Risk Management

One of the core stages in making investment, business and personal finance decisions is Risk Management.

The Model

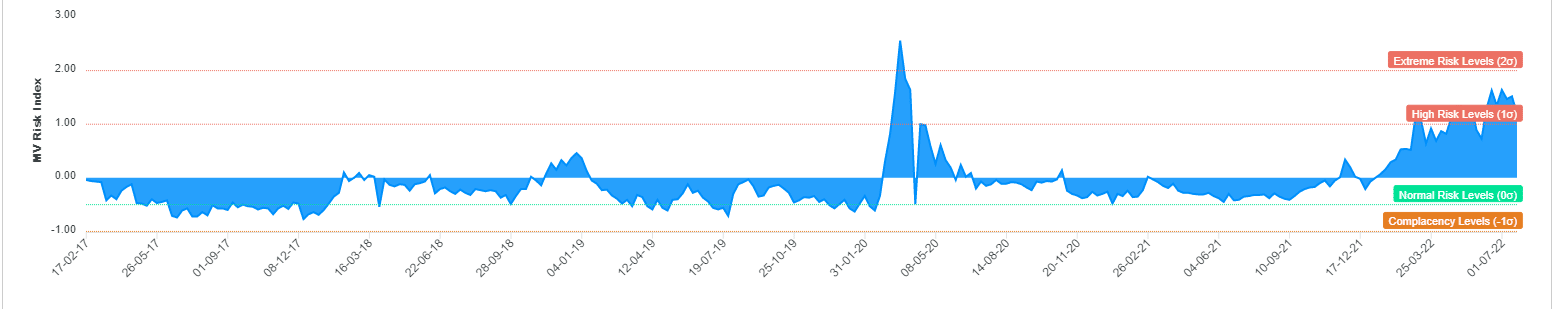

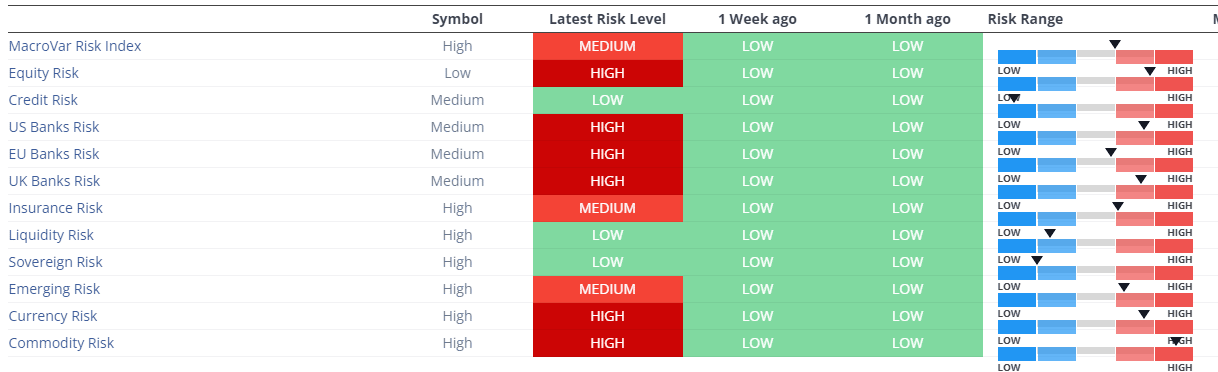

MacroVar risk management models monitor global financial risk conditions and provide automatic signals when market risk has changed by analysing systemic segments of global financial system and markets using quantitative methods.

Analyzing the Global Economy and Markets versus Financial risk

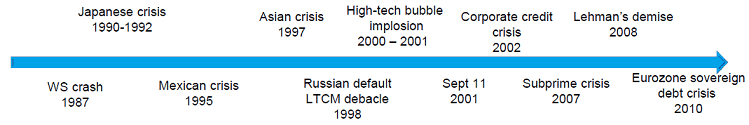

Financial markets and the real economy have historically experienced a series of severe crises. During these financial crisis, catastrophic investment and economic losses where experienced. It is critical for any investment or business strategy to understand financial risk conditions and adapt strategies based on these conditions.

The global economy and financial markets experience long-term growth. When financial risk is low, financial markets operate smoothly providing ample liquidity to financial markets and the economy. During these periods high growth assets like stocks experience high returns and are priced efficiently based on their fundamental drivers. On the contrary, when financial risk is rising, market liquidity deteriorates because of a loss of confidence in banks, funding institutions or governments which causes a feedback loop of surging funding costs, increased price volatility and asset fire sales. MV Risk Management Model Components Overview

MacroVar produces a composite index called MV Risk Index representing current global financial risk conditions.

| Stock Risk monitor |

| Stock risk is monitored by analysing the implied volatility and shape of the term structure of the US, European and Emerging stock markets. |

| Credit Risk monitor |

| Credit risk is monitored by analysing the credit default swaps indices of the United States, European and Emerging Markets. |

| Bonds Risk |

| Bonds risk is monitored by analysing the implied volatility of the US treasury market. |

| Emerging markets risk |

| Emerging markets risk is monitored by analysing the credit default swaps of government bonds for major emerging countries. |

| Liquidity risk |

| Liquidity risk is monitored by analysing interbank rates in the US and Europe. |

| Currency risk |

| Currency risk is monitored by analysing the implied volatility of currencies. |

| Bank risk |

| Bank risk is gauged by monitoring credit risk of US, European, UK banks and insurance institutions through credit default swaps. |

| Country Risk |

| Country risk is gauged by monitoring the Credit Default Swaps dynamics of developed and emerging countries. |

Our Risk management models are open-source and MacroVar displays these signals in the Risk Management section of the dashboard and will alert you through MacroVar Newsfeed and Daily newsletter automatically when new signals are generated. You can also access process these signals further and combine them with your research by downloading them from the MacroVar database using Excel, Python API or the Web.