Emerging Markets Risk

MacroVar monitors emerging market risk by monitoring credit default swap indices of emerging markets. Emerging markets risk is one of the components of MacroVar Risk Management model. Learn more about how MacroVar risk management model monitors emerging markets risk.

Emerging markets risk Report

Last Update: 2022-08-26

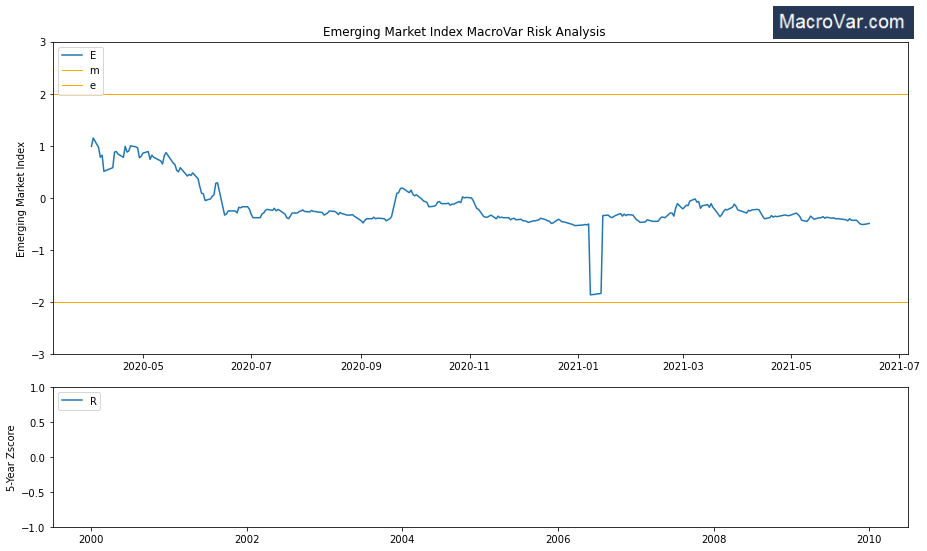

Bonds - MacroVar Emerging Markets Risk index was calculated at -0.3 as of 22th January 2021 indicating low global Emerging Markets risk and hence low financial risk conditions. Values lower than 0 indicating low risk Bonds conditions while values higher than 0 up to +2 indicate high risk conditions.

Emerging markets risk model

| Last | -1 Week | -1 Month | -3 Months | -6 Months | Strength | |

|---|---|---|---|---|---|---|

| Emerging Markets risk | -0.49 | -0.43 | -0.41 | -0.18 | -0.49 |

Emerging market risk model

Emerging market risk is modeled by monitoring credit risk in emerging markets. Credit risk is the likelihood that a company or a government goes bankrupt and the amount the investor loses if it happens. Credit risky securities include corporate debt securities like corporate bonds and bank loans and sovereign debt.

Credit default swaps are widely used derivatives used in credit risk management to describe market perceptions of credit risk for a specific government or corporation. Credit default swaps (CDS) are derivatives contracts which by construction aim at quantifying the risk of default of a counterparty. Therefore, CDS written major financial institutions or corporations are early signals to monitor and detect elevated credit risk conditions in the global financial system.

MacroVar monitors CDX emerging markets index. CDX emerging markets index is composed of fifteen sovereign entities that trade in the CDS market. Extreme values of z-scores greater than two indicate elevated credit risk conditions and vice-versa.