PEG Ratio: A Better Way to Compare Growth Stocks

The PEG ratio, short for Price/Earnings to Growth ratio, is a financial metric used to assess the relative valuation of a company’s stock by taking into account both its price-to-earnings (P/E) ratio and its expected earnings growth rate.

It’s designed to provide a more comprehensive view of a company’s valuation compared to just using the P/E ratio alone.

A PEG ratio is what the market is willing to pay for a company’s forecasted EPS growth.

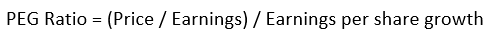

PEG ratio formula

Stocks with PEG ratio less than 1 are considered “undervalued” whereas stocks with PEG ratio higher than 1 are considered “overvalued”.

However, “overvalued” or “undervalued” stocks characterization is wrong. The PEG ratio represents the price the market is willing to pay based on the quality of earnings of the company.

Solid companies which have historically generated good earnings growth are rewarded by the market with high stock prices and high PEG ratios relative to the rest of the sector’s companies. Stock prices of those companies will trade on a premium to its sector because the companies’ earnings are valued higher than the earnings of all other companies in the sector.

On the contrary, poor companies which have historically missed earnings and generated poor earnings have low stock prices, low PEG ratios and trade at discount to their sector. Poor companies are valued lower than the rest of the sector’s companies.

PEG Ratio Example

Stock XYZ has price of $8 per share, earnings per share (EPS) of $1 and growth in earnings per share (EPS growth) estimate of 15%

PEG Ratio = (P/EPS)/EPS Growth = (8/1)/15 = 0.53

Last year’s EPS is obtained by discounting this year expected EPS by the expected EPS growth = $1/1.15 = $0.87

The company reports revised lower earnings per share (EPS) estimate of $0.9

This changes the earnings per share (EPS) growth rate to (0.9-0.87)/0.87 = 3.4%

The PEG ratio can remain constant if the stock price ends up at P = 0.53 x 3.4 x 0.9 = $1.62