Implied Volatility: A Measure of Market Expectations and Uncertainty

What is implied volatility

Implied volatility is a volatility measure implied from the options market. It is an especially important measure of market risk since it is forward-looking. Implied Volatility is one of the most important tools professional traders use to adjust their portfolio to market conditions is by assessing implied market volatility.

MacroVar closely monitors implied volatility in the equity risk section. The most important implied volatility indicators is the VIX which estimates the implied volatility of the US S&P 500 stock market in the next 3-months and VSTOXX which estimates the implied volatility of the EU stock market. Implied volatility is also calculated for other assets like currencies and commodities. The most important commodity implied volatility indicators are the crude oil implied volatility index OVX and the gold implied volatility index GVZ.

Implied volatility calculator

Implied volatility is based on options pricing. Read our MacroVar option basics guide.

The price of an option is affected by 6 factors:

- Current underlying asset price (spot price)

- Strike price (the price you pay for the asset when you exercise the option)

- Time to expiration

- Volatility of the asset price

- Risk-free interest rate

- Dividend payments

To calculate implied volatility of the asset price we will consider 5 of the 6 factors above as known parameters. Options pricing is based on the Black-Scholes-Merton formula which uses the 6 parameters above. However, Black Scholes is used to calculate the real price of an option on the market whereas we want to use the formula to estimate the implied volatility of the asset price given the current price of the option and the 5 parameters above.

Hence, we use a computer model to insert the 5 parameters above and estimate the implied volatility using an optimisation computer model. Excel Goal Seek is the simplest method we can use.

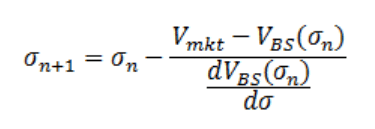

Implied Volatility formula

The implied volatility formula of an option is presented here:

Where Vmkt is the market price of option, Vbs is the option price given by the Black-Scholes equation and σ is the volatility.

Implied Volatility Calculator

Stocks Implied Volatility

We are looking for stocks with approximately 1.5 times the S&P 500 Implied Volatility (VIX). This can be calculated using annualized historical volatility.