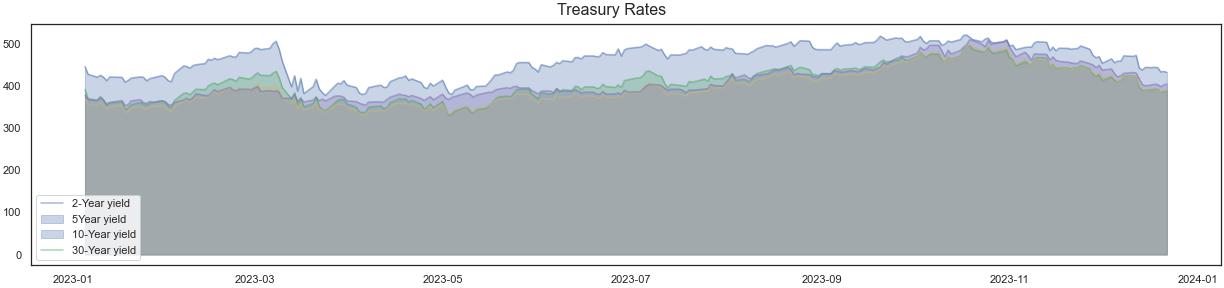

Treasury rates

| Treasury Rates | |

|---|---|

| 1-Year | 5.343% |

| 2-Year | 4.928% |

| 3-Year | 4.679% |

| 5-Year | 4.508% |

| 7-Year | 4.525% |

| 10-Year | 4.497% |

| 30-Year | 4.617% |

Treasury rates

What are Treasury rates

Treasury rates, or treasury yields, are the effective annual interest rates that the U.S. government pays on its debt obligations, expressed as a percentage. The U.S. government issues debt securities through the U.S. Treasury to finance its spending and borrowing needs. These securities are known as Treasuries, and they come in different maturities, ranging from a few weeks to 30 years.

Treasury rates are inversely related to Treasury prices. When the demand for Treasuries is high, their prices go up and their yields go down. Conversely, when the demand for Treasuries is low, their prices go down and their yields go up. Treasury rates reflect the market's expectations of future interest rate movements, inflation, economic growth, and risk appetite.

Why Are Treasury Rates Important?

Treasury rates are important for several reasons. First, they are considered the benchmark for risk-free investments, since they are backed by the full faith and credit of the U.S. government. Therefore, they influence the interest rates that other borrowers and lenders pay or receive in the market. For example, corporate bonds, mortgages, and consumer loans usually have higher interest rates than Treasuries of similar maturities, to compensate for their higher risk.

Second, treasury rates affect the returns and values of other assets, such as stocks, commodities, and currencies. For example, when treasury rates are low, investors may seek higher returns in other markets, boosting their prices. When treasury rates are high, investors may sell other assets and buy Treasuries, lowering their prices.

Third, treasury rates indicate the market's perception of the economy's prospects and the Federal Reserve's monetary policy. For example, when treasury rates are rising, it may signal that the economy is growing strongly and that inflation is picking up. This may prompt the Fed to raise its short-term interest rate target to keep inflation under control. When treasury rates are falling, it may signal that the economy is slowing down and that inflation is low. This may prompt the Fed to lower its short-term interest rate target to stimulate the economy.

How Are Treasury Rates Determined?

Treasury rates are determined by supply and demand in an auction process. The U.S. Treasury sells its securities to primary dealers (large financial institutions) who bid for them based on their desired yield. The highest yield that clears the auction is called the stop-out yield, and it becomes the yield for that maturity.

The supply of Treasuries depends on how much the government needs to borrow to finance its budget deficit and refinance its maturing debt. The demand for Treasuries depends on various factors, such as:

- The fed funds rate: This is the overnight rate at which banks lend each other reserves. The Fed directly controls this rate by buying or selling Treasuries in the open market. When the Fed lowers the fed funds rate, it increases the demand for Treasuries by making them more attractive relative to other short-term investments. - The trade deficit: This is the difference between what the U.S. imports and exports. When the U.S. has a trade deficit, it means that it spends more than it earns from abroad. This creates a net outflow of dollars that can be used to buy Treasuries from foreign investors. - Regulatory policies: These are rules and regulations that affect financial institutions' behavior and preferences. For example, banks may be required to hold a certain amount of Treasuries as part of their capital requirements or liquidity buffers. - Inflation expectations: These are projections of future inflation based on current and past data. When inflation expectations are high, investors demand higher yields on Treasuries to protect their purchasing power. When inflation expectations are low, investors accept lower yields on Treasuries as they expect stable prices.

Treasury rates are the interest rates the US government pays to borrow money for varying periods of time. Treasury rates are inversely related to Treasury prices. Treasury securities with different maturities have different rates. Treasury rates reflect the market's assessment of the economy's prospects. Higher rates on long-term treasuries indicate a more optimistic outlook and higher inflation expectations and vice-versa.

Treasury rates and the Yield Curve

The US yield curve is a line that plots treasury rates for differing maturity dates. The benchmark US yield curve monitored closely is the spread between the 10-year treasury rate and the 2-year treasury rate. The 10-year to 2-year yield curve predicts economic conditions 4-5 years out.The 2-year traasury rate of the yield curve is driven by market expectations of the Federal Reserve's actions while the 10-year treasury rates is driven by the market's expectations of future economic conditions and the inflation outlook.

The US yield curve is one of the most important leading indicators used to predict the US economy and markets. The full US yield curve (the spread between the US 10-year treasury rate and the Fed funds target rate) is often leading or lagging other leading indicators of the economy and markets.