Fundamentals of active trading

Active trading is the science of structuring a portfolio of investments to protect the capital of clients (investors) and generate steady returns in both rising and falling markets.

Active trading mission

The performance of an active trader’s strategy is measured by its Sharpe ratio which summarises in one number the trading return generated compared to the risk undertaken.

Successful active traders generate Sharpe ratios between 1.0 and 3.0 in all market environments including economic recessions and bear markets. The aim of active traders is to generate consistent adjusted returns with high Sharpe ratios, compounded over many years to generate growth and wealth creation.

If you are new to trading, check MacroVar’s guide introduction to professional trading.

Active trading principles

One of the most successful investors is Ray Dalio, founder of Bridgewater the world’s largest hedge fund ($150bln AUM). The most important principles in investing are:

- The holy grail of investing is finding 15 or more good uncorrelated return streams

- Diversification can reduce risk more than it reduces returns so it improves return-to risk ratio

- Return streams can be risk adjusted to be risk balanced

- Systematic decision making; rules should be timeless and universal

Active trading framework

Active trading should involve a thorough analysis of top-down global macroeconomic conditions combined with bottom-up fundamental analysis of individual assets selected in a portfolio.

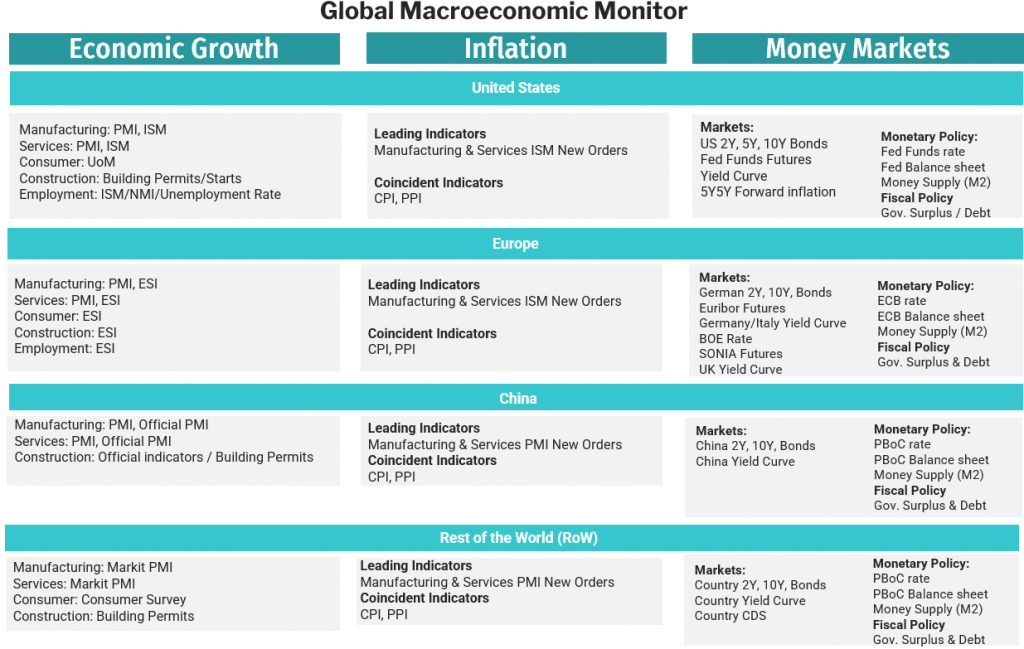

Macroeconomic analysis

Global markets are closely correlated with global economic growth. A country’s economic growth is defined by the country’s GDP which is the total income of a country in given year (GDP definition).

Historically, GDP explain 70% of the stock market moves across countries globally. When GDP and stock markets are disconnected, it is because markets are in profit taking or price correction mode while economic growth (GDP) is still in effect. Moreover, historically expansions last longer than contractions, but contractions tend to be much sharper and larger in magnitude.

The Global Economy section presents the current global macroeconomic conditions using different statistics. The largest four economies in the world closely monitored are the US, Eurozone, China and Japan economies comprising more than 50% of Global GDP. MacroVar also monitors the relative performance of Developed and Emerging economies.

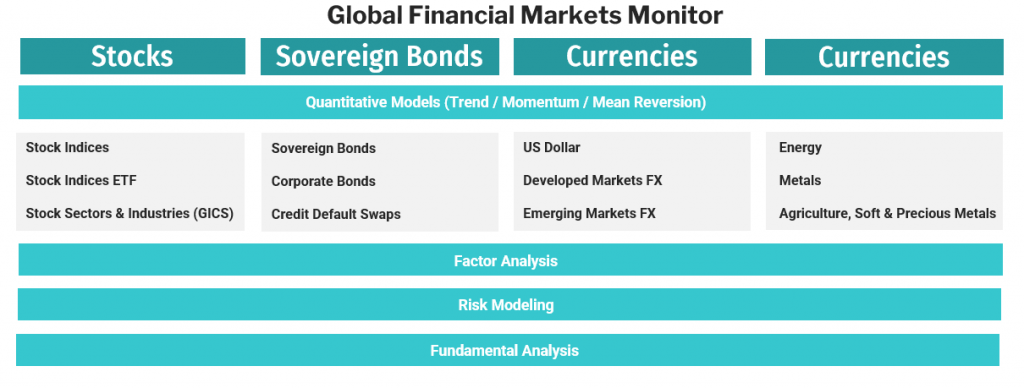

Markets Dashboard

MacroVar models monitor all the major Global financial markets and the factors affecting them. Monitor real-time World Markets.

Financial Assets Logic

The basic logic on how financial assets behaves during different economic conditions is provided below. There are periods where correlations between financial assets breakdown and where economic data are disconnected from financial markets but the core market logic is described below.

There are two market environments: Risk On periods during which funds flow from safe assets to risky assets and Risk Off periods where funds flow from risky assets to low-risk assets.

Risk Assets (Risk-On): Stocks, Cyclical Commodities, Cyclical Sectors / Industries, High Yield Bonds, Cyclical Currencies, Emerging Markets (Capital flows to emerging markets in search for higher yields, higher growth rates and hence profits)

Safe Assets (Risk-Off): US Treasuries, German Bunds, Defensive Sectors / Industries, US Dollar DXY, Swiss Franc, Japanese Yen, Gold

The most important asset correlation is between the US stocks and US Bonds. During risk on periods US stocks rise while US bonds are sold and vice-versa. Since equities are closely linked with credit, MacroVar monitors closely the performance of corporate bonds for each sector in US and EU markets.

During Risk on Periods the markets behave as follows:

- Global Risk

- Equity Risk (VIX, VSTOXX): falling

- Credit Risk (CDX IG, ITRAXX IG, BofA High Yield credit spreads): falling

- Volatility Term Structure: steep contango

- MacroVar Risk Index: falling

- MacroVar Risk On/Off monitor Ratios: falling

- Stocks

- Global Stocks rising (ideally this should occur with global bond market weakness)

- US Stock Breadth rising

- Emerging Market Stocks rising (often outperforming developed markets like US & EU)

- Global Stock Breadth rising

- Stock Sectors

- Cyclical sectors outperform Defensive sectors

- Sector breadth rising

- Bonds (MacroVar monitors 2-year, 5-year and 10-year bonds)

- Safe Bonds

- US Treasuries falling (yields rising)

- German Bunds falling (yields rising)

- Risky Bonds

- US High Yield Bonds rising (yields falling)

- Europe: Club Med Bonds rising (yields falling)

- Emerging Markets Bonds rising (yields falling)

- Bond interest rates breadth rising (funds move out of bonds into stocks hence yield rates rise)

- Safe Bonds

- Yield Curve

- Yield Curve Bear steepening (on the contrary a Yield Curve bull re-steepening signifies Risk Off environment)

- Fed Funds futures above US 2-year bonds implying strong economic growth and FED hawkish stance

- Yield Curve Steepening Breadth rising

- Eurodollar Futures rising

- Currencies

- US Dollar (DXY) falling

- Safe Currencies (JPY, CHF) falling

- Risky Currencies (AUD, NZD, CAD) rising

- Currencies Breadth (vs the US Dollar) rising

- Commodities

- Energy (Crude Oil) rising

- Metals (Copper) rising

- Safe commodities (Gold) falling

- Commodities Breadth rising

- Macroeconomic Conditions

- Global PMI trend and momentum rising

- Global PMI breadth monitored strong

Risk Management

Successful trading requires adjusting the portfolio based on current global financial risk conditions. When global financial risk is low, trading portfolio should be structured to trade growth assets (stocks, commodities, currencies). Conversely, when global financial risk is high trading portfolio must be shifted towards safe investments such as cash, bonds, gold and safe currencies like the CHF.

MacroVar has developed risk management models which monitors global financial risk conditions and automatically updates users on global financial risk conditions.

The major risk components monitored by MacroVar are:

- Equity Risk

- Credit Risk

- Liquidity Risk

- Corporate Credit Risk

- Emerging Market Risk

- Global Bank Risk

- Sovereign Risk

- Currencies Risk

- Commodities Risk

Monitor real-time global risk conditions

Portfolio Management

Professional Portfolio Management requires a systematic investment process to achieve the following targets:

| Protect capital by controlling the portfolio’s risk (hedged portfolio) |

| Generate Consistent & Smooth compounded risk-adjusted returns irrespective of the general market trend |

There are different investment strategies to achieve this either systematic (using software models) or discretionary. Irrespective of the investment strategy followed, any investment strategy should be based on the following core principles. Explore portfolio management.

Trading Idea generation

Professional portfolio management requires structuring a diversified portfolio of 15 or more uncorrelated trading positions.

Learn more on trading idea generation

Tradable Assets

MacroVar provides Investment Research for trading major asset classes. Click on any asset class below to learn more about asset specific trading framework.

Next step

Let’s move now to the first step which is top-down macroeconomic analysis.