Analysing inflation types and their causes

Inflation definition

Inflation measures the rate of increase of the average prices of goods and services in an economy. When prices rise the purchasing power of money falls and vice-versa.

MacroVar monitors inflation for the two components of a country’s economy: consumers and producers. Consumer inflation is measured by the consumer price index while business inflation is measured by the producer price index.

Inflation is measured using two important metrics: general inflation rate and core inflation rate.

General inflation rate monitors the average price level of all goods and services in an economy, while core inflation monitors all the goods and services excluding food and energy.

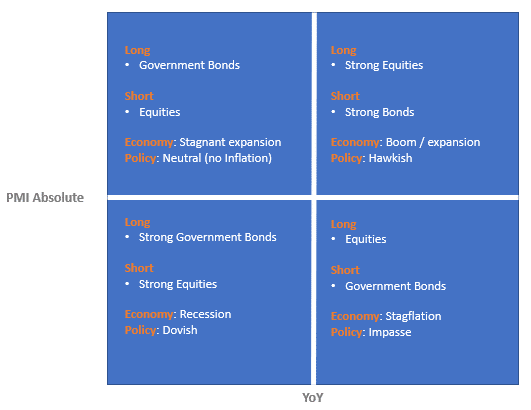

Economic growth vs Inflation

The aim of a country’s policymakers is to balance sustainable economic growth and stable inflation. Policymakers control economic activity and inflation by using fiscal policy and monetary policy tools.

During an overheating economy, the central bank and government tighten monetary and fiscal conditions using the following tools:

- Monetary policy tools: Increase Interest rates, Reduce money supply, Reduce central bank balance sheet

- Fiscal policy tools: reduce government spending, increase taxes

A tightening of monetary and fiscal conditions, helps slowdown the economy and bring the inflation into the policymakers target zone.

The US Federal reserve and the Eurozone’s ECB target an inflation of 2%. During economic recessions and severe economic recessions like that experienced in 2008 and 2019 Covid 19 central banks will do anything to avoid deflation. The main reason central banks target a positive inflation rate of 2% is that inflation helps governments, businesses and individuals pay of their debts with lower valued money. most interest payments are fixed in minimal terms. Inflation makes existing debt less important in real terms. Hence, keeping inflation high increases the rate at which debt effectively is paid off.

Central banks use the following monetary and fiscal policy tools to combat deflation during economic recessions:

- Monetary policy: lower interest rates, expand money supply, expand central bank balance sheet, debt monetization

- Fiscal policy tools: raise government spending, reduce taxes, increase government deficit

The degree to which policymakers can use monetary and fiscal policy tools to boost economic activity depends on the capital markets’ confidence for the specific countries. Reserve currency countries like the US and Eurozone are more flexible to use these tools to boost activity when compared to emerging countries. The main reason is that these countries and regions have debt in their currencies and hence are more flexible. However, history has proven that reckless monetary and fiscal policies by politicians for long periods of time have led to capital markets loss of confidence for these economies and their currencies. The results have been economic crisis driven by inflationary crisis which ultimately led to loss of economic, political and military power.

Learn more about the stages of economic crisis faced by developed countries and the balance between deflationary and inflationary forces in an economy.

Negative effects of inflation

High inflation causes severe economic recessions and political and social crisis. It is very important for countries to keep inflation under control. The negative effects of high inflation are the following:

- Value of money erosion: A rice in prices means that money can purchase fewer goods or assets. Inflation erodes the purchasing power of money. Hence during inflationary periods, individuals prefer to store their wealth in physical assets like gold, real estate whose value rises with the rest of prices

- Income redistribution: Individuals who can protect their assets and income from inflation become wealthier compared to other individuals whose income is fixed like pensioners.

- Balance of payments imbalances: High inflation rates cause domestic products to be more expensive than foreign goods causing a rise in imports, fall in exports. This leads to a current account deficit.

- Reduced Investment: Businesses postpone investments since they face reduced demand for their products and services due to reduced consumer confidence and exports. Moreover, strong inflation causes rise in interest rates which also undermines business confidence.

Cost-push inflation:

Cost push inflation occurs when an economy’s production slows down leading to a reduction in aggregate supply. Given a steady aggregate demand, the price levels rise and aggregate demand adapts by contracting. Cost push inflation is much harder to solve than demand pull inflation, since it’s easier to control an economy’s aggregate demand than the aggregate supply. Learn more about cost push inflation.

Demand-pull inflation:

Demand pull inflation occurs when aggregate demand in the economy increases much more than aggregate supply. The country’s central bank can reduce demand pull inflation by slowing down the economy through higher interest rates, central bank balance sheet tightening and reduction in the money supply. Learn more about demand pull inflation.

Learn more about how high inflation may lead to severe inflationary crisis.

Inflation versus Currency

The value of a country’s currency is strongly correlated to the rate of inflation. High inflation rates lead to lower real rates of return in a specific country, which cause capital to flow out of the specific country and cause the currency to depreciate substantially.