How to Navigate Financial Markets: Strategies for Investors

There are two market environments: Risk On periods during which funds flow from safe assets to risky assets and Risk Off periods where funds flow from risky assets to low-risk assets.

Risk Assets (Risk-On): Stocks, Cyclical Commodities, Cyclical Sectors / Industries, High Yield Bonds, Cyclical Currencies, Emerging Markets (Capital flows to emerging markets in search for higher yields, higher growth rates and hence profits)

Safe Assets (Risk-Off): US Treasuries, German Bunds, Defensive Sectors / Industries, US Dollar DXY, Swiss Franc, Japanese Yen, Gold

The most important asset correlation is between the US stocks and US Bonds. During risk on periods US stocks rise while US bonds are sold and vice-versa. Since equities are closely linked with credit, MacroVar monitors closely the performance of corporate bonds for each sector in US and EU markets.

During Risk on Periods the markets behave as follows:

- Global Risk

- Equity Risk (VIX, VSTOXX): falling

- Credit Risk (CDX IG, ITRAXX IG, BofA High Yield credit spreads): falling

- Volatility Term Structure: steep contango

- MacroVar Risk Index: falling

- MacroVar Risk On/Off monitor Ratios: falling

- Stocks

- Global Stocks rising (ideally this should occur with global bond market weakness)

- US Stock Breadth rising

- Emerging Market Stocks rising (often outperforming developed markets like US & EU)

- Global Stock Breadth rising

- Stock Sectors

- Cyclical sectors outperform Defensive sectors

- Sector breadth rising

- Bonds (MacroVar monitors 2-year, 5-year and 10-year bonds)

- Safe Bonds

- US Treasuries falling (yields rising)

- German Bunds falling (yields rising)

- Risky Bonds

- US High Yield Bonds rising (yields falling)

- Europe: Club Med Bonds rising (yields falling)

- Emerging Markets Bonds rising (yields falling)

- Bond interest rates breadth rising (funds move out of bonds into stocks hence yield rates rise)

- Safe Bonds

- Yield Curve

- Yield Curve Bear steepening (on the contrary a Yield Curve bull re-steepening signifies Risk Off environment)

- Fed Funds futures above US 2-year bonds implying strong economic growth and FED hawkish stance

- Yield Curve Steepening Breadth rising

- Eurodollar Futures rising

- Currencies

- US Dollar (DXY) falling

- Safe Currencies (JPY, CHF) falling

- Risky Currencies (AUD, NZD, CAD) rising

- Currencies Breadth (vs the US Dollar) rising

- Commodities

- Energy (Crude Oil) rising

- Metals (Copper) rising

- Safe commodities (Gold) falling

- Commodities Breadth rising

- Macroeconomic Conditions

- Global PMI trend and momentum rising

- Global PMI breadth monitored strong

Individual country economic growth expectations are gauged using principally each country’s Manufacturing PMI and other business and consumer confidence indicators.

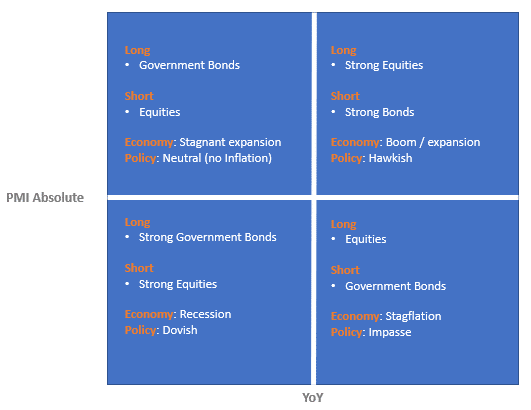

Financial Markets & 4 Economic Envrionments

Financial assets are affected by economic growth and inflation expectations. The performance of each financial asset for each economic environment is explained below.

MacroVar uses leading economic indicators for each country to predict economic and inflation expectations. More specifically for each country the Price Expectations and New Orders expectations components of the PMI, ISM and ESI indicators are used for structuring the models.

- Inflation boom: Accelerating Economic growth with Rising inflation

The best performers are emerging market stocks, international real estate, emerging countries’ currencies, commodities, and TIPS (treasury inflation protected securities).

The worst performers are US treasury bonds and cash since they are adversely affected by rising inflation.

High global growth with rising inflation expectations lifts commodities. Many emerging economies growth is linked to commodities. When commodities rise emerging market stocks, currencies and real estate rise as well.

- Stagflation: Slowing Economic Growth with Rising Inflation

The best asset performers protecting investors from inflation are Gold, Cash, Treasury Inflation Protected Securities, and the US Dollar.

The worst performers are long-duration treasury bonds adversely affected by rising inflation.

- Disinflation boom: Accelerating Economic growth with Slowing Inflation

The best performers are developed markets stocks, developed Real estate and US Treasury bonds.

Low inflation with moderate growth is a good environment for bonds and stocks and bad for the worst performs which are commodities and commodity related sectors.

- Deflation Bust: Slowing Economic Growth with Falling Inflation

During this environment the best asset performers are Long-Duration Treasuries and Cash. Everything else experiences big volatility and often large losses.

During crashes and economic depressions bonds rise while stocks and commodities fall. Investors during these environments look for the safety of their asset rushing into the safety of US treasury bonds and the US dollar while selling stocks and commodities.

MacroVar uses leading economic indicators for each country to predict economic and inflation expectations. More specifically, PMI, ISM and ESI components are used for structuring this model. MacroVar also provides a detailed analysis of a country’s economy by analyzing more than 30 indicators for each country. Read more about analyzing a country’s macroeconomics in detail.

Analysis of a specific Financial Market

Every financial market is linked (correlated) with economic growth expectations and other related markets.

Hence, analyzing a financial market requires monitoring the asset’s price dynamics (trend & momentum) and how the financial market reacts against economic indicators affecting it and other related markets.

For example, a specific stock is affected by the company’s fundamentals, it’s sector performance which in turn depends on the country and world economic growth. Moreover, the stock price must be analyzed in combination with the company’s bond price since both markets are closely linked and often a divergence between them may signal an trading opportunity.

MacroVar monitors various macroeconomic and financial factors affecting each financial market. A brief list is provided below. From click on a specific financial market in the World Markets or Sectors sections of MacroVar to examine the related factors.

- Global Manufacturing PMI vs Global Stock Market, US Dollar, Emerging Markets, US 10 year treasury

- Emerging Markets vs US 10 year treasury, US Dollar

- Global Manufacturing PMI vs Cyclical Commodities (Metals, Energy, Shipping)

- Country Stock Market vs Yield Curve, Manufacturing PMI, 10-year Bond, ZEW

- Country Bonds vs Manufacturing PMI, ESI, Inflation, ZEW, Inflation Expectations (ISM, ESI)

- Country Currency vs 10-year Bond, Stock Market, Central Bank B/S, 10-Year bond yield differential, 2-year bond yield differential, Manufacturing PMI, ZEW

- Country ETF vs Manufacturing PMI, ESI, Country Currency, 10-year Bond, CDS, ESI

- US & EU Stock Market vs Credit Index (YoY) – Index and Sector Analysis

- Commodity related currencies vs Metals, Energy

- Gold vs Bonds

- Construction ETF vs Building Permits

- Commodities ETF vs Commodity Futures

- Bank Sector ETF vs Yield Curve

- Equity vs Credit Volatility Indices

Trend & Momentum indicators

Momentum trading is used to capture moves in shorter timeframes than trends. Momentum is the relative change occurring in markets. Relative change is different to a trend. A long-term trend can be up but the short-term momentum of a specific market can be 0.

If a market moves down and then moves up and then moves back down the net relative change in price is 0. That means momentum is 0.

A short-term positive momentum, with a long-term downtrend results in markets with no momentum.

MacroVar Momentum model for Financial Markets

MacroVar Trend signal ranges from -100 to +100. The market trend signal is derived as the mean value from 4 calculations for each asset. The timeframes monitored are the following: 1 Day (1 trading day), 1 Week (5 trading days), 1 Month (20 trading days), 3 Months (60 trading days)

For each timeframe, the following calculations are performed: 1. Calculations of the return for the specific timeframe, 2. If return calculated is higher than 0, signal value 1 else signal value -1

Finally, the 4 values are aggregated daily.

MacroVar Trend model for Financial Markets

The most important trend indicator

The 52-week simple moving average and its slope are the most important indicators defining a market’s trend. An uptrend is characterized by price above the 52-week moving average followed by an upward slope. If fundamentals of the market have not changed and the moving average slope is still in uptrend, a price drop signifies a market correction and not a change of trend. Traders should watch oscillators like MacroVar oscillator and RSI to buy the dip and still follow the trend. The moving average slope turn signifies a change of trend.

MacroVar Trend model for financial markets

MacroVar Trend signal ranges from -100 to +100. The market trend signal is derived as the mean value from 8 calculations for each asset. The timeframes monitored are the following: 1-month (20 trading days), 3-months (60 trading days), 6-months (125 trading days), 1-year (250 trading days)

For each timeframe, the following calculations are performed: 1. Closing price vs moving average (MA): if price greater than MA value is +1, else -1, 2. Moving average slope: if current MA is higher than previous MA, upward slope +1, else -1

MacroVar trend model can be used as a trend strength indicator. MacroVar trend strength values ranging between +75 and +100 or -75 and -100 show strong trend strength.

A technical rollover is identified when MacroVar trend strength indicator moves from positive to negative value or vice-versa.

MacroVar Trend model for Macroeconomic Indicators

A macroeconomic indicator is in an uptrend when last value is higher than its twelve month moving average and its twelve month moving average slope is positive (last twelve month moving average is higher than the previous month’s twelve month moving average)

Lastly, MacroVar calculates the number of months the current value has recorded highs or lows. Trend change is assumed when a specific indicator has recorded a 3-month high / low or more.

MacroVar Momentum model for Macroeconomic Indicators

A macroeconomic indicator’s momentum is monitored by calculating its long-term year over year (Y/Y) return and its short-term month on month (M/M) return.