Mastering the Art of Stocks Trading: A Comprehensive Guide

MacroVar models analyze global stock markets by analyzing multiple macroeconomic and financial factors affecting global stock markets.

Individual stock analysis is currently outside Microvar scope. However, individual stocks are highly correlated to general stock market performance. Hence, investors should follow a top-down approach when structuring a stock portfolio by first analysing Global macroeconomic and market dynamics and then focusing on specific sectors and stocks.

Top-Down Stock Analysis

MacroVar approach in analysing stock markets starts from the global macroeconomic view, moving on to individual countries and then to individual sectors inside the stock markets.

The dynamics of each stock market is monitored in conjunction with the global market dynamics, and other markets.

Stock Factor Analysis

Stock Markets versus related markets

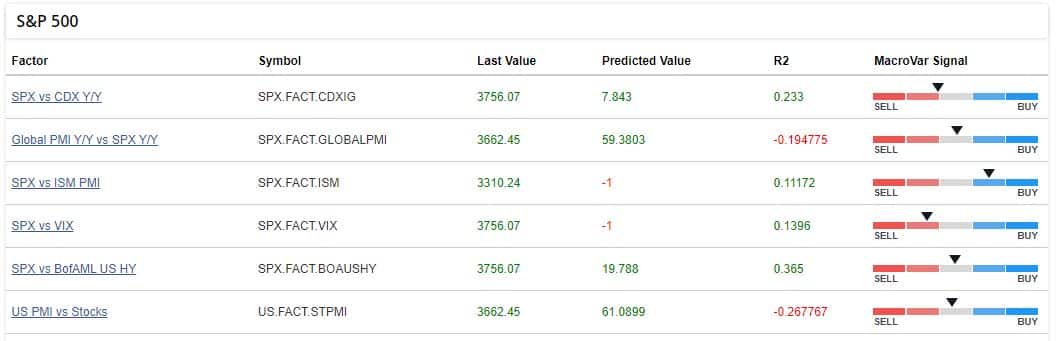

Macrovar models analyze in real-time the following relative factors which will be explained briefly in the next sections of this article.

- Stocks versus Bond Markets

- Stocks versus Credit Markets (CDS and corporate bonds)

- Stocks versus Macroeconomic PMI & ESI Surveys

- Stocks versus Credit Markets (CDS and corporate bonds)

Moreover, MacroVar monitors at least 200 factors specific to specific sectors. Some Examples are displayed below:

- Commodity related Stock Sectors versus commodities (E.g. Energy ETF sector (XLE) versus crude oil price)

- Banking related Stock Sectors vs Yield Curve dynamics (E.g. Bank ETF sector (KBE) vs US 2s10 Yield Curve)

- Real estate stock sectors vs Macroeconomic Indicators (E.g. Homebuilders ETF sector (ITB) vs Building Permits & 30-Year US Mortage Rates)

- Stock Sectors versus Macroeconomic Surveys for specific sectors (Sources: Eurostat ESI, ZEW Institute, IFO)

- Stock Seasonality

Other Factors MacroVar monitors closely are:

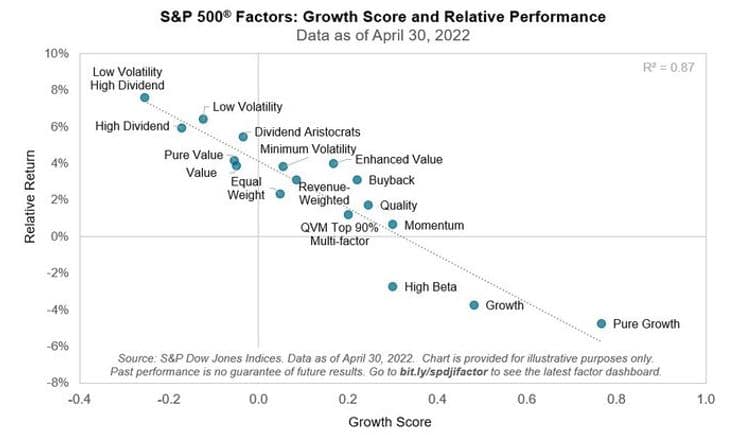

Style: Growth, Value, Momentum, Small Cap, low Volatility, High Dividend Yield

Size versus Value: Large-Cap Value vs Growth, Mid-Cap Value vs Growth, Small-Cap Value vs Growth

Stocks Market Risk

Investors need to monitor Global Market risk before deciding whether to be long, short or market neutral in a specific stock market, sector and specific stock. Moreover, Global market risk is important in defining a portfolio’s gross and net exposure The sections below briefly analyze what MacroVar models monitor to gauge Risk related to the stock market. You can monitor Global market risk conditions in the Risk Management section.

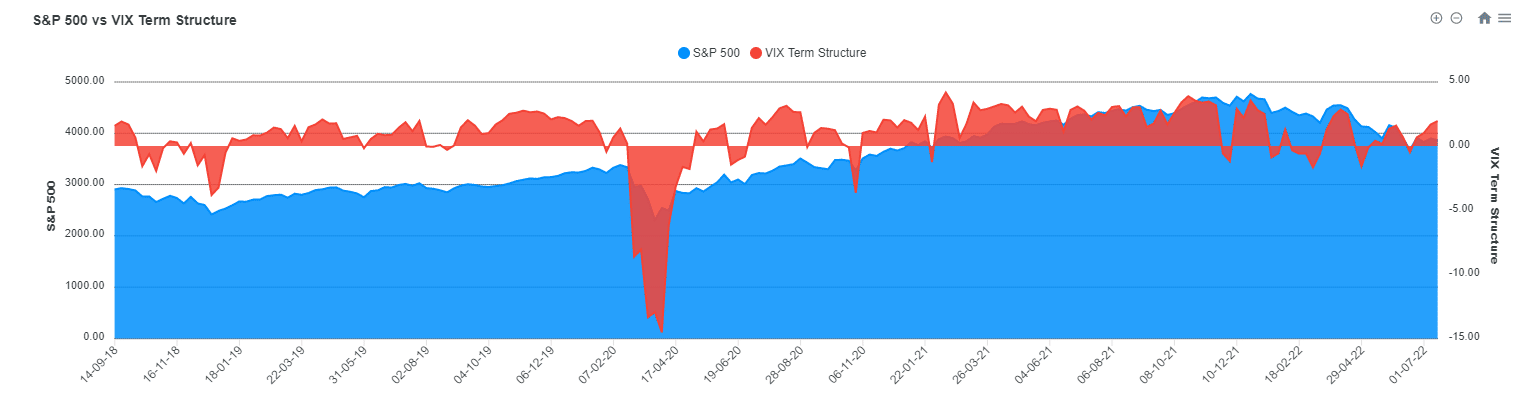

Equity Risk

MacroVar models monitor the most important indicators to gauge risk implied stock market volatility across US & European markets. The volatility index (VIX) monitors the implied volatility of the S&P 500 while the VSTOXX tracks the implied volatility of Euro Stoxx 50 stock index.

During low-risk environments, VIX, VSTOXX are low and their respective VIX futures curve are in contango. However, other factors are closely monitored to identify periods of market complacency which are often followed by market corrections. You can monitor MacroVar Volatility models in detail in the Risk Management section.

Credit Risk

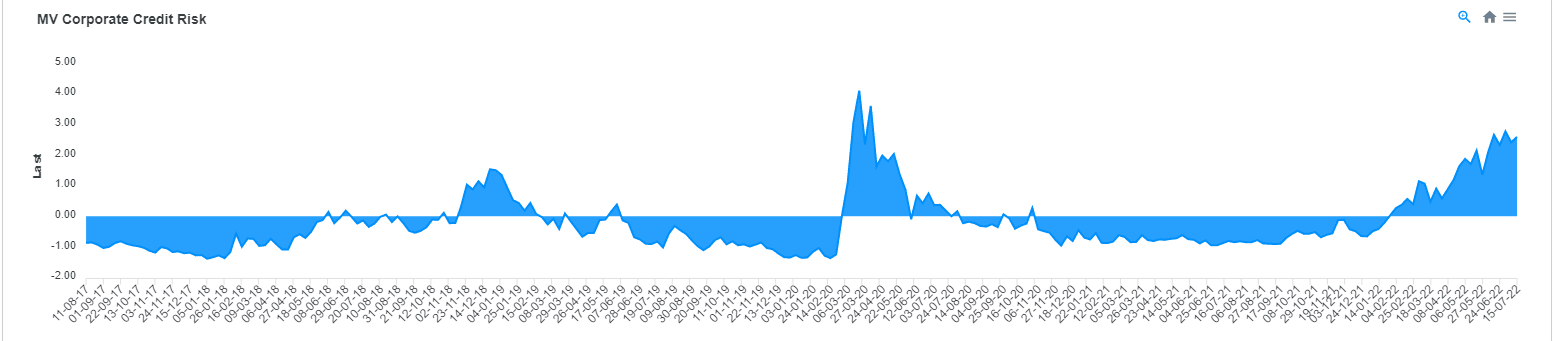

Stocks are closely correlated with corporate bonds. Bond investors are often more sophisticated than stock investors. As a result, corporate bonds performance often decouples from stocks which very often predicts a correction period for stocks.

MacroVar monitors an extensive series of Credit Default Swaps and Corporate Bond indices however the most important ones to monitor are the Markit CDX IG and HY indexes for the US, the ITRAXX IG and HY for Europe and the CDX EM for Emerging Markets.

During low-risk environments the indicators mentioned above are low. It is important to monitor the momentum of the CDS indices vs S&P 500 and the VIX components.

You can monitor MacroVar Credit models in detail in the Credit Markets and Stock Market Risk monitors and quantitative models.

Stocks vs Global Economic Growth

Manufacturing and Services PMI for all countries combined with ESI surveys for European countries only are surveys based on corporations’ expectations on how the economy is performing.

They are leading indicators of how the individual economies are performing and hence are closely correlated with stocks.

However, sometimes there is divergence between the performance of PMIs and Stock Markets, which often lead to Stock Market corrections or recoveries.

MacroVar models closely monitor the dynamics between stocks markets and these macroeconomic indicators to identify divergences. You can find these in the Stock Markets section.

Price Action

Stock Market Breadth

MacroVar analysis monitors global flows into stock markets as a whole. Hence, MacroVar monitors the Stock Market Breadth across the 35 biggest stock markets in the world as well Stock Market Breadth of the US Stock markets.

MacroVar Momentum Model (M)

Momentum trading is used to capture moves in shorter timeframes than trends. Momentum is the relative change occurring in markets. Relative change is different to a trend. A long-term trend can be up but the short-term momentum of a specific market can be 0. Learn more about Momentum Trading

If a market moves down and then moves up and then moves back down the net relative change in price is 0. That means momentum is 0. A short-term positive momentum, with a long-term downtrend results in markets with no momentum.

MacroVar Trend Model (M)

MacroVar Trend signal ranges from -100 to +100. The market trend signal is derived as the mean value from 8 calculations for each asset. Learn more about Market Trends.

You cna find more information about the difference between trend and momentum

MacroVar Bubble Risk Model (B)

MacroVar bubble model monitors a financial asset’s price relative to its 252-day moving average to identify possible inflection point. Extreme moves often followed by price reversals have a high probability of occuring when MacroVar bubble indicator is greater than 2.5 or less than -2.5. Learn more about Bubble risk model.

Fundamental Analysis

When forming a comprehensive perspective on the economy, it’s crucial to consider not just Economic Growth but also Growth and Liquidity.

But a stock must also be analysed from a fundamental perspective. Learn more about fundamental analysis

Stock Investing Strategies

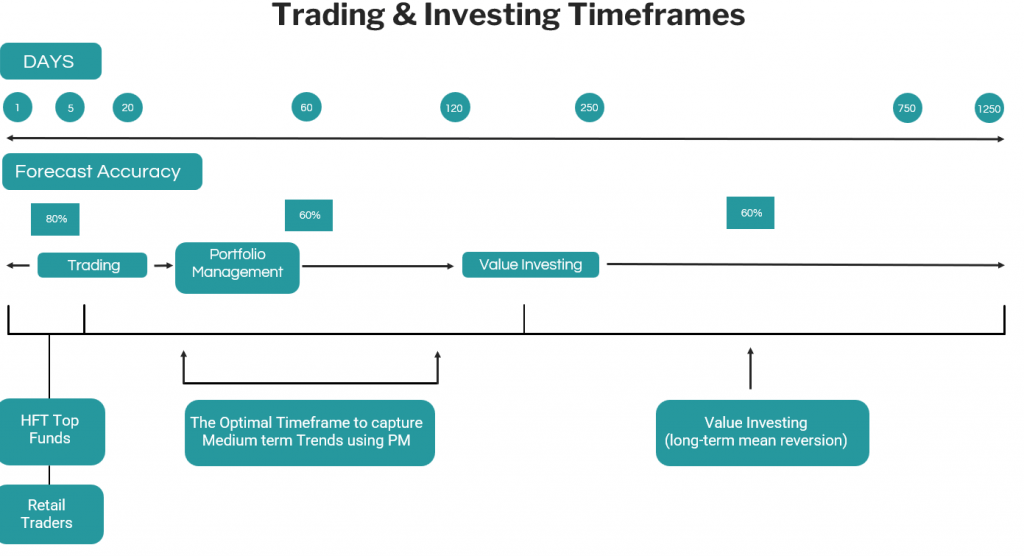

Investing in stocks can take many forms, from value investing to event-driven trading to long/short strategies. Different trading strategies can be applied to different timeframes.

The most common form of investing in stocks is investing with a timeframe of 1-3 months during low volatility periods when it has been historically proven that stocks experience momentum.

Momentum investing is short-term investing, as traders are merely looking to capture part of the price movement in a trend. It involves long and short trading.

Value investing on the other hand, is long-term investing where traders are looking to buy undervalued stocks or assets in general in speculating that stocks will revert to their fair values.

This is a brief summary of different types of investments strategies used by hedge funds.

- Long Short Equity Investment Strategies

- Long Short Value This strategy requires investing in equities the portfolio manager believes are cheap/undervalued by the market. Typically they look for equities having discounted valuation multiples or generate high free cash flow.

- Long Short Growth This investment strategy focuses on investing in companies based on growth prospects. Fund managers look at companies’ earnings growth and capital appreciation.

- Sector Focused / Niche These strategies focus on investing in specific sectors (healthcare, tech, energy and materials), geographies, or companies of certain market cpaitalization (small, medium, large cap).

- Short Funds These strategies focus on identifying companies that are overvalued based on various investment criteria including expectations, bad management, fraud etc

- Multi Strategy Long Short Equity These funds use a mix of the investment strategies described above.

- Link

- Event Driven Investment Strategies

- Activist These funds invest in the company’s equity capital to obtain board representation in order to influence specific decisions in the company’s management like asset changes, divestitures, buybacks, board modification.

- Special Situations These funds focus on investing in the equity of companies involved in some type of situation like sale, issuance or spin-off.

- Distressed These funds focus on trading corporate credit at a discount due to bankruptcy. They involve negotiations with management and creditor committees to negotiate the outcome.

- Merger Arbitrage These funds invest in equity companies undergoing some type of corporate transaction typically a merger or acquisition.

- Multi Strategy Event driven funds These funds use a mix of investment strategies described above.

- Macro Investment Strategies

- Active Trading These strategies include both systematic and discretionary approaches to investing and positioning is based on macro analysis. These strategies require rapid response to market conditions.

- Commodity trading These strategies use a mix of market data, systematic and/or technical analysis. They focus on investing in commodities like metals, agriculture, energy or some mix of these.

- Currency trading These strategies use a mix of approaches like systematic (algorithmic) or discretionary. They use a top down macro analysis and also identify trends and momentum across the asset classes monitored.

- Thematic trading These strategies use algorithms to determine a position’s size based on certain risk constraints or a discretinary approach where the management team decides portfolio positions based on top down approach.or discretionary apporach

- Multi strategy macro investing These strategies use a mix of investment strategies described above

- Relative value investment strategies

- Market Neutral Equities This strategy requires maintaining a net equity exposure from 0-10%. It also includes factor based trading strategies and statistical arbitrage. Manaers use quantitative techniques to evaluate which positions to buy and sell.

- Fixed Income Relative Value These strategies focus capturing a spread differential. They invest in different asset classes including corporate credit, sovereight debt, convertible arbitrage.

- Convertible arbitrage This investment strategy is a subset of fixed income relative value and seeks to profit from the spread between convertible and non-convertible securities of a specific issuer.

- Volatility This strategy involves investing in volatility instruments of various asset classes

- Risk Parity Investment strategies These funds are focused on risk allocation across different asset classes to manage a diversified investment portfolio based on desired level of portfolio volatility. MacroVar offers a free guide to manage your investment portfolio based on risk parity for free.

- Fund of Funds These funds invest in various other funds with uncorrelated strategies.

- Crypto and/or blockchain investing These strategies involve investing in crypto directly or by investing in crypto infrastructure plays like storage, new platforms and decentralized computing.

Long-Short Portfolio management

A popular active portfolio management strategy is long-short portfolio management.