial crisis. The degree of intervention depends on the country’s fundamentals. Read how to analyze an economy’s fundamentals.

Advanced Economic Model

Introduction: An economy is the sum of the transactions that make it up. A country’s economy is comprised of the public and private sector. The private sector is comprised of businesses and consumers. Learn more about the factors that determine which countries succeed and fail.

Economic Aim: A nation’s economy is healthy when it experiences stable economic growth with low inflation and low unemployment. Economic growth is measured by Real GDP and inflation by CPI, PPI. An economy is affected by its individual performance and its economic performance relative to the rest of the World (RoW).

Economic activity is driven by 1. Productivity growth (GDP growth 2% per year due knowledge increase), 2. the Long-term debt cycle (50-75 years), 3. the business cycle (5-8 years). Credit (promise to pay) is driven by the debt cycle. If credit is used to purchase productive resources, it helps economic growth and income. If credit is used for consumption it has no added value.

Money and Credit: Economic transactions are filled with either money or credit (promise to pay). The availability of credit is determined by the country’s central bank. Credit used to purchase productive resources generating sufficient income to service the debt, helps economic growth and income.

Country versus Rest of the World: A country’s finances consist of a simple income statement (revenue–expenses) and a balance sheet (assets–liabilities). Exports are imports are the main revenue and expense for countries. Uncompetitive economies have negative net income (imports higher than exports), which is financed by either savings (FX & Gold reserves) or rising debt (owed to exporters).

Debt: A nation’s debt is categorized as local currency debt and FX debt. Local debt is manageable since a country’s central bank can print money and repay it. FX debt is controlled by foreign central banks hence it is difficult to be repaid. For example. Turkey has US dollar denominated debt. Only the US central bank (the Federal Reserve), can print US dollars hence FX debt is out of Turkey’s control.

A country can control its debt by either: 1. Inflate it away, 2. Restructure, 3. Default. The US aims to keep nominal GDP growth above interest rates (kept low) to gradually reduce its debt.

Injections & Withdrawals

The government and central bank use fiscal and monetary policies to inject liquidity during slowdowns to boost growth and withdraw liquidity from an overheating economy to control rising inflation. The available policies and tools used during recessions are the following:

Monetary Policies(MP)

- 1. Reduce short-term interest rates > Boost Economic growth by 1. Raising Credit, Easing Debt service

- 2. Print money > purchase financial assets > force investors to take more risk & create wealth effect

- 3. Print Money > purchase new debt issued to finance Gov. deficits when no local or foreign investors

Fiscal Policies (FP)

Expansionary FP is when government spends more than tax received to boost economic growth. This is financed by issuing new debt financed by 1. domestic or foreign investors or 2. CB money printing

Currency vs Injections & Withdrawals and inflation

The degree of economic intervention depends on the country’s economic fundamentals, its currency status and credibility. Countries with reserve currencies or strong fundamentals are allowed by markets to intervene. However, when nations with weak economic fundamentals intervene heavily, confidence is lost, causing a capital flight out of the country, spiking inflation and interest rates which lead to a severe recession, political and social crisis.

Reserve vs Non-reserve currencies: Reserve currencies are used by countries and corporations to borrow funds, store wealth and for international transactions (buy commodities). They are considered low risk. The US dollar is the world’s largest reserve currency. The main advantage of reserve currency nations is their ability to borrow (issue debt) on their own currency. These countries have increased power to conduct monetary and fiscal policies to boost their economies. However, prolonged expansionary fiscal and monetary policies eventually lead to loss of confidence in these currencies as a store of value and potential inflationary crisis.

Non-reserve currency countries

Conversely, developing nations are not considered low risk hence their ability to borrow in their own currencies is limited. Their economic growth is dependent on foreign capital inflows denominated in foreign currencies like the US dollar. During periods of global economic growth, capital flows from developed markets into developing nations looking for higher returns. These economies and their corporations’ issue foreign debt to grow. However, during periods of weak global economic growth or financial stress, foreign capital flows (also called capital flight) back to developed countries causing an inability of countries and companies to repay their debt. Central banks gather foreign exchange reserves during growth periods to create a cushion against capital outflows.

A nation’s economy is vulnerable to economic weakness or financial stress when it experiences:

- Current account deficit: a current account deficit indicates an uncompetitive economy which relies on foreign capital to sustain its spending. Hence, is vulnerable to capital outflows

- Government deficit: a big government deficit indicates an economy relying or rising debt to finance its operations

- Debt/GDP: a high Debt/GDP pushes a nation to borrow large amounts to finance its debt, print money or default. Historically, Debt/GDP higher than 100% is a red warning for economies.

- Low or no foreign exchange reserves: Developing economies are vulnerable to capital flight since foreign exchange reserves provide a cushion against capital outflows

- High external debt: Nations are vulnerable to high external debts which may be caused by a sudden depreciation of their currency or rising foreign interest rates (due to foreign growth)

- Negative real interest rates: Lower interest rates than inflation, are not compensating lenders for holding a nation’s debt hence making nation’s currency vulnerable to capital outflows.

- A history of high inflation and negative total returns: Nations with bad history have lack of trust in value of their currency and debt