Forex Trading: a professional trader’s guide

Successful Forex trading strategies use systematic processes to predict future currency moves by analysing macroeconomic and global financial market dynamics.

MacroVar is a free financial advisory platform developed by professional traders to share our experience and guide you on how to first protect your capital and generate consistent returns using Forex trading strategies applied by investment banks and hedge funds.

The performance of a Forex trading strategy is measured by its Sharpe ratio which summarises in one number the investment return generated compared to the risk undertaken.

What is Forex Trading

Forex trading involves the systematic analysis of countries’ economies and global financial markets to predict currency moves and generate consistent returns with low risk. Professional traders identify forex trading opportunities by initially conducting fundamental analysis of macroeconomic trends and then using statistical methods and risk management to execute and manage a forex portfolio.

What is the Forex Market

The forex market is a global marketplace for exchanging currencies. It is one of the largest global markets with a daily trading volume of over five trillion us dollars. The market opens in New Zealand every Sunday at 5pm EST and closes every Friday at 5pm EST. 20% of the trading volume is for real business transactions whereas 80% is for pure speculation conducted by forex traders.

The forex market is a global marketplace for multiple currencies. Professional traders focus only on currencies affected by predictable economic and financial factors. These currencies provide good trading opportunities with consistent returns and low risk.

The G10 currencies for example are the most heavily traded currencies in the world and are very liquid. However, they have low volatility hence they rarely offer good trading opportunities.

Tradable Forex Markets

| Floating Currencies | Fixed Currencies | |

| Diverse Currencies | Commodity Related | Diverse Currencies |

| US Dollar (USD) | Australian Dollar (AUD) | Chinese Yuan (CNH) |

| Euro (EUR) | Canadian Dollar (CAD) | Hong Kong Dollar (HKD) |

| Japanese Yen (JPY) | New Zealand Dollar (NZD) | Singapore Dollar (SGD) |

| British Pound (GBP) | Russian Rubble (RUB) | Danish Krone (DKK) |

| Swiss Franc (CHF) | Norwegian Krone (NOK) | |

| Swedish Krona (SEK) | South African Rand (ZAR) | |

| Czech Koruna (CZK) | Brazilian Real (BRL) | |

| Hungarian Forint (HUF) | Mexican Peso (MXN | |

| Polish Zloty (PLN) | Peruvian New Sol (PEN) | |

| Indian Rupee (INR) | ||

| Turkish Lira (TRY) | ||

| Indonesian Rupiah (IDR) | ||

| Malaysian Ringgit (MYR) | ||

| Thai Baht (BHT) |

The Chinese Yuan (CNH) and Hong Kong Dollar (HKD) are pegged to the US dollar (USD), the Singapore Dollar (SGD) is pegged to a basket of currencies and the DKK is pegged to the EUR.

If you are new to forex trading, click our guide on forex trading for beginners since you need to first understand the forex trading basics before moving to the trading forex principles and strategies explained below.

Currency Groups

The value of a country’s currency depends on the financial markets confidence for the country’s economic and political system. Currencies are mainly grouped into reserve and non-reserve currencies.

Reserve currencies

Reserve currencies are used globally by countries and corporations to borrow funds (debt), as a store of wealth and to carry out international transactions. They are considered low risk. The US dollar is the world’s largest reserve currency (learn more about reserve currencies). The main advantage of reserve currency nations is their ability to borrow (issue debt) on their own currency. These countries have increased power to conduct monetary and fiscal policies to boost their economies. However, prolonged expansionary fiscal and monetary policies eventually lead to loss of confidence in these currencies as a store of value.

Non-reserve currency countries

Conversely, developing nations are not considered low risk hence their ability to borrow in their own currencies is limited. Their economic growth is dependent on foreign capital inflows denominated in foreign currencies like the US dollar. During periods of global economic growth, capital flows from developed markets into developing nations looking for higher returns. These economies and their corporations’ issue foreign debt to grow. However, during periods of weak global economic growth or financial stress, foreign capital flows (also called capital flight) back to developed countries causing an inability of countries and companies to repay their debt. Central banks gather foreign exchange reserves during growth periods to create a cushion against capital outflows.

Analysing a Country’s economy

A country’s economy is healthy when there is robust economic growth combined with stable inflation and low unemployment. The country’s government and central bank monitor economic indicators like GDP growth, inflation, employment and react when these indicators show weakening or overheating economic conditions. The central bank conducts the nation’s monetary policy while the government conducts fiscal policy to control economic activity.

Economic growth is measured by real GDP. However, GDP is a lagging indicator hence traders use leading indicators like Manufacturing and Services PMIs to gauge economic activity.

Inflation is measured by CPI and PPI. Leading indicators of inflation are the ISM Manufacturing price index for the US and ESI manufacturing prices for European countries

During weak economic conditions policymakers use expansionary monetary and fiscal policies to boost economic activity.

Expansionary monetary policy is a set of actions by the central bank to stimulate an economy by lowering short-term interest rates, purchasing long-term assets, and conducting debt-financed fiscal spending or cash transfers to households to boost the economy through the 1. wealth effect, 2. rising demand for goods and services, 3. Easing of debt service by lowering interest payments, 4. incentivizing investors to move capital to riskier investments and 5. weakening the country’s currency causing rising exports. Check MacroVar in depth analysis of monetary policy.

Expansionary Fiscal policy is when a government runs a government deficit by spending more than its revenues to boost aggregate demand. The government deficit is financed by debt either purchased by investors or by the central bank itself by printing money (also called debt monetization). Check MacroVar in depth analysis of fiscal policy.

A nation’s economy is vulnerable to economic weakness or financial stress when it experiences:

- Current account deficit: a current account deficit indicates an uncompetitive economy which relies on foreign capital to sustain its spending. Hence, is vulnerable to capital outflows

- Government deficit: a big government deficit indicates an economy relying or rising debt to finance its operations

- Debt/GDP: a high Debt/GDP pushes a nation to borrow large amounts to finance its debt, print money or default. Historically, Debt/GDP higher than 100% is a red warning for economies.

- Low or no foreign exchange reserves: Developing economies are vulnerable to capital flight since foreign exchange reserves provide a cushion against capital outflows

- High external debt: Nations are vulnerable to high external debts which may be caused by a sudden depreciation of their currency or rising foreign interest rates (due to foreign growth)

- Negative real interest rates: Lower interest rates than inflation, are not compensating lenders for holding a nation’s debt hence making nation’s currency vulnerable to capital outflows.

- A history of high inflation and negative total returns: Nations with bad history have lack of trust in value of their currency and debt

MacroVar Forex Trading Monitor

In this section we will explain how MacroVar monitors global forex markets and the factors affecting different currencies. Later sections analyze the theory and mechanics of how macroeconomics affects forex markets.

Forex Trading and Global capital flows

Profitable forex trading requires an understanding of how capital flows between low risk developed nations like the United States and emerging markets under different global economic environments. Capital flows are dependent on global economic growth, liquidity, and market risk as well factors specific to an individual nation’s economy.

Global Economic Growth

Global economic growth drives all financial markets and the forex market. Global growth is gauged by monitoring countries’ leading economic indicators. MacroVar monitors closely the four largest economies in the world (United States, Eurozone, China, Japan) comprising more than 50% of global GDP. MacroVaralso calculates Global Manufacturing PMI which is an indicator of global economic activity based on each country’s weighting to Global GDP of the 35 largest economies monitored.

Risk On vs Risk Off

When global GDP is forecast to grow, funds flow out of the US into the rest of the world looking for higher returns in foreign stock markets and bonds causing the US dollar to depreciate, Rest of the World (ROW) currencies to appreciate and vice-versa.

US Dollar

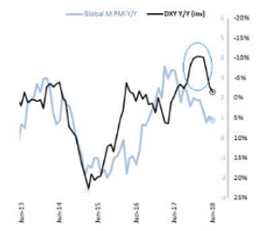

The US dollar value is gauged using the DYX index. The US Dollar is affected by the US economy and global market conditions. During global economic expansions, funds flow out of the US into emerging markets searching for higher investment returns causing the US Dollar to depreciate (learn more about the carry trade strategy). Conversely, during global economic slowdowns, global market risk is high, credit conditions are tight and funds flow into the US in search for low-risk safe assets causing the US Dollar to appreciate. Economic divergences between the US economy and the rest of the world may also cause US dollar to appreciate. When the US economy outperforms other economies, the Fed may raise short-term rates higher related to other countries causing funds to flow back to the US.

The relationship between Global economic conditions and the US Dollar is monitored by MacroVar closely and presented below.

Low-Risk Currencies

During safe weak economic growth periods or economic recessions, funds flow into the world’s safe currencies which are the Japanese Yen and Swiss Franc. These currencies are considered low-risk due to their stable financial systems, credible governments, and trade surpluses.

Emerging Market Currencies

Emerging market currencies are dependent on global economic conditions, US relative economic growth, short-term rates, and central banks’ monetary policies.

Global economic growth and loose Fed monetary policies lead to a weak US dollar and low US short-term rates, causing capital flows out of low-risk countries like the US into emerging currencies for higher investment returns and vice-versa.

MacroVar uses CEW as the benchmark for monitoring the emerging market currencies basket.

During emerging countries’ financial crisis, the country’s currency is hit hard by capital flight. The currency selloff is combined with stock weakness, bond weakness and yield curve inversion. The country experiences deteriorating economic conditions with weak business confidence and skyrocketing inflation. Read MacroVar analysis on emerging market economies and crisis.

Global Market Risk

During global economic expansions and low global market risk capital flows out of safe low-risk currencies like the US dollar, the Japanese Yen and Swiss Franc into the high return currencies of emerging market countries. MacroVar also monitors Global currencies breadth versus the US Dollar. Risk on environments coincide with global currencies breadth depreciations versus the US Dollar.

MacroVar monitors AUDJPY as an especially useful risk on / risk off indicator. Australia is a major exporter of metals to China and Japan is considered a low-risk country. During low market risk, the Australian dollar appreciates versus the Japanese Yen indicating rising industrial metals demand. Conversely, during high market risk, capital flows out of risky assets like the Australian Dollar to safe heaven currencies like the Japanese Yen.

Exchange rate versus the country’s economy

Currencies are highly correlated to the country’s economy. The country’s economy is compared with the currency’s performance using manufacturing PMI.

Currency versus Commodities

The currencies of countries which depend on heavily on producing commodities are closely correlated with the price of commodities.

Crude Oil related currencies

The Russian Rubble, Norwegian Krona, Canadian dollar depend on the price of crude oil because these countries are major crude oil producers.

Metals related currencies

The Australian Dollar is dependent on industrial metals because Australia is a major metal exporter mainly to China. Chile is a major producer and exporter of copper, hence the Chilean Peso is closely correlated with the spot price of copper.

South Africa is major producer and exporter of Gold and Platinum. Gold and Platinum are respectively 20% and 7.5% of South Africa’s exports. Hence, the South African Rand (ZARUSD) is closely correlated with the spot price of these commodities.

Currencies versus Yield differential

Currencies are highly correlated with the yield differential between the bonds of the pair’s countries. Asset monitors the yield differential between the 2-year bond rates of countries.

For example, let us examine the USDGBP in an environment where the US economy is stronger than the UK economy. During a strong US economy, the Fed raises short-term rates to keep the economy strong while controlling inflation. This causes the US 2-year bond rates to rise. At the same time, the BOE keeps short-term interest rates low to help a weak UK economy strengthen. This causes UK 2-year bond rates to stay low. Since US 2-year bond rates yield more than UK 2-year bond rates, capital flows out of GBP into the US Dollar causing the USDGBP to appreciate.

Currencies and Monetary Policy

When a country’s economy weakens, the government and central bank use fiscal policy and monetary policy tools to inject or withdraw liquidity from the country’s financial system to support the economy.

Central banks use monetary policy tools to inject liquidity. The tools used are the expansion of their balance sheets, reduction of the required reserve ratio and cutting short-term rates. Expansion monetary tools cause the country’s currency to weaken versus other countries. Read more about fiscal and monetary policy tools using our free step by step guide on forex trading

Currencies and Fiscal Policy

Countries’ policymakers use fiscal policy tools to strengthen a weakening economy. Fiscal policies may include reduction in taxes and increase in government spending through infrastructure spending. Fiscal and Monetary policy stimuli weaken the country’s currency. Read more about fiscal and monetary policy tools using our free step by step guide on Forex trading.

Currencies and Financial Markets

A country’s currency is also intricately linked with the country’s global bond markets and stocks. More specifically when funds flow in a specific country they cause the currency to appreciate. These funds are invested in the stock market and the country’s bonds causing the respective markets to rise as well.

Currencies technical analysis

MacroVar models monitor many statistics for all currencies. The most important currencies price indicators are: 1. MacroVar Trend Indicator, 2. MacroVar Momentum Indicator, 3. Year on Year momentum, 4. 3m, 5. 1m, 6. 1w

There are however two other important tools used to monitor currency risk and capital flows for a specific currency.

Geopolitics

Trade tensions between countries cause global economic slowdowns which lead to rising market risk and capital flows to low-risk countries and financial assets like the US Dollar. Moreover, sanctions or tariffs imposed by major importing countries like the United States to other countries leads to depreciation of those currencies. For example, in June of 2019 the United States increased tariffs in Mexico causing the Mexican peso to depreciate a lot.

Currency Implied Volatility

MacroVar monitors implied volatility of major currencies. Implied volatility is used as a leading indicator of the currency’s risk. Currency implied volatility indicates how much the market expects a currency pair to fluctuate. Currency implied volatility is considered a measure of market risk.

During elevated global market risk, the implied volatility of emerging currencies tends to rise a lot indicating.

Currencies Analysis

MacroVar Quantitative Signals

MacroVar models monitor different quantitative values for all currencies. The most important currencies price indicators are: 1. MacroVar Trend Indicator, 2. MacroVar Momentum Indicator, 3. Year on Year momentum, 4. 3m, 5. 1m, 6. 1w

MacroVar currencies trend indicator is compiled from signals compiles from different timeframes. Currencies trend indicator ranges from -100 to +100. A currency technical rollover is identified when MacroVar trend strength indicator moves from positive to negative. MacroVar currencies momentum indicator monitors price action for different timeframes of commodities. Momentum indicator ranges from -100 to +100.

COT Report

The COT report is published weekly (available every Friday) and provides analysis of holdings of different market participants for all major currencies monitored.

The COT report is used to monitor capital flows of currencies and detect trend continuations or reversals. A specific currency tends to reverse when the currency is overbought or oversold. COT report data are especially useful in detecting overbought and oversold market conditions.

COT Report versus US Dollar

The COT report is used by MacroVar to monitor the market’s US Dollar net positioning by calculating the average position of total Open Interest of large speculators for the following assets: EUR, GBP, CHF, JPY, CAD, AUD, NZD, MXN, RUB, BRL. Net long positioning in this indicator is interpreted as net long in the US Dollar.

COT Report and Safe Currencies

MacroVar also monitors net positions in low-risk currencies like the JPY and CHF. During high market risk environments capital flows to these currencies reporting increasing net long positions. Other safe financial assets related to the JPY, CHF are the US 10-year bond, Gold and VIX.