Philippines Economy & Philippines Markets Data analytics

MacroVar monitors real-time economic, financial and geopolitical developments for the Philippines economy and Philippines markets by analyzing financial, economic data and real-time news using statistical models. To help you forecast and analyze economic and financial developments, our team provides you with explanations of the theory and structure of our models and access to financial and economic data.

Philippines Overview

Philippines Overview presents the current trends and dynamics of the major Philippines financial markets and economic indicators. Select Details to get more information for each indicator, use Factors to monitor current statistical analysis of financial & economic factors affecting the specific asset, and select research to read the latest MacroVar research for the specific asset/indicator.

| Price | 1D% | M | T | B | Details | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PSI Composite | 6062.1 | -0.94 | -0.05 | -11.5 | ||||||||||

|

||||||||||||||

| Philippines 2-year bond yield | 5.79 | 1.1 | 0.03 | -7.13 | ||||||||||

|

||||||||||||||

| Philippines 10-Year Bond Yield | 6.19 | 0.7 | -0 | -4.21 | ||||||||||

|

||||||||||||||

| Philippine peso US Dollar (PHP/USD) | 58.02 | -0.16 | -0.01 | 3.68 | ||||||||||

|

||||||||||||||

| Manufacturing PMI | 54.3 | 1 | 1 | 5 | ||||||||||

|

||||||||||||||

| Price | 1D% | M | T | B | Details | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PSI Composite | 6062.1 | -0.94 | -0.05 | -11.5 | ||||||||||

|

||||||||||||||

| Philippines ETF | 24.37 | 0.29 | -0.02 | -11.77 | ||||||||||

|

||||||||||||||

| Philippines 2-year bond yield | 5.79 | 1.1 | 0.03 | -7.13 | ||||||||||

|

||||||||||||||

| Philippines 10-Year Bond Yield | 6.19 | 0.7 | -0 | -4.21 | ||||||||||

|

||||||||||||||

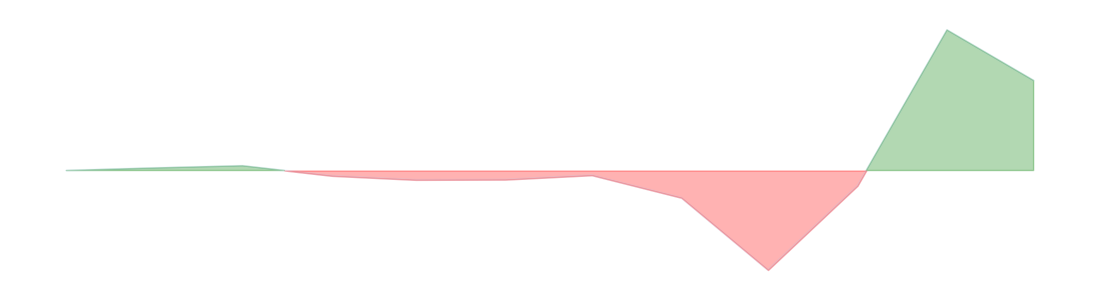

| Philippines Yield Curve | 0.4 | -4.74 | -0.31 | 79.46 | ||||||||||

|

||||||||||||||

| Philippine peso US Dollar (PHP/USD) | 58.02 | -0.16 | -0.01 | 3.68 | ||||||||||

|

||||||||||||||

| Philippines Credit Default Swaps | 71.38 | 3.44 | 0.14 | 14.66 | ||||||||||

|

||||||||||||||

| Price | 1D% | M | T | B | Details | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Manufacturing PMI | 54.3 | 1 | 1 | 5 | ||||||||||

|

||||||||||||||

| GDP Growth (annual) | 5.2 | -19 | -19 | -26 | ||||||||||

|

||||||||||||||

| Inflation CPI | 2.9 | 16 | 16 | -26 | ||||||||||

|

||||||||||||||

| Unemployment rate | 3.1 | -3 | -3 | -31 | ||||||||||

|

||||||||||||||

| Price | 1D% | M | T | B | Details | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PSI Composite | 6062.1 | -0.94 | -0.05 | -11.5 | ||||||||||

|

||||||||||||||

| Philippines 2-year bond yield | 5.79 | 1.1 | 0.03 | -7.13 | ||||||||||

|

||||||||||||||

| Philippines 10-Year Bond Yield | 6.19 | 0.7 | -0 | -4.21 | ||||||||||

|

||||||||||||||

| Philippine peso US Dollar (PHP/USD) | 58.02 | -0.16 | -0.01 | 3.68 | ||||||||||

|

||||||||||||||

| Philippines Credit Default Swaps | 71.38 | 3.44 | 0.14 | 14.66 | ||||||||||

|

||||||||||||||

Philippines Economic Calendar

Economic calendar presents real-time updates for actual, forecasts and consensus values of economic indicators and updates related to the United States economy.

| Time | Imp | Event | Country | Actual | Previous | Forecast |

|---|---|---|---|---|---|---|

| 23/02 21:45 | retail sales mom | New Zealand | -0.1% | 0.5% | ||

| 23/02 21:45 | retail sales yoy | New Zealand | -2.5% | 1.8% | ||

| 24/02 00:00 | current account | Peru | $ 1.2B | |||

| 24/02 05:00 | core inflation rate | Singapore | 1.8% | 2.0% | ||

| 24/02 05:00 | inflation rate | Singapore | 1.6% | 2.1% | ||

| 24/02 07:00 | business confidence | Turkey | 100.9 | |||

| 24/02 07:00 | capacity utilization | Turkey | 74.6% | |||

| 24/02 08:00 | inflation rate | Austria | 2% | 3.3% | ||

| 24/02 08:20 | money supply m2 | Taiwan | 5.51% | |||

| 24/02 09:00 | business confidence | Germany | 85.1 | |||

| 24/02 09:00 | ifo current conditions | Germany | 86.1 | |||

| 24/02 09:00 | retail sales yoy | Poland | 1.9% | |||

| 24/02 09:00 | unemployment rate | Poland | 5.1% | 5.4% | ||

| 24/02 09:30 | business confidence | Slovenia | -7 | |||

| 24/02 10:00 | inflation rate | Croatia | 3.4% | 4.0% | ||

| 24/02 10:00 | consumer price index cpi | Eurozone | 127.07 | 126.71 | ||

| 24/02 10:00 | core inflation rate | Eurozone | 2.7% | 2.7% | ||

| 24/02 10:00 | inflation rate | Eurozone | 2.4% | 2.5% | ||

| 24/02 10:00 | interest rate | |||||

| 24/02 10:00 | inflation rate | Malta | ||||

| 24/02 11:00 | interest rate | |||||

| 24/02 11:00 | unemployment rate | Latvia | 6.7% | 6.60% | ||

| 24/02 12:00 | producer prices change | Chile | 11.2% | |||

| 24/02 13:00 | money supply m3 | Poland | 9.3% | |||

| 24/02 14:00 | business confidence | Belgium | -13.6 | |||

| 24/02 15:30 | dallas fed manufacturing index | United States | 14.1 | |||

| 25/02 03:30 | balance of trade | Thailand | $-0.01B | $-3.1B | ||

| 25/02 06:00 | unemployment rate | Finland | 8.1% | 8.4% | ||

| 25/02 07:00 | gdp growth rate | Germany | 0.1% | -0.2% | ||

| 25/02 07:00 | gdp annual growth rate | Germany | -0.3% | -0.2% | ||

| 25/02 08:00 | producer prices change | Czech Republic | 2.8% | |||

| 25/02 08:00 | industrial production | Taiwan | ||||

| 25/02 08:00 | retail sales yoy | Taiwan | 2.9% | |||

| 25/02 08:30 | balance of trade | Hong Kong | H$-34.5B | H$7.0B | ||

| 25/02 10:00 | interest rate | |||||

| 25/02 11:00 | balance of trade | Luxembourg | €-0.74B | €-0.7B | ||

| 25/02 15:00 | current account | Mexico | $733M | $ 7500M | ||

| 25/02 15:00 | richmond fed manufacturing index | United States | -4 | |||

| 25/02 15:00 | richmond fed services index | United States | ||||

| 25/02 18:00 | money supply m2 | United States | $21.53T | |||

| 26/02 00:00 | total vehicle sales | Thailand | -20.94% | |||

| 26/02 00:00 | building permits | United States | 1.482M | |||

| 26/02 03:01 | consumer confidence | Ireland | 74.9 | 75.1 | ||

| 26/02 05:00 | industrial production | Singapore | 10.6% | 8.9% | ||

| 26/02 05:00 | industrial production mom | Singapore | -0.7% | 0.4% | ||

| 26/02 06:00 | producer prices change | Finland | -0.8% | -0.2% | ||

| 26/02 07:00 | consumer confidence | Germany | -22.4 | -10 | ||

| 26/02 07:00 | loan growth | Norway | 3.3% | 3.1% | ||

| 26/02 07:00 | producer prices change | Sweden | 2% | 1.8% | ||

| 26/02 07:30 | balance of trade | Hungary | €819M | |||

| 26/02 07:45 | consumer confidence | France | 92 | |||

| 26/02 08:00 | producer prices change | Spain | 2.3% | 2.7% | ||

| 26/02 08:00 | unemployment rate | Taiwan | 3.39% | |||

| 26/02 08:30 | gdp growth rate | Hong Kong | -0.1% | 0.8% | ||

| 26/02 08:30 | gdp annual growth rate | Hong Kong | 1.9% | 2.4% | ||

| 26/02 08:30 | gdp annual growth rate | Taiwan | 4.17% | 2.8% | ||

| 26/02 09:00 | manufacturing pmi | Austria | 45.7 | 46.5 | ||

| 26/02 12:00 | mortgage rate | United States | ||||

| 26/02 15:00 | new home sales | United States | 0.698M | |||

| 26/02 16:00 | industrial production | Russia | ||||

| 26/02 19:00 | retail sales yoy | Argentina | 134.8% | 110.0% | ||

| 27/02 00:00 | business confidence | New Zealand | 54.4 | |||

| 27/02 00:00 | consumer confidence | Norway | -14.40 | -14 | ||

| 27/02 02:00 | consumer confidence | Taiwan | 72.54 | |||

| 27/02 04:00 | producer prices change | Malaysia | 0.5% | 0.7% | ||

| 27/02 05:30 | business confidence | Netherlands | -1.6 | |||

| 27/02 06:00 | business confidence | Finland | -7 | -8 | ||

| 27/02 06:00 | consumer confidence | Finland | -8.4 | -8 | ||

| 27/02 07:00 | retail sales mom | Denmark | 0.1% | 0.4% | ||

| 27/02 07:00 | retail sales yoy | Denmark | 1.5% | 1.9% | ||

| 27/02 07:00 | unemployment rate | Norway | 4.2% | 4.2% | ||

| 27/02 07:00 | loan growth | Sweden | 1.6% | 1.7% | ||

| 27/02 07:00 | balance of trade | Turkey | $-8.78B | |||

| 27/02 07:00 | exports | Turkey | $23.44B | |||

| 27/02 07:00 | imports | Turkey | $32.22B | |||

| 27/02 07:30 | unemployment rate | Hungary | 4.4% | |||

| 27/02 07:45 | producer prices change | France | -3.8% | -2.4% | ||

| 27/02 08:00 | business confidence | Slovakia | -1 | |||

| 27/02 08:00 | consumer confidence | Slovakia | -23.4 | |||

| 27/02 08:00 | core inflation rate | Spain | 2.4% | |||

| 27/02 08:00 | inflation rate | Spain | 2.9% | |||

| 27/02 08:00 | business confidence | Sweden | 101.1 | 100.5 | ||

| 27/02 08:00 | consumer confidence | Sweden | 99.1 | 98.5 | ||

| 27/02 08:00 | gdp growth rate | Switzerland | 0.4% | 0.3% | ||

| 27/02 08:00 | gdp annual growth rate | Switzerland | 2% | 1.1% | ||

| 27/02 09:00 | loan growth | Eurozone | 1.1% | 1.2% | ||

| 27/02 09:00 | loans to private sector | Eurozone | 1.5% | |||

| 27/02 09:00 | money supply m3 | Eurozone | 3.5% | |||

| 27/02 09:00 | gdp growth rate | Poland | -0.1% | 1.3% | ||

| 27/02 09:00 | gdp annual growth rate | Poland | 2.7% | 3.2% | ||

| 27/02 09:30 | business confidence | Portugal | 2.8 | 2.7 | ||

| 27/02 09:30 | consumer confidence | Portugal | -15.10 | -14.7 | ||

| 27/02 09:30 | retail sales mom | Slovenia | -2.3% | |||

| 27/02 09:30 | retail sales yoy | Slovenia | -3.1% | |||

| 27/02 09:30 | producer prices change | South Africa | 0.7% | |||

| 27/02 10:00 | gdp annual growth rate | Croatia | 3.9% | 4.5% | ||

| 27/02 10:00 | industrial production | Cyprus | -4.9% | 1.9% | ||

| 27/02 10:00 | consumer confidence | Eurozone | -14.2 | |||

| 27/02 10:00 | consumer confidence price trends | Eurozone | ||||

| 27/02 10:00 | gdp annual growth rate | Malta | 4.9% | 3.6% | ||

| 27/02 10:30 | inflation rate | Belgium | 4.08% | 4.3% | ||

| 27/02 11:00 | loan growth | Greece | 5.3% | 5.5% | ||

| 27/02 11:30 | current account | Brazil | $-9B | $-6.7B | ||

| 27/02 11:30 | foreign direct investment | Brazil | $2.8B | |||

| 27/02 11:30 | foreign exchange reserves | Turkey | ||||

| 27/02 12:00 | unemployment rate | Brazil | 6.2% | |||

| 27/02 12:00 | balance of trade | Mexico | $2.567B | |||

| 27/02 12:00 | unemployment rate | Mexico | 2.4% | |||

| 27/02 13:30 | current account | Canada | C$-3.2B | C$-4.5B | ||

| 27/02 13:30 | continuing jobless claims | United States | ||||

| 27/02 13:30 | durable goods orders | United States | -2.2% | |||

| 27/02 13:30 | durable goods orders ex defense | United States | ||||

| 27/02 13:30 | durable goods orders ex transportation | United States | 0.3% | |||

| 27/02 13:30 | gdp growth rate | United States | 3.1% | 2.3% | ||

| 27/02 13:30 | initial jobless claims | United States | ||||

| 27/02 16:00 | kansas fed manufacturing index | United States | -9 | |||

| 27/02 23:50 | industrial production | Japan | -1.1% | |||

| 27/02 23:50 | industrial production mom | Japan | ||||

| 28/02 00:00 | government budget value | Mexico | MXN-1661.8B | MXN-1800.0B | ||

| 28/02 00:00 | government budget value | Philippines | PHP-213B | PHP-53.0B | ||

| 28/02 00:00 | money supply m2 | Russia | 19.2% | 18.8% | ||

| 28/02 01:00 | balance of trade | Philippines | $-4.135B | $-4.4B | ||

| 28/02 02:00 | loans to private sector | Singapore | S$835B | |||

| 28/02 04:00 | industrial production | Thailand | -2.11% | -1.8% | ||

| 28/02 05:00 | producer prices change | Singapore | 1.5% | |||

| 28/02 06:00 | producer prices change | Estonia | 1.1% | |||

| 28/02 06:00 | retail sales mom | Estonia | 13.3% | |||

| 28/02 06:00 | retail sales yoy | Estonia | 1.2% | |||

| 28/02 06:00 | gdp growth rate | Finland | 0.3% | 0.1% | ||

| 28/02 06:00 | gdp annual growth rate | Finland | 0.5% | 0.7% | ||

| 28/02 06:00 | money supply m3 | South Africa | 6.71% | |||

| 28/02 07:00 | unemployment rate | Denmark | 2.6% | 2.6% | ||

| 28/02 07:00 | retail sales mom | Germany | -1.6% | |||

| 28/02 07:00 | retail sales yoy | Germany | 1.8% | |||

| 28/02 07:00 | gdp growth rate | Lithuania | 1.2% | 0.9% | ||

| 28/02 07:00 | gdp annual growth rate | Lithuania | 2.5% | 3.8% | ||

| 28/02 07:00 | retail sales yoy | Lithuania | 7.7% | |||

| 28/02 07:00 | money supply m3 | Malaysia | 3.6% | |||

| 28/02 07:00 | retail sales mom | Norway | -0.1% | -0.2% | ||

| 28/02 07:00 | gdp growth rate | Sweden | 0.3% | 0.2% | ||

| 28/02 07:00 | gdp annual growth rate | Sweden | 0.7% | 1.1% | ||

| 28/02 07:00 | retail sales mom | Sweden | 2.9% | -1.6% | ||

| 28/02 07:00 | retail sales yoy | Sweden | 5.6% | 5.1% | ||

| 28/02 07:00 | current account | Thailand | $2.9B | $2.6B | ||

| 28/02 07:00 | gdp growth rate | Turkey | -0.2% | 0.7% | ||

| 28/02 07:00 | gdp annual growth rate | Turkey | 2.1% | 3% | ||

| 28/02 07:00 | unemployment rate | Turkey | 8.5% | 8.6% | ||

| 28/02 07:30 | producer prices change | Hungary | 9% | |||

| 28/02 07:30 | retail sales mom | Switzerland | 0.6% | |||

| 28/02 07:30 | retail sales yoy | Switzerland | 2.6% | |||

| 28/02 07:30 | business confidence | Thailand | 48.5 | 48.8 | ||

| 28/02 07:30 | retail sales yoy | Thailand | 15.1% | 14.0% | ||

| 28/02 07:45 | gdp growth rate | France | 0.4% | -0.1% | ||

| 28/02 07:45 | gdp annual growth rate | France | 1.2% | 0.7% | ||

| 28/02 07:45 | inflation rate | France | ||||

| 28/02 08:00 | gdp annual growth rate | Austria | -0.8% | -0.2% | ||

| 28/02 08:00 | producer prices change | Austria | -1.1% | 0.4% | ||

| 28/02 08:00 | gdp growth rate | Czech Republic | 0.5% | 0.5% | ||

| 28/02 08:00 | gdp annual growth rate | Czech Republic | 1.4% | 1.6% | ||

| 28/02 08:00 | manufacturing pmi | Hungary | 49.8 | |||

| 28/02 08:00 | business confidence | Switzerland | ||||

| 28/02 08:55 | unemployment rate | Germany | ||||

| 28/02 09:00 | business confidence | Bulgaria | 17.4 | |||

| 28/02 09:00 | producer prices change | Bulgaria | 5.3% | |||

| 28/02 09:00 | money supply m3 | Czech Republic | 7.4% | |||

| 28/02 09:00 | business confidence | Italy | 86.8 | |||

| 28/02 09:00 | consumer confidence | Italy | 98.2 | 98 | ||

| 28/02 09:00 | foreign exchange reserves | Nigeria | $39.77B | |||

| 28/02 09:00 | manufacturing pmi | Norway | 51.2 | 50.5 | ||

| 28/02 09:00 | current account | Spain | €1.26B | € 2.7B | ||

| 28/02 09:00 | zew economic sentiment index | Switzerland | 17.7 | |||

| 28/02 09:30 | inflation rate | Slovenia | 2% | |||

| 28/02 09:30 | producer prices change | Slovenia | -0.2% | |||

| 28/02 09:50 | current account | North Macedonia | ||||

| 28/02 10:00 | gdp growth rate | Belgium | 0.3% | 0.2% | ||

| 28/02 10:00 | gdp annual growth rate | Belgium | 1.2% | 1.1% | ||

| 28/02 10:00 | producer prices change | Croatia | -1.4% | -0.4% | ||

| 28/02 10:00 | gdp annual growth rate | Cyprus | 3.8% | 2.6% | ||

| 28/02 10:00 | producer prices change | Greece | -0.8% | -0.3% | ||

| 28/02 10:00 | retail sales yoy | Greece | 1.1% | 0.2% | ||

| 28/02 10:00 | inflation rate | Italy | ||||

| 28/02 10:30 | producer prices change | Belgium | 1.9% | 2.5% | ||

| 28/02 10:30 | government budget value | India | INR-9140.9B | INR -10500.0B | ||

| 28/02 11:00 | current account | Ireland | €23B | € 5.8B | ||

| 28/02 11:00 | gdp growth rate | Ireland | 3.5% | -1.3% | ||

| 28/02 11:00 | gdp annual growth rate | Ireland | 2.9% | 6.3% | ||

| 28/02 11:00 | retail sales mom | Ireland | 1.1% | -0.7% | ||

| 28/02 11:00 | retail sales yoy | Ireland | 0.8% | 0.5% | ||

| 28/02 11:00 | gdp growth rate | Latvia | -0.2% | 0.6% | ||

| 28/02 11:00 | gdp annual growth rate | Latvia | -1.6% | -1.5% | ||

| 28/02 11:00 | retail sales mom | Latvia | 0.5% | |||

| 28/02 11:00 | retail sales yoy | Latvia | 3.4% | |||

| 28/02 11:00 | producer prices change | Luxembourg | -0.7% | 0.9% | ||

| 28/02 11:00 | foreign exchange reserves | Mexico | $232.1B | |||

| 28/02 11:00 | retail sales yoy | North Macedonia | 3.6% | |||

| 28/02 11:00 | gdp growth rate | Portugal | 0.3% | 1.5% | ||

| 28/02 11:00 | gdp annual growth rate | Portugal | 2% | 2.7% | ||

| 28/02 11:00 | inflation rate | Portugal | 2.5% | 2.6% | ||

| 28/02 11:00 | gdp annual growth rate | Serbia | 3.1% | 3.3% | ||

| 28/02 11:00 | industrial production | Serbia | 2.7% | |||

| 28/02 11:00 | retail sales yoy | Serbia | 0.8% | |||

| 28/02 11:00 | unemployment rate | Serbia | 8.1% | 9.00% | ||

| 28/02 11:30 | government budget value | Brazil | BRL-80.372B | |||

| 28/02 11:30 | foreign exchange reserves | India | ||||

| 28/02 11:30 | loan growth | India | 11.4% | |||

| 28/02 11:30 | government budget value | South Africa | ZAR21.38B | ZAR -30.0B | ||

| 28/02 12:00 | gdp growth rate | Brazil | 0.9% | 0.8% | ||

| 28/02 12:00 | gdp annual growth rate | Brazil | 4% | |||

| 28/02 12:00 | gdp annual growth rate | India | 5.4% | 7% | ||

| 28/02 12:00 | industrial production | Chile | ||||

| 28/02 12:00 | retail sales mom | Chile | 1% | |||

| 28/02 12:00 | retail sales yoy | Chile | 5.8% | |||

| 28/02 12:00 | unemployment rate | Chile | 8.1% | |||

| 28/02 13:00 | inflation rate | Germany | ||||

| 28/02 13:00 | business confidence | Spain | -5.1 | |||

| 28/02 13:30 | gdp growth rate | Canada | 0.3% | 0.5% | ||

| 28/02 13:30 | gdp growth annualized | Canada | 1.2% | |||

| 28/02 14:45 | chicago pmi | United States | 39.5 | |||

| 28/02 16:00 | government budget value | Canada | C$-8.21B | C$-6.0B | ||

| 28/02 23:50 | retail sales mom | Japan | ||||

| 28/02 23:50 | retail sales yoy | Japan | 3.7% | |||

| 01/03 00:00 | balance of trade | South Korea | $-1.89B | $4.8B | ||

| 01/03 01:30 | business confidence | China | 49.1 | 50 | ||

| 01/03 01:30 | non manufacturing pmi | China | 50.2 | 50.5 | ||

| 02/03 22:00 | manufacturing pmi | Australia | 50.2 |

Philippines Economic Overview

Philippines economic overview presents a snapshot of Philippines current economic conditions. You can find details for the Philippines economy subsections by exploring the sections below.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| Manufacturing PMI | ph.manpmi | 52.3 | 54.3 | -4 | 3 | UP | UP |

Philippines Manufacturing

MacroVar tracks hundreds of indicators related to Philippines manufacturing. Our focus is on the most important leading indicators based on the ISM report and related indicators. The ISM report is the most important report reflecting the real demand of goods in the Philippines economy.

| 1Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| Manufacturing PMI | ph.manpmi | 52.3 | 54.3 | -4 | 3 | UP | UP |

| industrial production | ph.indproduction | 0.4 | -3.5 | -111 | -124 | Down | UP |

Philippines consumer sentiment

Consumer spending makes up 67% of the U.S. Economy. MacroVar monitors direct consumer reports like the University of Michigan Consumer Sentiment Index and indirect macroeconomic indicators related to Philippines employment and Philippines consumer activity (building permits).

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| consumer confidence | ph.consconfidence | -11.1 | -15.6s | -29 | -54 | UP | UP |

| unemployment rate | ph.unemploymentrate | 3.1 | 3.2s | -3 | -31 | Down | Down |

| retail sales MoM | ph.retailsales | 0.3 | 0.3s | 0 | 200 | UP | UP |

| building permits | ph.buildingpermits | 10809.0 | 13534s | -20 | -69 | Down | Down |

Philippines Construction

The Philippines construction sector is a significant component of the Philippines economy. MacroVar monitors leading indicators of construction activity like building permits and new home sales.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| building permits | ph.buildingpermits | 10809.0 | 13534 | -20 | -69 | Down | Down |

Philippines Macroeconomic outlook

Philippines Macroeconomic outlook presents an overview of the long-term fundamental coincident factors of the Philippines economy. Components monitored are the country's rserves, debt, Monetary Policy and Fiscal Policy. Explore Philippines macroeconomic model in detail.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| gdp | ph.gdp | 437.15 | 404.28 | 8 | 87 | UP | UP |

| Real GDP | ph.realgdp | 6192161.58 | 5318630 | 16 | 19 | UP | UP |

| gdp growth annual | ph.gdpgrowthan | 5.2 | 6.4 | -19 | -26 | Down | Down |

| gdp growth | ph.gdpgrowth | 1.8 | 1.5 | 20 | -49 | UP | Down |

| inflation cpi | ph.inflationcpi | 2.9 | 2.5 | 16 | -26 | Down | Down |

| interest rate | ph.interestrate | 6.0 | 6 | 0 | -8 | Down | Down |

| unemployment rate | ph.unemploymentrate | 3.1 | 3.2 | -3 | -31 | Down | Down |

| external debt | ph.externaldebt | 125393.69 | 111268 | 13 | 66 | UP | UP |

| government debt to gdp | ph.govdebtgdp | 60.1 | 60.9 | -1 | 18 | UP | UP |

| current account | ph.currentaccount | -2198.35 | -1791.21 | 23 | 270 | Down | Down |

| current account to gdp | ph.currentaccountgdp | -1.3 | -4.4 | -70 | -142 | Down | Down |

| exports | ph.exports | 6130084.86 | 5905850 | 4 | -6 | Down | Down |

| imports | ph.imports | 9792888.08 | 10549700 | -7 | -2 | Down | Down |

| foreign exchange reserves | ph.fxreserves | 103000.0 | 106800 | -4 | -1 | Down | Down |

| gold reserves | ph.goldres | 128.12 | 132.65 | -3 | -18 | Down | Down |

| government revenues | ph.govrev | 338312.0 | 473124 | -28 | -1 | Down | Down |

| fiscal expenditure | ph.fiscalexp | 551285.0 | 466784 | 18 | 27 | UP | UP |

Philippines Inflation

MacroVar monitors major inflation indexes and subcompoonents based on Bureau of Labour Statistics monthly report.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend |

|---|---|---|---|---|---|---|

| inflation cpi | ph.inflationcpi | 2.9 | 2.5 | 16 | -26 |  |

| core inflation rate | ph.coreinflationrate | 2.6 | 2.8 | -7 | -41 |  |

| Produce Prices YoY | ph.producerpricesch | 0.2 | 0.4 | -50 | -67 |  |

Philippines Employment

MacroVar monitors leading indicators (ISM/NMI employment activity), coincident (Initial & Continuing jobless claims) and lagging indicators of Philippines employment. Philippines employment is one of the major factors affecting Philippines monetary policy.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| unemployment rate | ph.unemploymentrate | 3.1 | 3.2 | -3 | -31 | Down | Down |

Philippines Monetary Policy

Philippines Monetary policy is monitored by tracking the most important indicators related to the Fed's balance sheet and interest rates.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| interest rate | ph.interestrate | 6.0 | 6 | 0 | -8 | Down | Down |

| central bank balance sheet | ph.cb.assets | 8053.1 | 8192.1 | -2 | 8 | UP | UP |

| banks balance sheet | ph.banks.bs | 1191.0 | 1186 | 0 | -5 | UP | Down |

| money supply m1 | ph.msm1 | 7393830.99 | 7055110 | 5 | 8 | UP | UP |

| money supply m2 | ph.msm2 | 18333403.92 | 17624900 | 4 | 8 | UP | UP |

| government debt to gdp | ph.govdebtgdp | 60.1 | 60.9 | -1 | 18 | UP | UP |

| loans to private sector | ph.loanprivate | 11216447.28 | 10814600 | 4 | 11 | UP | UP |

| Philippines Credit Rating (S&P) | RATING.S&P.PH | ||||||

| Philippines Credit Rating (Moody's) | RATING.MOODYS.PH | ||||||

| Philippines Credit Rating (Fitch) | RATING.FITCH.PH |

Philippines Fiscal Policy

Philippines Fiscal policy is monitored by tracking the most important indicators related to the Treasury's decisions on government spending, revenues and budget surplus/deficit.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| government revenues | ph.govrev | 338312.0 | 473124 | -28 | -1 | Down | Down |

| fiscal expenditure | ph.fiscalexp | 551285.0 | 466784 | 18 | 27 | UP | UP |

| government budget | ph.govbudget | -6.2 | -7.3 | -15 | 210 | Down | Down |

| Government budget | ph.govbudgetvalue | -212973.0 | 6340 | -3459 | -47 | Down | UP |

| government debt to gdp | ph.govdebtgdp | 60.1 | 60.9 | -1 | 18 | UP | UP |

Philippines Trade

Philippines trade activity is monitored by tracking Trade and Capital flows.

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope |

|---|---|---|---|---|---|---|---|

| current account | ph.currentaccount | -2198.35 | -1791.21 | 23 | 270 | Down | Down |

| current account to gdp | ph.currentaccountgdp | -1.3 | -4.4 | -70 | -142 | Down | Down |

| balance of trade | ph.balanceoftrade | -4135792.93 | -4852490 | -15 | -1 | UP | UP |

| imports | ph.imports | 9792888.08 | 10549700 | -7 | -2 | Down | Down |

| exports | ph.exports | 6130084.86 | 5905850 | 4 | -6 | Down | Down |

| capital flows | ph.capitalflows | 7.09 | 6.71 | 6 | 45 | UP | UP |

| foreign direct investment | ph.fdi | 901.0 | 1022 | -12 | -15 | UP | Down |

| external debt | ph.externaldebt | 125393.69 | 111268 | 13 | 66 | UP | UP |

| foreign exchange reserves | ph.fxreserves | 103000.0 | 106800 | -4 | -1 | Down | Down |

| gold reserves | ph.goldres | 128.12 | 132.65 | -3 | -18 | Down | Down |