Risk management

Monitor market risk across global markets using MacroVar risk management models

Explore MacroVar Risk management models and how they can be implemented to manage financial risk.| Help (?) | Symbol | Last | Week | Quarter | Momentum | Details | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

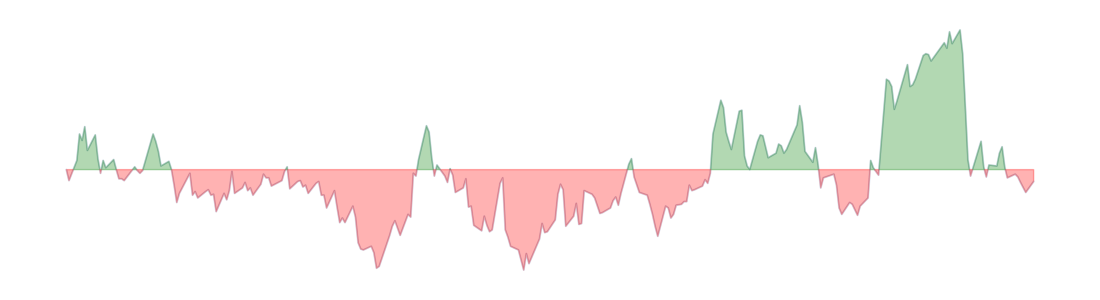

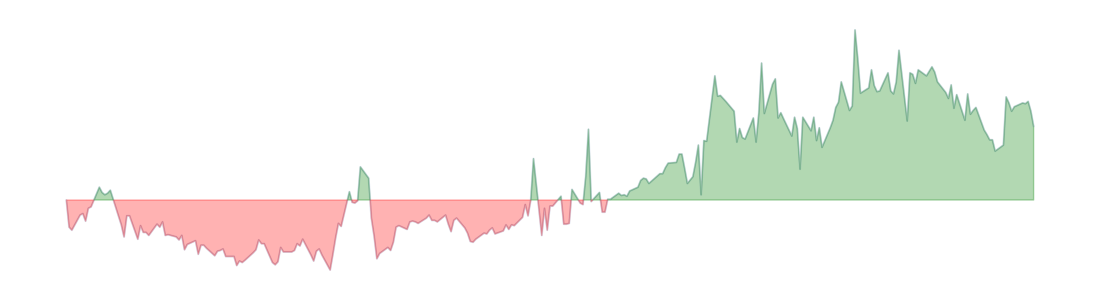

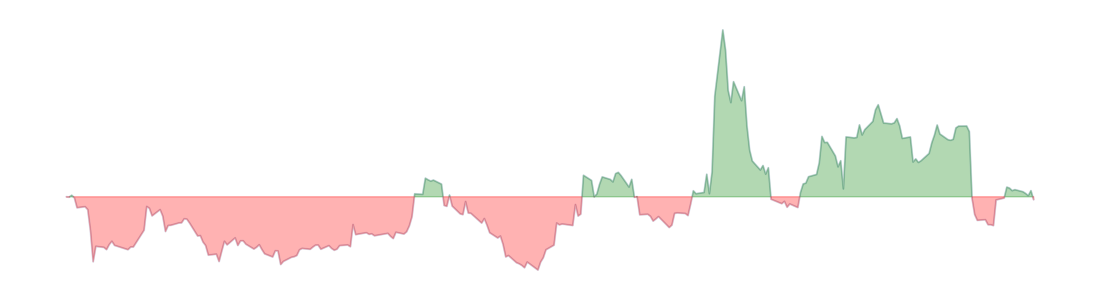

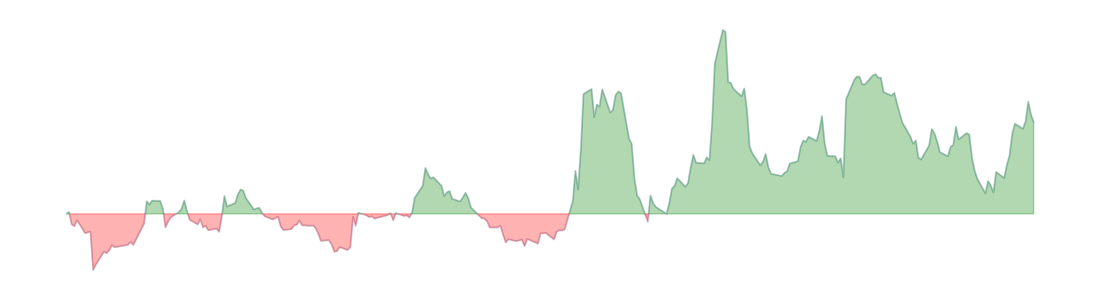

| MacroVar Global Risk Model | MV.RISK.INDEX | Low |  |

|||||||||||

|

||||||||||||||

| MV Equity Risk | MV.RISK.STOCK.INDEX | Low |  |

|||||||||||

|

||||||||||||||

| MV Credit Risk | MV.RISK.CREDIT.INDEX | Low |  |

|||||||||||

|

||||||||||||||

| MV FX risk | MV.RISK.FX.INDEX | Low |  |

|||||||||||

|

||||||||||||||

| MV Bond Risk | MV.RISK.BOND.INDEX | Low |  |

|||||||||||

|

||||||||||||||

| MV Liquidity Risk | MV.RISK.LIQUIDITY.INDEX | Low |  |

|||||||||||

|

||||||||||||||

| MV US Bank Risk | MV.RISK.USBANKS | Low |  |

|||||||||||

|

||||||||||||||

| MV Europe Bank Risk | MV.RISK.EUBANKS | Low |  |

|||||||||||

|

||||||||||||||

| MV UK Bank Risk | MV.RISK.UKBANKS | Low |  |

|||||||||||

|

||||||||||||||

| MV Country Risk | MV.RISK.COUNTRIES | Low |  |

|||||||||||

|

||||||||||||||

MacroVar risk management model

Successful investing requires managing a portfolio of assets to protect the capital of investors and generate steady returns in both rising and falling markets. This requires investing in growth assets (stocks, commodities, currencies) when global financial risk is low while shifting the portfolio to safe investments (bonds, cash) when financial risk exceeds certain levels.

MacroVar has developed risk management models which monitors global financial risk conditions and automatically updates users on global financial risk conditions. Explore MacroVar Risk Management in detail.

What is Financial risk management

Risk management identifies the potential sources of financial loss and uses strategies to minimize the financial loss.

Risk management analysis

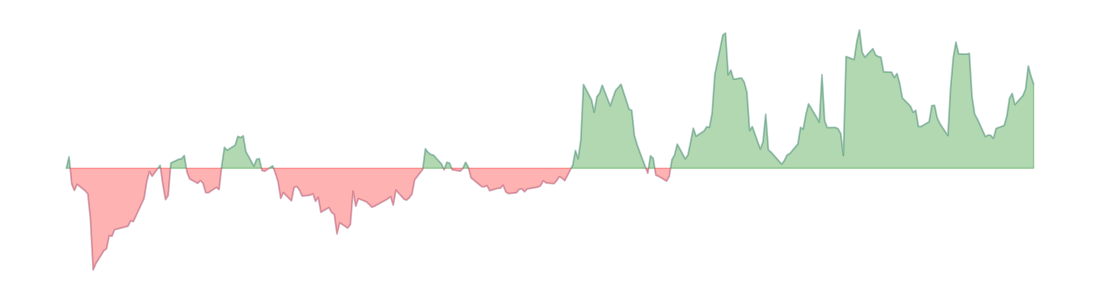

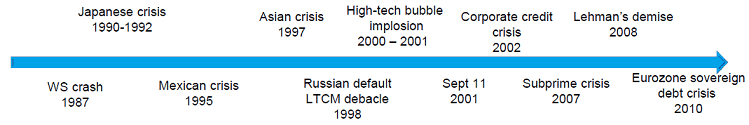

Financial markets and the real economy have historically experienced a series of severe crises. During these financial crisis, catastrophic investment and economic losses where experienced. It is critical for any investment or business strategy to understand financial risk conditions and adapt strategies based on these conditions.

Analyzing the Global Economy and Financial risk

The global economy and financial markets experience long-term growth. When financial risk is low, financial markets operate smoothly providing ample liquidity to financial markets and the economy. During these periods high growth assets like stocks experience high returns and are priced efficiently based on their fundamental drivers. On the contrary, when financial risk is rising, market liquidity deteriorates because of a loss of confidence in banks, funding institutions or governments which causes a feedback loop of surging funding costs, increased price volatility and asset fire sales.

MacroVar risk management model overview

MacroVar risk management model is a quantitative model which monitors critical financial markets and warns investors when financial risk is rising quickly. The risk management model monitors stocks, bonds, credit markets,

currencies and global liquidity daily.

MacroVar model components

MacroVar risk management model is comprised of the following segments:

- Stock Risk monitor : Stock risk is monitored by analyzing the implied volatility and shape of the term sturcture of the S&P 500 and Eurostoxx 50 stock markets.

- Credit Risk monitor: Credit risk is monitored by analyzing the credit default swaps indices of the United States and European markets.

- Bond Risk: Bond risk is monitored by analyzing the implied volatility of the US treasury market.

- Emerging markets risk: Emerging markets risk is monitored by analyzing the credit default swaps of government bonds for major emerging countries.

- Liquidity risk: Liquidity risk is monitored by analyzing the LIBOR-OIS spread.

- Currency risk: Currency risk is monitored by analyzing the implied volatility of low-risk currencies and gold.

- Bank risk: Bank risk is gauged by monitoring credit risk of US, European, UK banks and insurance institutions through credit default swaps.

- Country Risk: Country risk is gauged by monitoring the Credit Default Swaps dynamics of developed and emerging countries.

MacroVar risk management model analysis

MacroVar risk management factors are analyzed below.

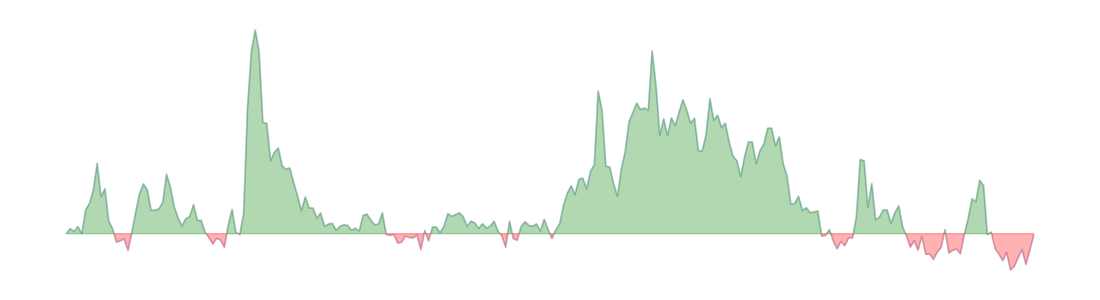

Stock Risk: Stock risk is the financial risk involved in holding stocks in an investment portfolio. Stock risk is modeled by monitoring the implied volatility of major global stock markets. The stock market is a leading indicator of future economic growth and financial coditions. When the stock market senses elevated financial risk, implied volatility increases and vice-versa.

MacroVar calculates for each of the fixed implied volatility indicators tracked the five year z-score. Extreme values of z-scores greater than two indicate elevated credit risk conditions and vice-versa. MacroVar credit risk index is the average of z-scores of the six indices tracked.

MacroVar monitors the following volatility indicators to model global stock risk:

- VIX: VIX is the implied volatility index of the S&P 500

- VXN: VXN is the implied volatility of Nasdaq 100

- VSTXX: VSTXX is the implied volatility of the European major stock index Eurostoxx 50.

- VIX term structure: VIX term structure monitors the slope of the VIX futures contracts term structure.

- VSTOXX term structure: VSTOXX term structure monitors the slope of hte VSTOXX futures contracts term structure.

Credit Risk

Credit risk is the likelihood that a company or a government goes bankrupt and the amount the investor loses if it happens. Credit-risky securities include corporate debt securities like corporate bonds and bank loans and sovereign debt.

Credit default swaps are widely used derivatives used in credit risk management to describe market perceptions of credit risk for a specific government or corporation. Credit default swaps (CDS) are derivatives contracts which by construction aim at quantifying the risk of default of a counterparty. Therefore, CDS written major financial institutions or corporations are early signals to monitor and detect elevated credit risk conditions in the global financial system.

MacroVar calculates for each of the six credit default swap indices tracked the five year z-score. Extreme values of z-scores greater than two indicate elevated credit risk conditions and vice-versa. MacroVar credit risk index is the average of z-scores of the six indices tracked.

MacroVar monitors the following credit default swaps indexes to capture the level of credit risk in the United States and European markets:

- CDX NA IG: CDX NA IG is a credit default swap index used to track credit risk of investment grade (low risk) corporations in North America

- CDX NA HY: CDX NA HY is a credit default swap index used to track credit risk in high yield (high risk) corporations in North America.

- ITRAXX Main: ITRAXX Europe Main is an index tracking credit default swaps of European companies with investment grade credit ratings published by Markit.

- ITRAXX Crossover: ITRAXX Europe Crossover is an index tracking credit default swaps of the 75 most liquid sub-investment grade corporations.

- ITRAXX Financials Senior: ITRAXX Europe Senior Financials is an index tracking credit default swaps of the 25 largest financial entities.

- ITRAXX Financials Subordinated: ITRAXX Europe Subordinated Financials is an index tracking credit default swaps of the 25 financials from the ITRAXX Europe Index.

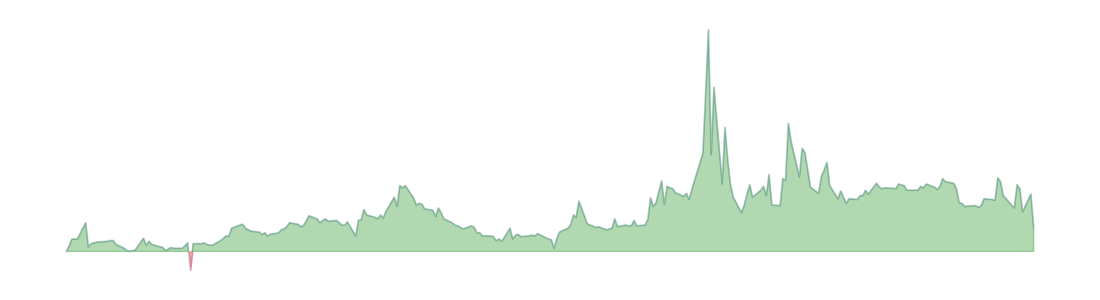

The bond market is the largest financial market in the world. Hence, it is very crucial to monitor the bond market's signals for future financial conditions. Bonds' greater risk is inflation risk. When an investor buys a bond, they commit to receiving a fixed rate of return for the duration of the bond as long as it is held. When inflation rises significantly, investors purchasing power erodes, and they may end up achieving a negative rate of return after factoring inflation. For example if an investor earns a 4% rate of return on a bond, but inflation rate is 6% then the investor's real rate of return is -2%.

MacroVar monitors bond risk, by modeling the MOVE index. the MOVE index is a well-recognized measure of US interest rate volatility that tracks the movement of the U.S. treasury yield volatility implied by current prices of one-month over-the-counter options on the two-year, five-year, ten-year and thirty-year treasuries.

MacroVar calculates the five year z-score of the MOVE index. Extreme positive values of the z-score greater than 2 indicate elevated bond implied volatility and rising financial risk conditions and vice-versa.

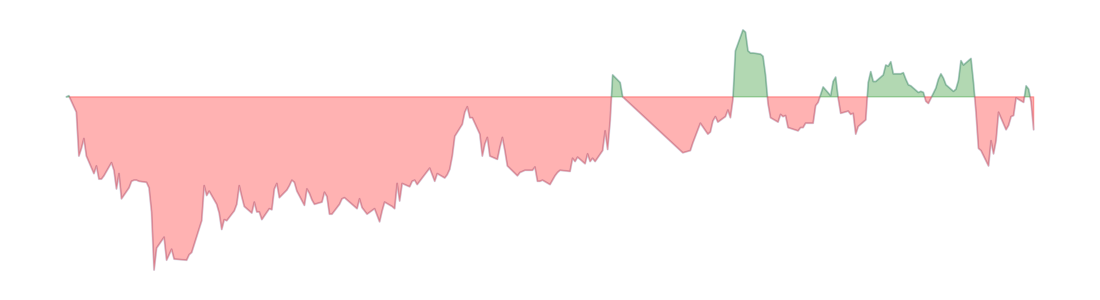

Liquidity risk is the risk that credit becomes unavailable, or is offered only on more stringest terms in the global financial market. Liquidity dry ups lead to systemic crises causing economic recessions and elevated financial risk.

MacroVar monitors the liquidity crisis by analyzing the LIBOR-OIS spread.

The Libor-OIS spread is the difference between LIBOR - the floating rate at which banks lend to each other for short-term unsecured loans and overnight index swap rates which are set by central banks.

Since LIBOR reflects bank credit risk, and OIS is risk-free, a significant rise in the LIBOR-OIS spread signals rising bank credit risk and liquidity risk.

During the subprime crisis for example, banks desire to keep ample cash balances, and their reluctance to lend to other banks, led to an unusual widening of the LIBOR-OIS spread which signaled global liquidity drie upa and predicted the upcoming global financial and economic crisis.

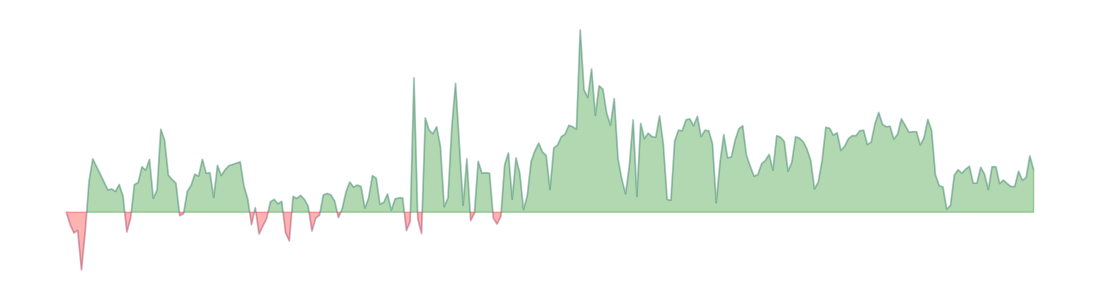

Currency risk is the increased volatility of currencies. Currency risk is modeled by monitoring the implied volatility of one month for the Swiss Franc (CHF), Japanese Yen (JPY) and Gold (GVZ). When investors sense rising financial risk, they move funds to safe currencies and commodities like the CHF, JPY and Gold. This causes a rise in implied volatility of these assets.

MacroVar calculates for each of the fixed implied volatility indicators tracked the five year z-score. Extreme values of z-scores greater than two indicate elevated credit risk conditions and vice-versa. MacroVar currency risk index is the average of z-scores of the six indices tracked.

Emerging market risk is modeled by monitoring credit risk in emerging markets. Credit risk is the likelihood that a company or a government goes bankrupt and the amount the investor loses if it happens. Credit risky securities include corporate debt securities like corporate bonds and bank loans and sovereign debt.

Credit default swaps are widely used derivatives used in credit risk management to describe market perceptions of credit risk for a specific government or corporation. Credit default swaps (CDS) are derivatives contracts which by construction aim at quantifying the risk of default of a counterparty. Therefore, CDS written major financial institutions or corporations are early signals to monitor and detect elevated credit risk conditions in the global financial system.

MacroVar monitors CDX emerging markets index. CDX emerging markets index is composed of fifteen sovereign entities that trade in the CDS market. Extreme values of z-scores greater than two indicate elevated credit risk conditions and vice-versa.

US, European and UK banks credibility plays an important role in monitoring global liquidity risk. When Banks risk is rising, global market liquidity risk is rising and therefore global financial risk is rising. MacroVar monitors Global Bank risk by monitoring credit default swaps levels of the following major global systemic banks.

- US Banks: Bank of America, Morgan Stanley, Goldman Sachs, Wells Fargo, JP Morgan, Citigroup

- European Banks: Deutsche Bank , Banco Bilbao Vizcaya Argentaria, Banco Santander, UBS, Societe Generale, ING Group, Commerzbank, BNP Paribas, Unicredit

- UK Banks: Royal Bank of Scotland, Barclays Bank, HSBC

- Insurance Institutions: AIG, AVIVA, AXA, ALLIANZ

Sovereign credit risk plays an important in gauging global financial risk. MacroVar monitors Sovereign Risk by monitoring Credit Default Swaps Levels for the following developed countries:

- United States

- France

- Germany

- United Kingdom

- Portugal

- Italy

- Spain

- Ireland

- Japan