Risk adjusted Return Definition: How to Calculate and Interpret Your Investment Performance

The risk adjusted return calculates the average return of an investment relative to the investment’s risk.

More specifically, the risk adjusted return is a ratio of an investment’s average return divided by the investment’s returns volatility. Investments with higher risk adjusted returns are preferred to investments with lower risk adjusted returns since they generate extra return for the risk taken.

The most important metric for calculating an investment’s risk adjusted return is the Sharpe ratio.

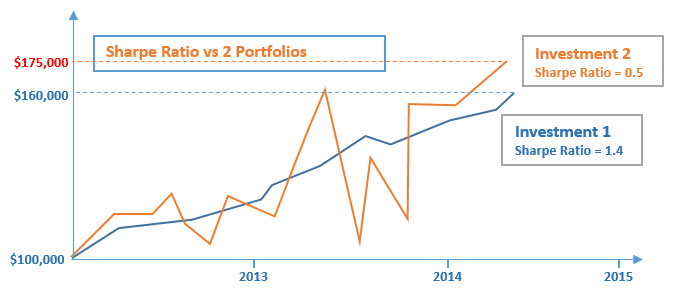

Risk adjusted return example

An investor has to choose between two investments with the investment performance displayed above. Although Investment 2 has a higher ending value than Investment 1, it has much higher volatility and drawdown than Investment 1. As a result, Investment’s 1 risk adjusted return is 3 times higher than Investment’s 2 risk adjusted return and hence for low risk investors Investment 1 is preferred.

In the example during the half of 2013 till the end of 2013 Investment 2 dropped from $160,000 to $105,000 losing 35% of its value. On the other hand, Investment 1 biggest drawdown occurred in end of 2013 losing 4.5 of its value.

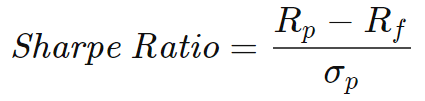

Risk Adjusted Return formula

Rp = annualized rate of return of the investment

Rf = Risk-free rate (typically the one- or two-year US Treasury rate)

σp = annualized volatility (standard deviation of the investment’s daily returns)

Sign up free to download risk adjusted return calculator.