Netherlands Economy & Netherlands Markets Data analytics

MacroVar monitors real-time economic, financial and geopolitical developments for the Netherlands economy and Netherlands markets by analyzing financial, economic data and real-time news using statistical models. To help you forecast and analyze economic and financial developments, our team provides you with explanations of the theory and structure of our models and access to financial and economic data.

Netherlands Overview presents the current trends and dynamics of the major Netherlands financial markets and economic indicators. Select Details to get more information for each indicator, use Factors to monitor current statistical analysis of financial & economic factors affecting the specific asset, and select research to read the latest MacroVar research for the specific asset/indicator.

| Price | 1D% | M | T | B | Factors | Research | Details | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

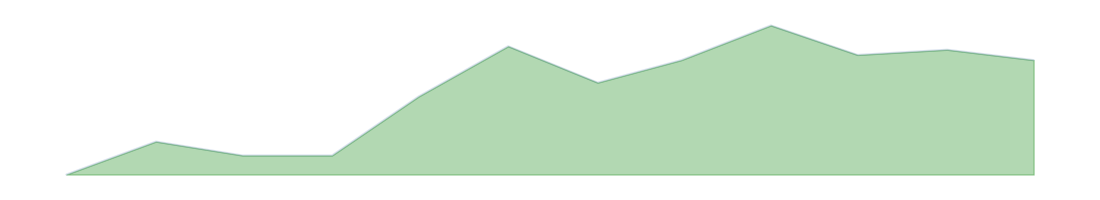

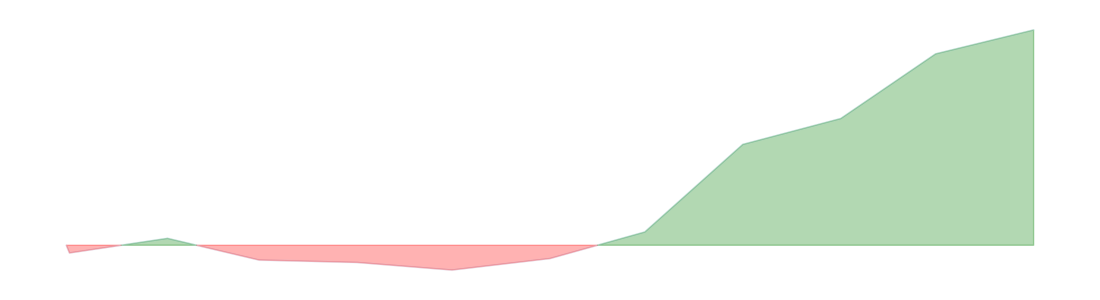

| AEX | 939.62 | 0.96 | 0.01 | 20.63 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Netherlands 2-year bond yield | 2.88 | -2.04 | -0.03 | -9.47 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Netherlands 10-Year Bond Yield | 2.82 | -0.11 | 0 | 1.11 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Manufacturing PMI | 50.7 | -3 | -3 | 16 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| ESI - Economic Composite | 99.4 | 0 | 1 | 4 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Price | 1D% | M | T | B | Factors | Research | Details | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AEX | 939.62 | 0.96 | 0.01 | 20.63 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Netherlands ETF | 52.26 | 1.73 | 0 | 22.1 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

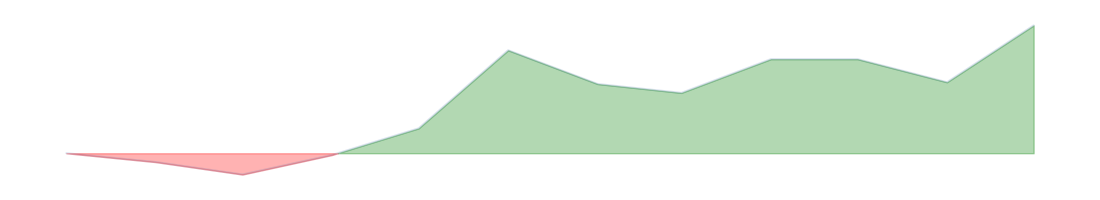

| Netherlands 2-year bond yield | 2.88 | -2.04 | -0.03 | -9.47 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

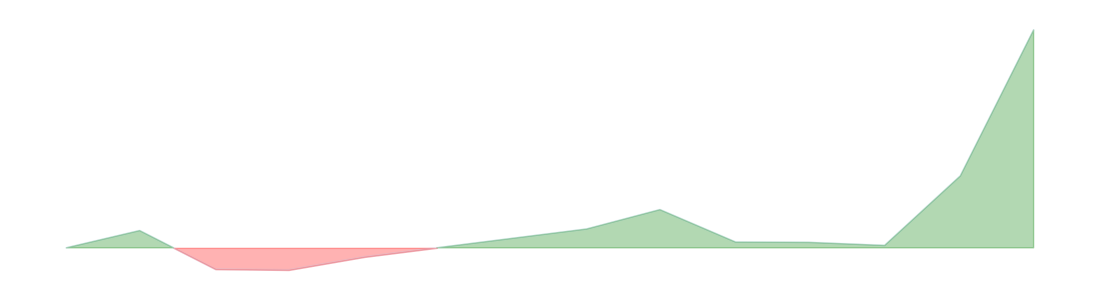

| Netherlands 10-Year Bond Yield | 2.82 | -0.11 | 0 | 1.11 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

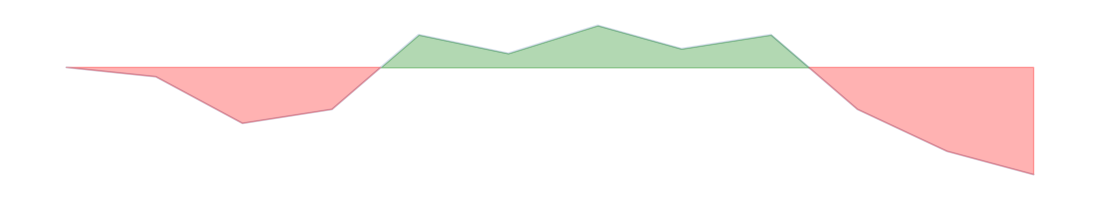

| Netherlands Yield Curve | -0.05 | -21.21 | -0.31 | -61.77 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

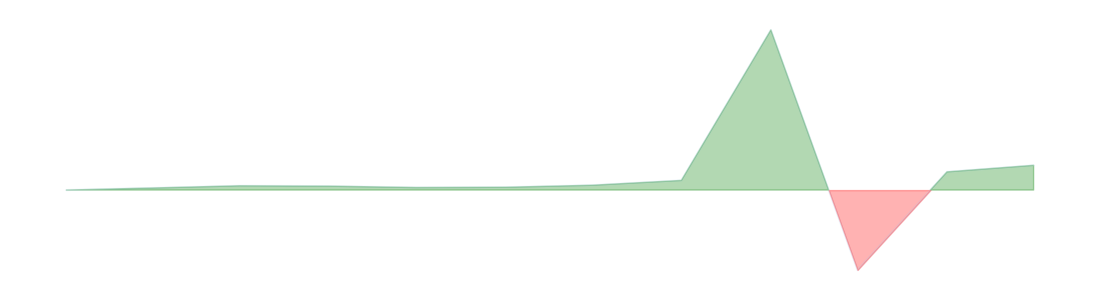

| Netherlands Credit Default Swaps | 9.5 | -8.97 | -0.17 | -23.78 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Price | 1D% | M | T | B | Factors | Research | Details | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ESI - Economic Composite | 99.4 | 0 | 1 | 4 | |||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| Manufacturing PMI | 50.7 | -3 | -3 | 16 | |||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| GDP Growth (annual) | -0.7 | 75 | 75 | -107 | |||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| Inflation CPI | 3.2 | 19 | 19 | -30 | |||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| Unemployment rate | 3.6 | 0 | 0 | 3 | |||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||

| Price | 1D% | M | T | B | Factors | Research | Details | ||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AEX | 939.62 | 0.96 | 0.01 | 20.63 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Netherlands 2-year bond yield | 2.88 | -2.04 | -0.03 | -9.47 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Netherlands 10-Year Bond Yield | 2.82 | -0.11 | 0 | 1.11 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| Netherlands Credit Default Swaps | 9.5 | -8.97 | -0.17 | -23.78 | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||

Netherlands Market News

| Time | Headlines | |

|---|---|---|

| 2024-07-04 08:44 | German Industrial Orders MoM Actual -1.6% (Forecast 0.5%, Previous -0.2%) | |

| 2024-07-02 05:40 | Treasuries Are Hit as US election risks come into focus - US Market Wrap | |

| 2024-07-02 05:40 | ECB's President Lagarde: It will take time to be certain that inflation is on track. | |

| 2024-07-02 05:40 | ECB's President Lagarde: A strong labour market means we have time to gather information. | |

| 2024-07-02 05:40 | ECB's President Lagarde: The strong labor market allows the ECB to gather enough data. | |

| 2024-07-02 05:40 | ECB's President Lagarde: A soft landing for the euro zone economy is not guaranteed. | |

| 2024-07-02 05:40 | ECB's Wunsch: I would need convincing to cut more than twice this year. | |

| 2024-07-02 05:40 | ECB's Wunsch: We would need convincing to cut more than twice this year. | |

| 2024-07-02 05:40 | ECB's Wunsch: Market pricing on the ECB rate path looks reasonable. | |

| 2024-07-02 05:40 | ECB's Simkus: We shouldn't limit rate moves to projection meetings. | |

Netherlands Economic Sectors

MacroVar analyzes in detail the dynamics of the Netherlands economy by economic sector and subsector based on data obtained from Eurostat. MacroVar presents for free current dynamics of Netherlands economic sectors.

| Sectors | Last | Previous | Trend | Momentum | Trend | MoM% | QoQ% | YoY% |

|---|---|---|---|---|---|---|---|---|

| General Economic Conditions | 99.9 | 99.4 |  | 1 | 2 | 6 | ||

| Manufacturing sector | -2.3 | -2.3 |  | 0 | -47 | 10 | ||

| Services sector | 6.5 | 5.7 |  | 14 | 16 | 51 | ||

| Retail sector | -3.9 | -0.9 |  | 333 | 225 | -139 | ||

| Consumer sector | -12.1 | -11.5 |  | 5 | 20 | -37 | ||

| Construction sector | 9.8 | 6.6 |  | 48 | 24 | 308 | ||

| Employment dynamics | 101.1 | 101.6 |  | -0 | -3 | -1 |

Netherlands's detailed economic sector analysis by subsectors and industries is only available to Premium users.

Upgrade your membership to get access

Upgrade your membership to get access

Check Subsector analysis details

Netherlands Economic Overview

Netherlands economic overview presents a snapshot of US current economic conditions. You can find details for the Netherlands economy subsections by exploring the sections below.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| ESI - Economic Composite | nl.esi.conf | 99.9 | 99.4 | 1 | 6 | UP | UP |

| Industrial New Orders | nl.man.orders | -8.8 | -9.1 | -3 | 389 | Down | Down |

| Industrial Prices | nl.man.priceexp | 9.3 | 7.6 | 22 | -8 | UP | Down |

| Manufacturing PMI | nl.manpmi | 50.7 | 52.5 | -3 | 16 | UP | UP |

| Industrial Confidence | nl.esi.man | -2.3 | -2.3 | 0 | 10 | UP | Down |

| Services Confidence | nl.esi.serv | 6.5 | 5.7 | 14 | 51 | UP | UP |

| Consumer Confidence | nl.esi.cons | -12.1 | -11.5 | 5 | -37 | UP | UP |

| Retail Confidence | nl.esi.ret | -3.9 | -0.9 | 333 | -139 | Down | Down |

| Construction Confidence | nl.constr.conf | 9.8 | 6.6 | 48 | 308 | UP | UP |

Netherlands Manufacturing

MacroVar tracks hundreds of indicators related to Netherlands manufacturing sector.

| 1Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| Manufacturing PMI | nl.manpmi | 50.7 | 52.5 | -3 | 16 | UP | UP |

| industrial production | nl.indproduction | -1.2 | -1.4 | -14 | -20 | UP | UP |

Netherlands consumer sentiment

Consumer spending makes a large part of the Netherlands Economy.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| consumer confidence | nl.consconfidence | -24.0 | -23s | 4 | -38 | UP | UP |

| Consumer Confidence | nl.esi.cons | -12.1 | -11.5s | 5 | -37 | UP | UP |

| Employment Dynamics | nl.eei.emp | 101.1 | 101.6s | -0 | -1 | Down | Down |

| unemployment rate | nl.unemploymentrate | 3.6 | 3.6s | 0 | 3 | Down | UP |

| retail sales | nl.retailsalesan | 2.9 | 2.2s | 32 | -42 | Down | Down |

| retail sales MoM | nl.retailsales | 0.8 | -0.9s | -189 | 100 | UP | UP |

| car registrations | nl.carregistrations | 35386.0 | 28361s | 25 | -14 | UP | Down |

| building permits | nl.buildingpermits | 6858.0 | 6627s | 3 | 85 | UP | UP |

Netherlands Construction

The Netherlands construction sector is a significant component of the Netherlands economy. MacroVar monitors leading indicators of construction activity like building permits and new home sales.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| building permits | nl.buildingpermits | 6858.0 | 6627 | 3 | 85 | UP | UP |

Netherlands Macroeconomic outlook

Netherlands Macroeconomic outlook presents an overview of the long-term fundamental coincident factors of the Netherlands economy. Components monitored are the country's rserves, debt, Monetary Policy and Fiscal Policy. Explore Netherlands macroeconomic model in detail.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| gdp | nl.gdp | 1118.13 | 991.11 | 13 | 24 | UP | UP |

| Real GDP | nl.realgdp | 201663.0 | 201880 | -0 | 10 | UP | UP |

| gdp growth annual | nl.gdpgrowthan | -0.7 | -0.4 | 75 | -107 | Down | Down |

| gdp growth | nl.gdpgrowth | -0.1 | 0.4 | -125 | -103 | Down | Down |

| inflation cpi | nl.inflationcpi | 3.2 | 2.7 | 19 | -30 | UP | Down |

| interest rate | nl.interestrate | 4.5 | 4.5 | 0 | 8900 | UP | UP |

| unemployment rate | nl.unemploymentrate | 3.6 | 3.6 | 0 | 3 | Down | UP |

| government debt | nl.govdebt | 480671.0 | 466907 | 3 | 6 | UP | UP |

| external debt | nl.externaldebt | 3950234.0 | 3865000 | 2 | 10 | UP | UP |

| government debt to gdp | nl.govdebtgdp | 46.8 | 50.1 | -7 | -24 | Down | Down |

| current account | nl.currentaccount | 28259.0 | 33190 | -15 | 21 | UP | UP |

| current account to gdp | nl.currentaccountgdp | 10.2 | 6.9 | 48 | 0 | UP | Down |

| exports | nl.exports | 70700.0 | 71035 | -0 | 1 | UP | UP |

| imports | nl.imports | 59055.0 | 58086 | 2 | -3 | UP | Down |

| foreign exchange reserves | nl.fxreserves | 69546.0 | 68986 | 1 | 11 | UP | UP |

| gold reserves | nl.goldres | 612.45 | 612.45 | 0 | 0 | Down | Down |

| government revenues | nl.govrev | 39.4 | 34.4 | 15 | -36 | Down | Down |

| fiscal expenditure | nl.fiscalexp | 37.8 | 32.9 | 15 | -54 | Down | Down |

Netherlands Inflation

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend |

|---|---|---|---|---|---|---|

| inflation cpi | nl.inflationcpi | 3.2 | 2.7 | 19 | -30 |  |

| core inflation rate | nl.coreinflationrate | 2.6 | 2.5 | 4 | -57 |  |

| Produce Prices YoY | nl.producerpricesch | 0.4 | -0.1 | -500 | -79 |  |

Netherlands Employment

MacroVar monitors leading indicators (ESI employment activity) and lagging indicators of Netherlands employment. Netherlands employment is one of the major factors affecting ECB monetary policy.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| unemployment rate | nl.unemploymentrate | 3.6 | 3.6 | 0 | 3 | Down | UP |

Netherlands Monetary Policy

Netherlands Monetary policy is monitored by tracking the most important indicators related to the central bank's balance sheet and interest rates.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| interest rate | nl.interestrate | 4.5 | 4.5 | 0 | 8900 | UP | UP |

| central bank balance sheet | nl.cb.assets | 423681.0 | 426019 | -1 | -27 | Down | Down |

| banks balance sheet | nl.banks.bs | 2873717.0 | 2850600 | 1 | -4 | Down | Down |

| money supply m1 | nl.msm1 | 508231.0 | 514318 | -1 | -12 | Down | Down |

| money supply m2 | nl.msm2 | 1102753.0 | 1109080 | -1 | -2 | Down | Down |

| government debt to gdp | nl.govdebtgdp | 46.8 | 50.1 | -7 | -24 | Down | Down |

| loans to private sector | nl.loanprivate | 305487.0 | 304153 | 0 | 2 | UP | UP |

| Netherlands Credit Rating (S&P) | RATING.S&P.NL | ||||||

| Netherlands Credit Rating (Moody's) | RATING.MOODYS.NL | ||||||

| Netherlands Credit Rating (Fitch) | RATING.FITCH.NL |

Netherlands Fiscal Policy

Netherlands Fiscal policy is monitored by tracking the most important indicators related to the Treasury's decisions on government spending, revenues and budget surplus/deficit.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| government revenues | nl.govrev | 39.4 | 34.4 | 15 | -36 | Down | Down |

| fiscal expenditure | nl.fiscalexp | 37.8 | 32.9 | 15 | -54 | Down | Down |

| government budget | nl.govbudget | -0.9 | -0.1 | 800 | -80 | UP | UP |

| Government budget | nl.govbudgetvalue | 1.6 | 1.5 | 7 | -108 | UP | UP |

| government debt | nl.govdebt | 480671.0 | 466907 | 3 | 6 | UP | UP |

| government debt to gdp | nl.govdebtgdp | 46.8 | 50.1 | -7 | -24 | Down | Down |

Netherlands Trade

Netherlands trade activity is monitored by tracking Trade and Capital flows.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| current account | nl.currentaccount | 28259.0 | 33190 | -15 | 21 | UP | UP |

| current account to gdp | nl.currentaccountgdp | 10.2 | 6.9 | 48 | 0 | UP | Down |

| balance of trade | nl.balanceoftrade | 11645.0 | 12948 | -10 | 16 | Down | UP |

| imports | nl.imports | 59055.0 | 58086 | 2 | -3 | UP | Down |

| exports | nl.exports | 70700.0 | 71035 | -0 | 1 | UP | UP |

| capital flows | nl.capitalflows | 32547.0 | 21166 | 54 | 53 | Down | UP |

| foreign direct investment | nl.fdi | 13485.0 | -297017 | -105 | 65 | UP | UP |

| external debt | nl.externaldebt | 3950234.0 | 3865000 | 2 | 10 | UP | UP |

| foreign exchange reserves | nl.fxreserves | 69546.0 | 68986 | 1 | 11 | UP | UP |

| gold reserves | nl.goldres | 612.45 | 612.45 | 0 | 0 | Down | Down |