Investing in Bonds: A Guide to Understand the Benefits and Risks of Fixed Income Securities

Investing in bonds requires a systematic process explained in this guide for analysing macroeconomic and financial market dynamics affecting bonds.

What are bonds

A bond is a debt security that promises to make interest payments (also called coupon payment) periodically for a specific period and pay back the initial capital borrowed (also called maturity value, face value) when the bond matures.

The coupon rate is rate of interest the issuer must pay, and this payment is called coupon payment. This rate is fixed for the duration of the bond and is not affected by interest rates. In case the repayment terms of a bond are not met, the bondholder has a claim on the issuer’s assets.

Investing in Bonds

Investing in bonds requires an understanding of how bonds work and how their value is affected by the current economic conditions and other financial markets.

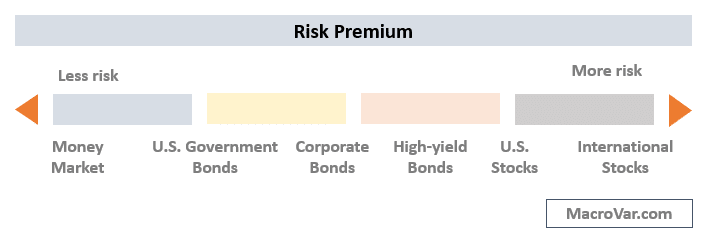

There are different types of bonds and each bond type has different risk return characteristics. Along the risk spectrum, U.S. and German Government bonds are considered the safest lowest-risk financial assets while junk bonds are the highest-risk financial assets.

Bonds and the Economy

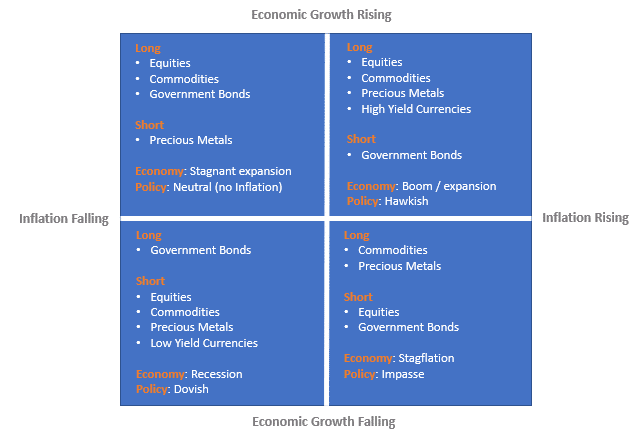

Real economic growth expectations and the inflation outlook of the global economy drive all financial assets. There are 4 economic environments based on economic growth and inflationary conditions.

- Inflation boom: Accelerating Economic growth with Rising inflation

- Stagflation: Slowing Economic Growth with Rising Inflation

- Disinflation boom: Accelerating Economic growth with Slowing Inflation

- Deflation Bust: Slowing Economic Growth with Falling Inflation

During an inflationary boom with strong economic growth and inflation, high yield bonds are well performing investment vehicles while government bonds are the worst performing financial assets.

During stagflation which is an economic environment of falling inflation and slowing economic growth government bonds are the best performing financial assets while high yield bonds are one fo the worst performing financial assets.

During disinflationary boom, with strong economic growth and falling inflation, government bonds are the best performing assets and high yield bonds are also good performing assets.

Deflationary busts are economic environments with falling economic growth and falling inflation. During this environment safe government bonds like US treasuries and German bunds are the best performing assets while high yield bonds are one of the worst performing assets.

Bonds and Market Risk

During global economic expansions when inflation expectations are positive, capital flows out of low-risk assets such as US treasuries and German bunds into higher risk financial assets such as high yield bonds and stocks. Inside the government bond market, during healthy economic conditions capital flows from safe German bunds to riskier bonds of the Eurozone periphery like Italian government bonds and Spanish government bonds and from low-risk US treasuries to other emerging market bonds in search of additional yield.

During economic slowdowns where the market expectation is disinflation funds flow from risky assets like emerging market bonds and stocks to low-risk financial assets like US treasuries and German bunds.

Types of Bonds

There are many types of bonds, but the most important long-term bond types are government notes and bonds, municipal bonds, and corporate bonds.

Treasury Notes and Treasury Bonds

The US Treasury issues bonds of different maturities to finance the United States national debt. Treasury notes have a maturity ranging from 1 to 10 years while treasury bonds have a maturity from 10 to 30 years.

US treasury notes and bonds are considered low-risk assets since the country’s central bank which in this case is the Federal Reserve can print money to pay off its debt. However, if the government is not prudent in applying its fiscal and monetary policies then other severe economic problems may arise which will also affect treasury notes and bonds prices.

Treasury Inflation Protected Securities

The advantage of treasury inflation protected securities is that they give bondholders the chance to buy a security whose value will not be affected by inflation. The interest rate of treasury inflation protected securities does not change throughout the duration of the security. However, the principal amount used to compute the interest payment fluctuates based on the US consumer price index (CPI).

Treasury STRIPS

When a treasury note or bond is stripped, each interest payment and the principal payment become separate zero-coupon securities. Each component has its own identification number and can be traded separately. For example, a treasury note with 10 years to maturity consists of a single principal payment paid at maturity and 20 interest payments, one payment every months for the next 10 years.

When this note is stripped, each of the 20 payments and the principal payment become separate securities. The treasury note becomes 21 securities that can be traded individually.

The STRIPS process is handled by the brokerage or other financial institution that sells the securities.

Agency Bonds

Special government sponsored enterprises or U.S. agencies are authorized to issue bonds. These agencies are not guaranteed by the government. Agency bonds are low risk since Agencies issue bonds to finance loans for various purposes and the bonds issued are secured by the loans financed. In 2008, the US government bailed out Fannie Mae and Freddie Mac without allowing their default.

Municipal Bonds

Municipal bonds are securities issued by local, county and state governments. Municipal bonds are issued to finance public infrastructure projects like roads and utilities. Municipal bonds are considered low risk investments, but they do not have zero default risk. The reason is that unlike the federal government, during recessions local governments cannot print money to repay the bonds issued. Hence, when local governments’ tax revenues fall, large fiscal deficits are created making it impossible to repay back the bonds issued in full.

Corporate Bonds

Corporate bonds are bonds issued by large corporations, to finance projects or their business activity. Bondholders of corporate bonds must thoroughly analyze the corporate bond’s indenture which is a contract clarifying the borrower’s obligations and the lender’s rights.

Corporate bonds have higher risk than US government bonds. Hence, corporate bonds interest rates are always higher than US government bonds.

Corporate bonds are having varying degree risk because the risk of default depends on the company’s health which is affected by many different variables. The interest rates of corporate bonds rise with increasing default risk of corporate bonds.

Bonds Research

Start monitoring bond markets by signing up to MacroVar Bonds research.