Emerging Markets

Get a snapshot of current economic and financial market conditions of emerging markets. MacroVar characterizes emerging markets the largest 18 countries in the world in terms of GDP. Click any country to view a detailed analysis of the country's current economic and financial conditions.

Emerging Markets Economic Growth

MacroVar Emerging Markets index is a gauge of developed markets economic grwoth. It is a weighted average of the Manufacturing PMI of the largest emerging 19 economies in the world weighted by each country's GDP. A value higher than 50 indicates growth while a value lower than 50 contraction.

Emerging Markets growth Statistics

| Indicator | Symbol | Actual | Previous | M/M% | Y/Y% | Trend | Slope | Percentile | Update |

|---|---|---|---|---|---|---|---|---|---|

| Manufacturing PMI | gl.emanpmi | 50.07 | 50.11 | 0 | 0 | Down | Down | 44 | 2024-10-31 |

Emerging Markets Economies

Get a snapshot of current economic and financial markets of emerging markets. MacroVar characterizes developed markets the largest 19 countries in the world in terms of GDP.

| Business Confidence | MV Model | Economic Growth | Monetary | Government (%GDP) | Markets (Y/Y%) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

CountryClick on each country link to view each country's macroeconomic and financial data analysis |

M.PMIManufacturing PMI |

GRGrowth Momentum |

INFLInflation Momentum |

GDPReal GDP Value |

GDP YYReal GDP Year on Year % Change |

UEUnemployment Rate |

CPIConsumer Price Index used to measure Inflation |

CBCentral Bank rate % |

M2M2 Money Supply Year on Year Change |

B/SBalance Sheet Year on Year Change |

FX ResForeign Exchange Reserves |

S/DGovernment Surplus / Deficit |

DebtGovernment Local Debt |

E. DebtExternal Debt |

CACurrent Account |

StocksStocks Year on Year change |

BondsBonds Year on Year change |

YCYield Curve year on year change |

FXFX year on year change |

CDSCDS year on year change |

| China | 50.5M. PMI Year on Year: -1 -- M. PMI 12 MA |

17794.8 | 1.6 | 5.1 | 0.1 | 3.1 | -2.8 | -4 | 121313 | -5.8 | 83.4 | 252 | 1.5 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

| India | 56.4M. PMI Year on Year: 3 -- M. PMI 12 MA |

3549.92 | 1.1 | 8 | 5.22 | 6.5 | -2.8 | 3 | 121313 | -5.63 | 81.59 | 16 | -1.2 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

| South Korea | 49M. PMI Year on Year: -2 -- M. PMI 12 MA |

1712.79 | 0.1 | 3.7 | 1.9 | 3 | -2.8 | 6 | 121313 | -2.6 | 51.5 | 18 | 9300 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

| Russia | 50.8M. PMI Year on Year: -6 -- M. PMI 12 MA |

2021.42 | -0.8 | 2.3 | 9.5 | 21 | -2.8 | 26 | 121313 | -1.9 | 14.9 | 2.5 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | |||

| Brazil | 50.4M. PMI Year on Year: 4 -- M. PMI 12 MA |

2173.67 | 0.9 | 6.1 | 4.83 | 12.25 | 3922520 | -1 | 353448 | -8.9 | 84.68 | 18 | -1.42 | 130208 | 9.24 | 1.56 | 5.06 | 163.38 | ||

| Mexico | 49.8M. PMI Year on Year: -4 -- M. PMI 12 MA |

1788.89 | 1.1 | 2.6 | 4.21 | 10 | -2.8 | 33 | 121313 | -5 | 49.7 | 28 | -1.5 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

| Indonesia | 51.2M. PMI Year on Year: -1 -- M. PMI 12 MA |

1371.17 | 1.5 | 4.91 | 1.57 | 5.75 | -2.8 | 8.65 | 121313 | -1.65 | 39.3 | -3 | -0.3 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

| Turkey | 49.1M. PMI Year on Year: 4 -- M. PMI 12 MA |

1108.02 | -0.2 | 8.6 | 44.38 | 47.5 | -2.8 | 37 | 121313 | -5.2 | 29.5 | -4 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | |||

| Taiwan | 52.7M. PMI Year on Year: 9 -- M. PMI 12 MA |

756.59 | 1.08 | 3.41 | 2.08 | 2 | -2.8 | 7 | 121313 | -0.5 | 28.2 | 11.8 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | |||

| Poland | 48.2M. PMI Year on Year: 2 -- M. PMI 12 MA |

811.23 | -0.1 | 5 | 4.7 | 5.75 | -2.8 | 12 | 121313 | -5.1 | 49.6 | 19 | 1.8 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

| Thailand | 51.4M. PMI Year on Year: 8 -- M. PMI 12 MA |

514.95 | 1.2 | 1.02 | 1.23 | 2.25 | -2.8 | 6 | 121313 | -2.8 | 61.9 | -0.2 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | |||

| Philippines | 54.3M. PMI Year on Year: 5 -- M. PMI 12 MA |

437.15 | 1.7 | 3.2 | 2.9 | 5.75 | -2.8 | 10 | 121313 | -6.2 | 60.1 | -1.3 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | |||

| Hong Kong | 51.1M. PMI Year on Year: 4 -- M. PMI 12 MA |

382.05 | -1.1 | 3.1 | 1.4 | 4.75 | -2.8 | 8.65 | 121313 | -5 | 38.4 | 4 | 7.1 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

| Malaysia | 48.6M. PMI Year on Year: 1 -- M. PMI 12 MA |

399.65 | 1.8 | 3.2 | 1.8 | 3 | -2.8 | -6 | 121313 | -5 | 61.1 | 2.7 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | |||

| South Africa | 52.8M. PMI Year on Year: 14 -- M. PMI 12 MA |

377.78 | -0.3 | 32.1 | 2.9 | 7.75 | -2.8 | 6 | 121313 | -4.9 | 72.2 | -1.6 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | |||

| Vietnam | 49.8M. PMI Year on Year: 5 -- M. PMI 12 MA |

429.72 | 6.88 | 2.24 | 2.94 | 4.5 | -2.8 | 8.65 | 121313 | -4 | 33.5 | 0.2 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | |||

| Czechia | 44.8M. PMI Year on Year: 4 -- M. PMI 12 MA |

330.86 | 0.5 | 4.1 | 3 | 4 | -2.8 | 12 | 121313 | -3.7 | 44 | 17 | 0.2 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

| Hungary | 50.6M. PMI Year on Year: -1 -- M. PMI 12 MA |

212.39 | -0.7 | 4.7 | 4.6 | 6.5 | -2.8 | 3 | 121313 | -6.7 | 73.4 | 52 | 0.8 | 12.2 | 12.2 | 12.2 | 12.2 | 12.2 | ||

Emerging Financial Markets

| Market | Symbol | Last | Mom | Trend | Exh | RSI | 1D% | 1W% | 1M% | 1Y% |

|---|---|---|---|---|---|---|---|---|---|---|

| Emerging Bond Risk | RISK.EMRISK | -0.306616 | -0.5 | 1 | 1.51 | 60.48 | -0.5 | -0.75 | 0.68 | -0.83 |

| Emerging Markets Bonds (EMB) | EMB | 91.17 | 0 | 0.25 | 0.53 | 44.08 | 0 | -0.01 | 0.01 | 0.03 |

| MSCI Emerging Markets | MSCI.EMERGING | 1120.71 | 1 | 1 | 2.09 | 70.65 | 0.85 | 1.5 | 4.2 | 8.57 |

| Emerging Markets ETF | EEM | 44.07 | 1 | 1 | 2.16 | 71.95 | 0.57 | 2.92 | 4.21 | 11.8 |

| JP Morgan Emerging Market Bonds Risk | EMB | 94 | -1 | -1 | -2.43 | 31.85 | -0.01 | -0.04 | -0.01 | -0.15 |

| Emerging Currency Strategy Fund | CEW | 17.995 | 0.5 | 0.75 | 1.11 | 65.35 | 0.42 | 1.75 | 1.24 | 2.87 |

| VXEEM | VXEEM | 15.36 | -0.5 | -1 | -0.89 | 45.6 | -36.16 | -8.24 | -38.56 | -17.02 |

| CDX Emerging Markets index | EM.CDXEM | 165.57 | -1 | -1 | -2.3 | 24.51 | -0 | -0.03 | -0.13 | -0.32 |

| EEM/SPY | EEMSPY.SPREAD | 0.072872 | 0.5 | -1 | -2.11 | 44.76 | 0 | 0.01 | 0.01 | -0.14 |

| EEM/CDX EM | EEM.CDXEM | 0.0276 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| EMB/TLH | EMBTLH | 0.432005 | 1 | 1 | 1.27 | 59.06 | 0.01 | 0.04 | 0.02 | 0.14 |

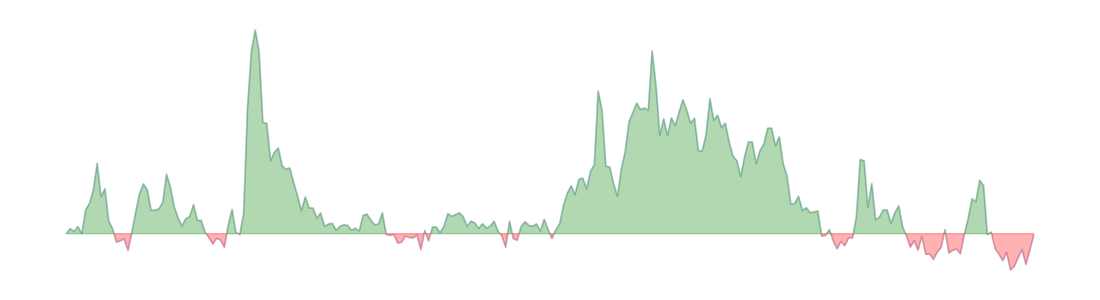

Emerging Markets Risk Model

Risk Management model

Emerging market risk model

Emerging market risk is modeled by monitoring credit risk in emerging markets. Credit risk is the likelihood that a company or a government goes bankrupt and the amount the investor loses if it happens. Credit risky securities include corporate debt securities like corporate bonds and bank loans and sovereign debt.

Credit default swaps are widely used derivatives used in credit risk management to describe market perceptions of credit risk for a specific government or corporation. Credit default swaps (CDS) are derivatives contracts which by construction aim at quantifying the risk of default of a counterparty. Therefore, CDS written major financial institutions or corporations are early signals to monitor and detect elevated credit risk conditions in the global financial system.

MacroVar monitors CDX emerging markets index. CDX emerging markets index is composed of fifteen sovereign entities that trade in the CDS market. Extreme values of z-scores greater than two indicate elevated credit risk conditions and vice-versa.